(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark® Illustration System)

When I formed InsMark in 1983, I had spent much of the previous year developing the first illustration modules which included Various Financial Alternatives, Other Investments vs. Your Policy, and Term vs. Permanent. I started with VisiCalc, the forerunner to Lotus (which was also a forerunner to Excel) and soon discovered that “real” coding was needed and proceeded to Basic, etc., etc.

Of the first modules, Various Financial Alternatives (“VFA”) was the most popular and remains so to this day. Our licensee base tells us it is their go-to module, particularly when the life insurance emphasizes both death benefits, serious retirement cash accumulation, and significant retirement cash flow.

VFA is virtually unchanged since those early days. Oh, the graphics are better, the options more sophisticated, but if I show you an illustration from “back in the day”, you would instantly recognize the format. The only real difference is we presented the early version in “landscape” format rather than the current “portrait” style we use today.

One of the reasons VFA became so popular is that it smoothly introduces cash value life insurance as a superb financial instrument. With it, you can take on equity accounts, annuities, tax-exempt bond funds, IRAs, and just about any economic alternative a critic could come up with – and “knock the socks off” a prospective client with the comparative results.

Prospective clients make quicker, easier and, frankly, better decisions when comparative logic is used. It frees you from trying to convince your prospects – in a vacuum – that purchasing life insurance is a good decision. “Compared to what?” has favorably changed the public perception of life insurance – and of life insurance producers. At InsMark, we take some credit for helping make this happen.

Now I want to knock your socks off with some new VFA capacity that will further enhance your prospect’s view of cash value life insurance. What I am about to show you is not only applicable to a straightforward retirement sale but to the most complex concepts like split dollar, COLI executive benefit plans, premium financing, etc. Because no matter what you present, letting VFA test the quality of the “eggs in the omelet” radically improves the perception of your overall presentation.

Specifics Follow

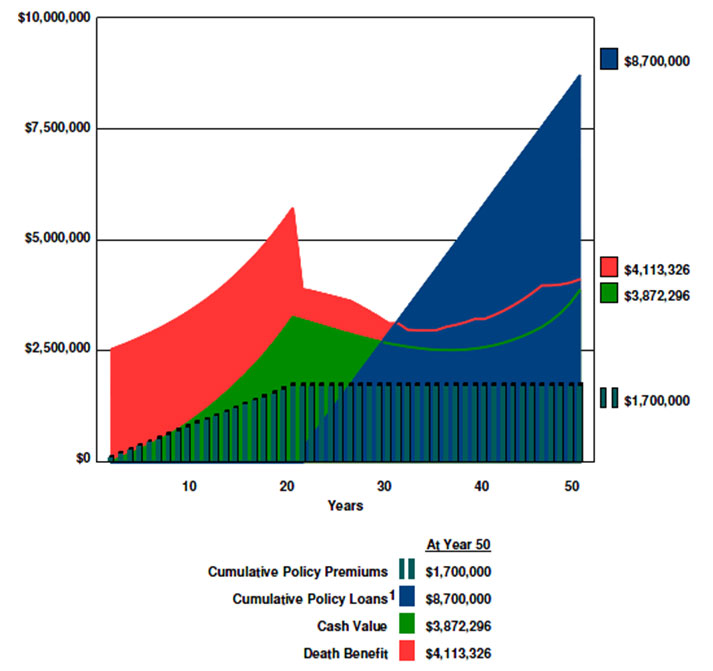

To start, let’s review our sample case. The client is Bill Jasper, age 46. We have shown contributing $85,000 per year into an IUL with after tax cash flow coming from participating policy loans starting at age 66. Shown below is a summary of the costs and benefits of this life insurance policy over time.

| Image 1 |

| Illustration of Values |

Click here to review the year-by-year numbers of the illustration.

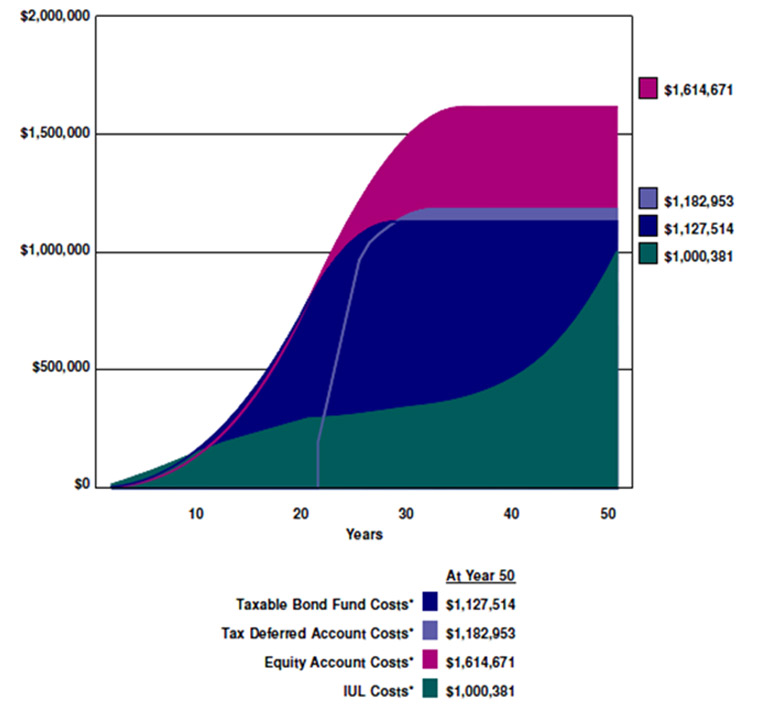

Next, we used VFA to answer the “compared to what?” question using three possible investment alternatives (a Taxable Bond Fund, Tax Deferred Account, an Equity Account – all compared to Indexed Universal Life). The IUL wins impressively as shown in the graphic results below, and here are the assumptions used:

- Indexed Universal Life: 6.5%

- Taxable Bond Fund: 6.5%

- Tax Deferred Account: 6.5%

- Equity Account: 6.5% growth; 2% dividend

- Client’s income tax bracket: 40% (combined state and federal)

- Capital Gains and Dividend tax rate: 25%

| Image 2 |

| Various Financial Alternatives |

But what is the client possibly thinking now? Could they still have reservations about the policy?

Specifically, you have explained to the client that IUL wins because the policy’s cash values grow tax deferred and can be accessed on a tax free basis using policy loans.

Unfortunately, these structural advantages are hard for some clients to quantify. And, this can cause a stall in the sale that typically leads to “no sale” over time. This situation is exacerbated by the fact that so many advisors point out that cash value life insurance pays high upfront commissions and has high expenses and charges not found with alternative investment options.

Also, is it possible that the client’s concerns above are also unspoken objections? Specifically, are there situations where the client doesn’t want to appear unsophisticated or they don’t want to offend you so they just say “well, it’s interesting, let me think about it”. We think the answer is yes and that these unspoken objections are responsible for preventing more cash value policy sales than any other single reason.

To solve these problems, we now have a powerful new way for you to help the client and advisor understand and quantify the dollar benefit advantages with cash value life insurance policies. This can then help them understand mathematically why the life insurance can outperform other investments. To do this, our new Comparison of Plan Cost reports examine the annual costs associated with alternative investments. Shown below is a graph of these different total costs over time.

| Image 3 |

| 50 Year Comparison of Cumulative Cost |

| *The Comparison of Plan Cost graphic above compares the management fees and/or taxes of each investment alternative to the mortality charges, policy expenses and income taxes (if applicable) associated with the life insurance policy. |

| The Taxable Bond Fund is depleted by age 74, the Tax Deferred Account is depleted by age 77, and the Equity Account is depleted by age 80. The IUL is not depleted and its $290,000 of annual cash flow continues to age 95 at which time it still contains over $3.8 million of cash surrender value which could extend the cash flow indefinitely.) |

Click here to review the year-by-year numbers of the full VFA presentation including the new Comparison of Plan Cost reports (available inside the new VFA module). This entire VFA presentation is 17 pages. To help you navigate these reports, we have provided some additional notes below:

Page 1 of 17: Here you will find the standard VFA Preface.

Page 2-3 of 17: Here you will find the standard VFA Comparison of Values illustration. (You have seen this presentation many times in the past from InsMark.)

Page 4-5 of 17: Here you will find the NEW Comparison of Plan Costs year-by-year numbers. Also, pay special attention to the Summary footnote in the bottom right of each page. It’s powerful, compelling information.

Page 6 of 17: Here is the summary graphic of the Comparison of Plan Costs (shown in Image 3).

Page 7 of 17: This is our new Multiple Mini Graph summarizing the new Comparison of Plan Costs information.

Page 8-9 of 17: These reports show the detail columns for how the Taxable Bond Fund cumulative costs were calculated.

Page 10-11 of 17: These reports show the detail columns for how the Tax Deferred Account cumulative costs were calculated.

Page 12-13 of 17: These reports show the detail columns for how the Equity Account cumulative costs were calculated.

Page 14-17 of 17: These reports provide additional information for how the Equity Account values were calculated. These reports have been in the InsMark Illustration System for many years and are not new.

“InsMark” is a registered trademarks of InsMark, Inc.

Copyright © 2018 InsMark, Inc.

All Rights Reserved

Important: InsMark will be releasing these new Comparison of Plan Costs reports as an enhancement to InsMark Illustration System in October. However, individuals that attend InsMark’s Symposium in Philadelphia on September 14th and 15th will receive early access to the enhancement at the Symposium. Also, Symposium attendees who are not licensed for the InsMark Illustration System software will receive use of the InsMark Illustration System for 30 days. To learn more about attending the Symposium in Philadelphia on September 14th and 15th, contact Julie Nayeri at 1-888-InsMark (467-6275) or Julien@insmark.com or click below to review the Agenda and register online:

Also, once released, you will find these Comparison of Plan Cost reports in the following InsMark modules in the InsMark Illustration System:

- Permanent vs. Term – Where the term premium costs are added to the alternative investment costs to provide even more devastating evidence of how expensive it is for your clients to “buy term and invest the difference”

- Other Investments vs. Your Policy

- Various Financial Alternatives

One final point. In order to create these new reports, you will need to get the policy’s annual mortality and administrative costs on a year by year basis from your carrier’s source proposal and then easily enter those values in the new VFA module.

Conclusion:

For the first time, you will now have a way to numerically quantity how the structural tax advantages of cash value life insurance turn into cost savings for your clients. In turn, this will give you an effective process to help the client test the quality of the “eggs in the omelet”. We think these new reports provide you with one of those “killer apps” that only come along once in every few years and will help you close substantially more business in the months and years to come. Once released, we encourage you to use these new Comparison of Plan Cost reports on every case where cash accumulation and retirement income are primary considerations.

Licensing InsMark Systems

To license the InsMark Illustration System, visit us online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

Creating Similar Presentations

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Files For This Blog

New Zip File Downloaders

Watch the video.

Digital Workbook Files For This Blog

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Before downloading and reviewing any files, be certain you have installed the most current updates to your InsMark Systems. Do this using Live Update available under Help on the main menu bar of the System or this icon on the main menu bar:

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

![]()

Testimonials

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“InsMark has increased my production by 10 fold. It clearly communicates to the client the best financial scenario to take.”

Gary Sipos, M.B.A., A.I.F.® InsMark Platinum Power Producer®, Sipos Insurance Services, Freehold, NJ

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more – often significantly more – than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type are utilized. It can be avoided, and you, the producer, are key to making sure your clients are aware of how to sidestep it.

A tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The foundation of this special treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component whether loans exist or not.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Does this note make it harder or easier to deliver the policy? It’s harder if you haven’t discussed it with your client; easier if you have. And that’s the point – you should discuss it.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender, and you would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.

![]()

More Recent Blogs:

Blog #179: Helping Millennials with Financial Decisions

Blog #178: Coordinating Exceptional Split Dollar™ with Wealthy and Wise® (Part 2 of 2)

Blog #176: Best Way to Evaluate Roth Conversions (Part 2 of 2)

Blog #175: Best Way to Evaluate Roth Conversions (Part 1 of 2)

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive