One of the top markets for premium financing involves large face amounts of personally-owned life insurance purchased by wealthy clients to produce significant amounts of spendable cash flow during their retirement years.

Case Study

Robert and Lynne Sullivan, both age 46, have a current net worth of $6,400,000. They are analyzing whether a premium financing arrangement can be a useful addition to their retirement plans.

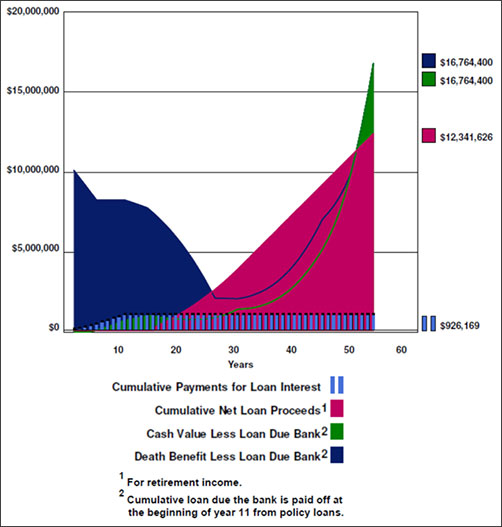

The graphic below summarizes the results of the premium financing arrangement prepared in the InsMark Premium Financing System.

| Premium Financing |

| Robert Sullivan, Age 46 |

Click here to review the illustration:

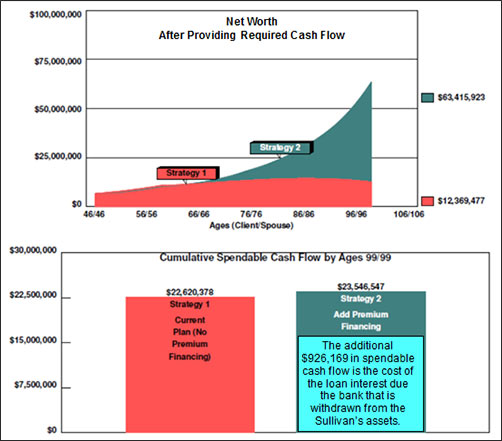

Next, the premium financing data was exported to InsMark’s Wealthy and Wise where it was integrated with the Sullivan’s overall financial plan. One of the cornerstones of their current plan (Strategy 1) is $300,000 of after tax cash flow beginning at their age 60 indexed at 3.00% as an inflation offset.

The graphic below compares Strategy 1, their current plan, with integrating the premium financing arrangement in Strategy 2.

| Strategy 1: Current Plan |

| Strategy 2: Add Premium Financing |

| Strategy 2 produces a net worth gain in excess of $51 million with no out-of-pocket cost to the Sullivans. |

| (Policy funded with bank loans, loan interest paid from client assets, |

| and policy loans repaying the bank loan in Year 11.) |

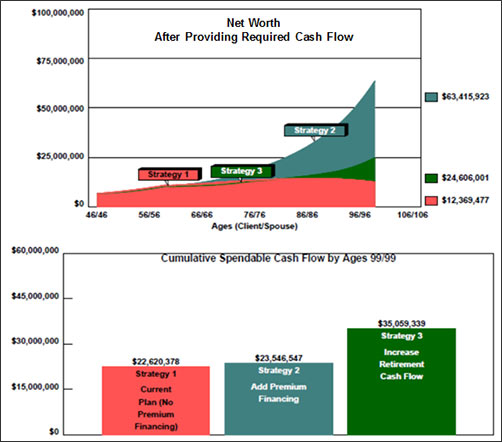

Strategy 3: An alternative to the $51 million increase in net worth of Strategy 2 is to add to their spendable retirement cash flow by reducing long-range net worth. The graphic below compares all three Strategies.

| Strategy 1: Current Plan |

| Strategy 2: Add Premium Financing |

| Strategy 3: Increase Retirement Cash Flow |

|

Strategy 3 reduces the gain in net worth while producing over |

| No Out-of-Pocket Cost to Clients |

| (Policy funded with bank loans, loan interest paid from client assets, |

| and policy loans repaying the bank loan in Year 11.) |

The choice is the Sullivans: increase net worth with Strategy 2 or increase net worth and spendable cash flow with Strategy 3 — or anywhere in between.

Note to Wealthy and Wise Licensees: To calculate the maximum additional cash flow, we used the Cash Flow Availability Calculator in Wealthy and Wise located on any of the drop-downs on the Desired Cash Flow tab.

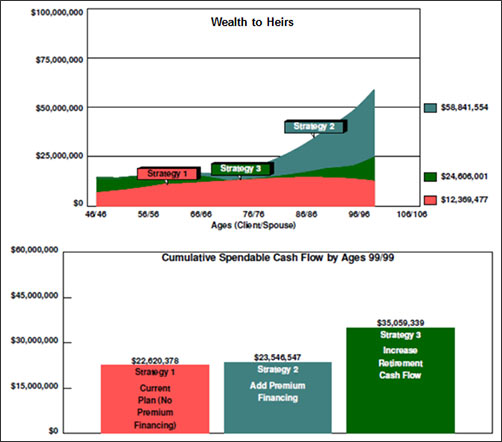

Below is the impact on the Sullivan’s heirs (assuming an annual 3.00% increase in the estate tax exemption).

| Strategy 1: Current Plan |

| Strategy 2: Add Premium Financing |

| Strategy 3: Increase Retirement Cash Flow |

Details of the Wealthy and Wise Analysis

Click here to view all the reports from this analysis divided into four sections.

Compare Strategies 1, 2, and 3 (Pages 1 – 5);

Strategy 1: Current Plan (Pages 6 – 37);

Strategy 2: Add Premium Financing (Pages 38 – 69);

Strategy 3: Increase Retirement Cash Flow (Pages 70 – 103).

That is a huge number of reports, I know; however, I recommend that you have all the reports for a given case with you when you are visiting with a client or client’s attorney or CPA. Wealthy and Wise backs up every number shown, and you never know which report you’ll need to answer the inevitable question, “Where did this number come from?” That’s why I provided all of them to you in this Blog so you can familiarize yourself with them.

Most Wealthy and Wise users select a few key illustrations for the main report and put the balance in an Appendix.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing

To license Wealthy and Wise or the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or 925-543-0513.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com, and we will provide you with recommendations.

Testimonials:

| “As with all of the InsMark software, InsMark’s Premium Financing System has proven to be an indispensable addition to my ability to show my clients the advantages in using a “Financed Premium” concept to solve their financial needs. Because of this, I was able to close three large financed premium cases easier and faster than ever before. I no longer need to use the cumbersome and illegible spreadsheets provided to me from other sources. As everyone understands, Premium Finance is a complex and involved concept to undertake. With the InsMark Premium Financing System, I am now able to show my clients a professional rendering of Premium Finance that is concise and easy to understand. As always, InsMark has delivered again. I encourage all who use Premium Finance as a solution to their clients’ needs to purchase this system. The cost of the system is not an expense, but rather an investment in your business.” |

| William Moates, Jr., Trilennium Financial Alliance LLC, Fort Smith, AR, InsMark Platinum Power Producer® |

| “InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.” |

| Simon Singer, CFP®, CAP®, RFC®, International Forum Member, InsMark Platinum Power Producer®, Encino, CA |

![]()

More Recent Blogs:

Blog #95: How Much Do I Really Need?

Blog #94: How to Double Your Affluent Clients

Blog #93: Maybe the Best Executive Benefit Plan Ever

Blog #92: The Prospecting Magic of Endorsed Referrals from CPAs

Blog #91: The Best of InsMark at the Symposium

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive