(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark® Illustration System)

While we all wait to see the enactment of the Biden administration’s income and estate tax policies, this Blog develops a concept that works well regardless of any income or estate tax increases.

You all have clients who are charitably motivated to one degree or another. Some of them will act favorably with the use of life insurance as a capital gift to charity.

Case Study

Arthur and Laura Bennett are ages 45 and 40. They are mid-five-figure annual donors to the San Francisco Zoo and are interested in creating an endowment for the Zoo upon their death to perpetuate their gift. They are considering acquiring a $1,000,000 life insurance policy. Assuming the Zoo can earn 5% ($50,000) annually on the $1,000,000 death benefit, the Bennetts can perpetuate their annual gift.

Since Laura is the incoming senior officer of one of the Zoo’s significant committees, Laura and Arthur have decided to insure her for the $1,000,000 at a premium of $25,000 paid for five years. The Zoo, a 501(c)(3) organization, will be named owner and beneficiary of the policy, and the Bennetts will deduct the premium as a charitable contribution.

What is the best way to illustrate such a plan? I like the discounted dollars approach that is present throughout much of the InsMark Illustration System. We have one variation for charitable giving that uses life insurance called “Dollars to Charity for Pennies of Cost.” It is on the Personal Insurance tab of the InsMark Illustration System, and I will use it in the analysis that follows.

Laura and Arthur are wealthy California residents. They are in a marginal income tax bracket of 50.3% (37% federal and 13.3% state). The charitable income tax deduction reduces the $25,000 premium cost to $12,425 a year for five years.

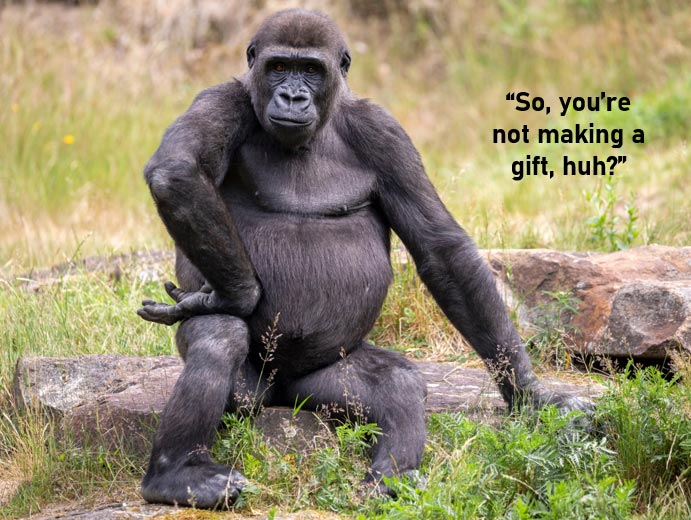

Below is a graphic showing the year-by-year cumulative cost to Laura and Arthur for each $1.00 of the death benefit to the Zoo. It never exceeds a cumulative cost of 6.3 cents!

| Image 1 |

| Laura and Arthur’s Cumulative Cost of |

| Funding Each $1.00 of Life Insurance |

Note: Although the policy has a level $1,000,000 death benefit, the cash values that develop force the face amount to increase beginning in year 40. This causes the cost of each $1.00 of death benefit to decrease (beginning at Laura’s age 79) to a low of 1.6 cents at the end of the analysis (Laura’s age 100).

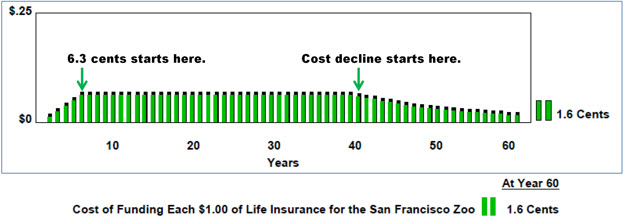

Below is a graphic of the overall results:

| Image 2 |

Click here to view the InsMark illustration for Laura Bennett.

Wealthy Clients Only?

Is this a plan suitable for wealthy clients only? Not at all — in a 25% tax bracket, the costs for a policy like Laura’s won’t exceed 9.5 cents for each $1.00 of death benefit, dropping to 2.4 cents at the end of the analysis.

This presentation is favorable at any age, even very advanced ones.

Type of Policy

Dollars to Charity for Pennies of Cost works with any permanent policy form: whole life, universal life, indexed universal life, and variable universal life.

Conclusion

The planned giving department of charitable organizations typically welcomes life insurance gifts. However, be aware that those in charge of current gifts would rather have the dollars associated with these plans donated in cash instead. So be sure you are speaking to someone who appreciates deferred giving.

Note: Due to mid-stream lapses, lifelong premiums for a charitable benefit are not a particularly good design feature for donors or recipients. This is why I illustrated a 5-pay premium structure for the Bennetts. In some cases, a single premium would be appropriate to consider even if the policy is classified as a modified endowment contract (MEC), as status as a MEC is irrelevant for a policy owned by a tax-exempt organization.

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) or visit us online. Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

Your Comments

What are your thoughts and conclusions after reviewing this material? Please add your comments to this Blog.

Creating Similar Presentations

If you would like highly qualified design assistance with no commission split required, contact LifePro Financial, InsMark’s Referral Resource discussed below.

The video below can also acquaint you with the general subject of downloading and using InsMark’s Digital Workbook Files.

Digital Workbook File for Blog #208

InsMark Illustration System

Assuming you are licensed for the InsMark Illustration System, you can download the same Digital Workbook File below that I used to prepare the Case Study for this Blog.

|

Before downloading and reviewing any files, be certain you have installed the most current updates to your InsMark System(s). Do this using Live Update available under Help on the main menu bar of the System or this icon on the main menu bar:

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you download the Digital Workbook File for Blog #208, click here for a Guide to its content. It will be invaluable to you as you design similar illustrations.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“InsMark’s referral resource, Brian Manderscheid from LifePro, has been a gem to work with! He helps us use InsMark with every one of our cases. The genius factor is InsMark’s commitment to “Compared to What.”

Glenn Main, InsMark Platinum Power Producer®, McMurray, PA

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer®, Financial Planner, Denver, CO

“InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, and InsMark Power Producer, Overland Park, KS

“InsMark” and the InsMark logo are registered trademarks of InsMark, Inc.

© Copyright 2021, InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more – often significantly more – than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type are utilized. It can be avoided, and you, the producer, are key to making sure your clients are aware of how to sidestep it.

A tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The foundation of this special treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component whether loans exist or not.

Note: It is best if you design the policy with no premiums scheduled after retirement if loans are anticipated in retirement years. This may require higher premiums during pre-retirement years, but a policy with no premiums scheduled is much more tolerable at advanced ages than one with continuous premiums.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Does this note make it harder or easier to deliver the policy? It’s harder if you haven’t discussed it with your client; easier if you have. And that’s the point – you should discuss it.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender, and you would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.

![]()

More Recent Blogs:

Blog #207: Merry Christmas and Happy Holidays from InsMark

Blog #205: Escaping an Oncoming Financial Nightmare

Blog #204: Leveraged Executive Bonus (Part 2 of 2)

Blog #203: Anybody Want A Free Dog? (Part 1 of 2)

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive