(Click here for Blog Archive)

(Click here for Blog Index)

Lisa Johnson is a single mother, age 40. She owns an employment agency in San Francisco that is thriving in the hi-tech environment.

Lisa is considering acquiring $700,000 of Indexed Universal Life (IUL) max-funded for retirement cash flow with five level premiums of $20,500. She is in a marginal state and federal income tax bracket of 35.00%.

Lisa wants the life insurance coverage, but her accountant has suggested that term insurance might be a smarter buy. So she is also looking at buying $700,000 of inexpensive 30-year level term at $700 a year and investing the difference.

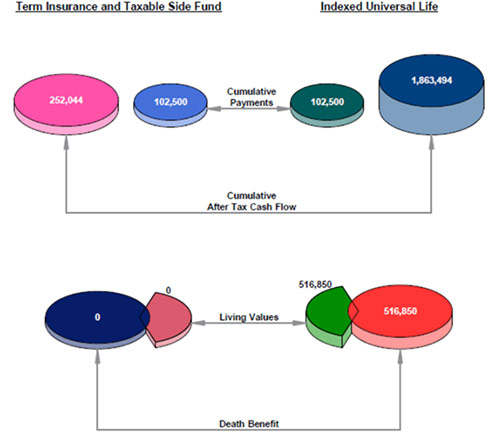

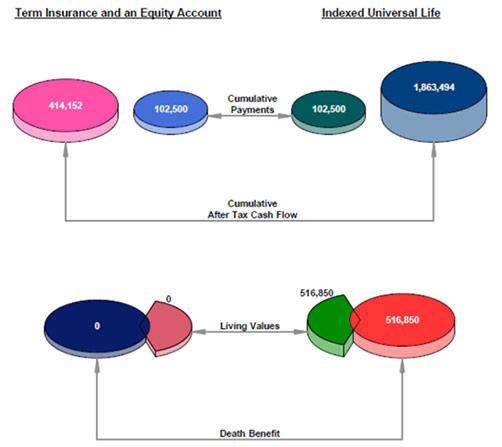

Let’s compare the two plans. We’ll do it two ways:

- Term insurance with the difference in premiums going into a taxable side fund yielding 7.50%, the same illustrated interest rate as the IUL.¹

- Term insurance with the difference in premiums going into an equity account with a growth rate of 7.50% plus a dividend yield of 1.00%.²

| ¹ Plus 0.75% management fee. |

| ² 0.75% management fee; Capital Gains rate of 30.00%; Dividend tax rate of 30.00%; 70.00% long-term gains; 30.00% short-term gains; 25.00% portfolio turnover. |

Below are summary graphics of each comparison:

| Term Insurance and a Taxable Side Fund |

| versus |

| Indexed Universal Life |

| (60 Year Analysis) |

Not only does the taxable account and its related cash flow run out of gas, it is illustrated to do so at Lisa’s age 71. That’s way too early for a retirement plan to have much significance. Lisa would have to earn 14.07% year in and year out on the taxable account to match the results of the IUL. (The 30-year term insurance will have expired by her age 70.)

Click here to see the full illustration.

| Term Insurance and an Equity Account |

| versus |

| Indexed Universal Life |

| (60 Year Analysis) |

The equity account and its related cash flow are illustrated to collapse at Lisa’s age 75. That’s still way too early for a retirement plan to be of much value. Lisa would have to experience growth of 11.02% year in and year out on the equity account (plus the dividend noted) to match the results of the IUL. (The 30-year term insurance will have expired by her age 70.)

Click here to see the full illustration.

Conclusion

Buy term and invest the difference . . . There is no valid economic theory that explains why a bad idea is acceptable simply because one hears it frequently.

Variations

Check out these Blogs to see how IUL compares to a 401(k):

Blog #61: Sacrificing Cash Flow with a 401(k) Plan

Blog #68: A Pretend 401(k) Plan vs. Indexed Universal Life

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com, and we will provide you with recommendations.

Testimonials:

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“I have been using InsMark since it was a C:> prompt back in the early 1980s. The new Jazz release is the most exciting upgrade to the InsMark Illustration System I’ve seen in 28 years! With unlimited options for customization, you can now be as creative as you want when producing illustrations.”

Chris Jacob, CFP, InsMark Platinum Power Producer®, SFI-Cadeau, St. Louis, MO.

![]()

More Recent Blogs:

Blog #77: Integrated Planning for College and Retirement

Blog #76: Smart Use of Term Coverage for Funding College Costs

Blog #75: Golden Handcuffs for Sam Hunt

Blog #74: Long-Term Care – Insure or Self-Insure

Blog #73: The Discounted Dollars Strategy (Part 2 of 2)

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive