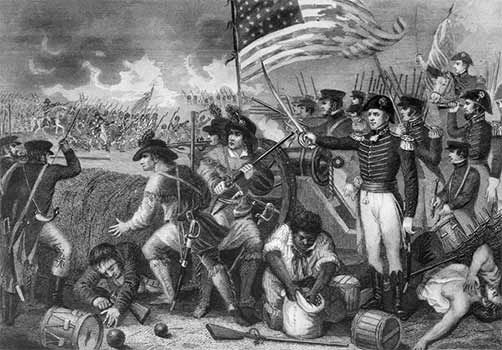

“There wasn’t nigh as many as there was a while ago” is one of the lines from Jimmy Driftwood’s classic, The Battle of New Orleans, about the last battle of the War of 1812 when 3,600 militiamen led by Colonel Jackson (Old Hickory) chased 12,000 British regulars “down the mighty Mississipp’.”

Here is the first verse and the chorus:

In 1814 we took a little trip

Along with Colonel Jackson down the mighty Mississip’.

We took a little bacon and we took a little beans

And we caught the bloody British in the town of New Orleans.

[Chorus:]

We fired our guns and the British kept a’comin.

There wasn’t nigh as many as there was a while ago.

We fired once more and they began to runnin’ on

Down the Mississippi to the Gulf of Mexico.

Click here for The Battle of New Orleans sung by Johnny Horton whose 1959 version is the best-known recording of the song.

“There wasn’t nigh as many as there was a while ago” got me thinking about why there are tens of thousands fewer career life insurance agents than a generation or so ago. The industry is simply not developing dedicated producers as it once did.

The decline began in earnest in the early 1980s with the advent of universal life (UL). The big mutual companies saw it as such a threat to Whole Life that they not only refused to offer UL, they bad-mouthed it continuously. I remember MassMutual had an advertisement featuring President Bill Clark stating something close to this: When MassMutal offers universal life, you’ll know it’s OK to buy it. Ultimately though, MassMutual, and almost all the other mutuals, began offering UL.

The non-mutual stock companies quickly adapted to UL, the new kid on the block. In most cases, uninhibited by the New York State insurance commissioner, they offered skyrocketing commissions often exceeding 100% of first year target premiums, a previously unheard level of producer compensation.

Producers left the old line mutuals in droves to join the companies offering UL and the higher commission that accompanied it. In response, the traditional companies hyped commissions and overrides and "poof" — there went much of the money traditionally spent on recruiting and training. And “poof” went many of the “green pea” recruits who, in turn, traditionally became career producers.

U.S. agents of Prudential Financial sank to around 2,500 from a peak of 20,000. MetLife’s fell to 8,000 from 14,000. In all, the number of U.S. life insurance agents affiliated with a specific company today is down nearly a third since the 1970s according to LIMRA.

When I first started InsMark in the late 1970s, there were more than 50 companies that hired and trained new agents each year. Now there are only a handful.

But experienced producers will continue to become independent from the few mutuals who remain in the recruiting game (e.g., New York Life, MassMutual, Northwestern, Guardian). As time passes, I believe Indexed UL (IUL) may draw off many of these producers just as UL did in the 1980s because, after the learning phase, those who become successful no longer need financing or sales assistance from career agencies. They are the candidates for increased compensation and products with higher potential yield. Speaking of potential yield, recently one of the premier IUL companies began offering a new index with a 140% participation rate with no cap.

Although they argue to the contrary, the mutual companies are very concerned about IUL. The argument about Whole Life vs. IUL is unending, and in many ways, it is like the eternal arguments about religion and politics where neither side gives the other any credit for serious thinking.

I have many friends dedicated to using Whole Life in their practices, and I have no quarrel with that. For many conservative consumers, the product guarantees of Whole Life are well worth the loss of the yield potential of IUL.

But independent producers have largely converted to IUL and so have their clients. Will the mutuals adopt IUL? Probably — but not for a while.

But one day soon, we might see this ad: MassMutal offers indexed universal life; it’s now OK to buy it. I hope so as it will tend to quiet down the controversy.

|

Note: Last week’s email with Blog #52: Fixed Loans vs. Participating Loans was blocked as spam for several readers due to our use of the word “Loans” in the title. It includes a good comparative analysis of the use of both loan-types on the same Indexed Universal Life policy. If you didn’t receive it, click here. |

New Features in InsMark

Our licensees are excited about the Jazz release (Version 17.0 of the InsMark Illustration System). Click here if you would like to see one of our most popular illustrations in the Jazz format.

Click here if you would like to review the features of Jazz.

To license your own copy of the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or 925-543-0513.

![]()

More Recent Blogs:

Blog #52: Participating Loans vs. Fixed Loans

Blog #51: Avoiding the Tax Bomb in Life Insurance

Blog #49: More CheckMate® Selling

Blog #48: Dollars of Benefits for Pennies of Cost

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

Another factor is that many recent college graduates are leaving college with substantial debt. This debt impacts their ability to purchase a new home and buy permanent insurance. Younger new agents no longer have a natural market. What brought this to my attention is the lack of home sales to people under age 35.

Joe

Sent from my iPhone

Good comment, Joe. I hadn’t thought of that. It’s bound to have an impact.

Bob Ritter

InsMark President