(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

-769x513.jpg)

We have referred recently to the value of participating loans with Indexed Universal Life (“IUL”) and thought you might like to see a mathematical comparison between fixed and participating loans.

To do this, we used the Comparison of Insurance Plans module that is available on the Personal Insurance tab in the InsMark Illustration System.

Case Study

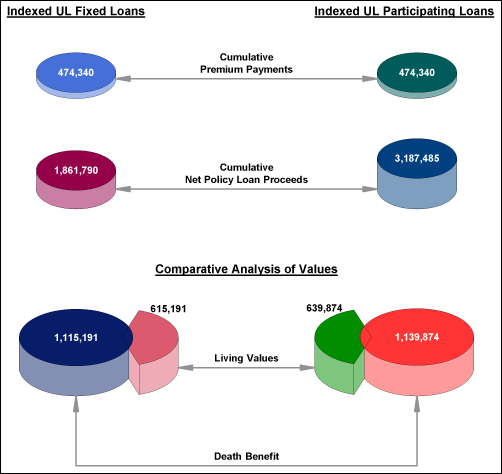

We’ll compare the following two alternatives:

- $500,000 increasing death benefit IUL issued at age 45 (max-funded with 20 annual premiums of $23,717 — just short of a MEC) with level participating policy loans of $91,071 starting at age 65).

- The same as #1 but with level fixed policy loans of $53,194 starting at age 65.

The goal is to have each policy with similar cash values and death benefits at a designated target point in the future — I chose 55 years to age 100 and measured the difference in cumulative loans between age 65 to 100. The difference is dramatic — 171.2% more cumulative cash flow with participating loans. As you can see, the policy values end up close to each other.

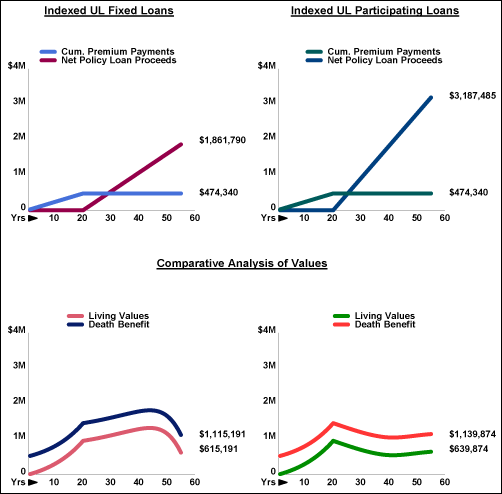

This next graphic reflects the trend lines for all 55 years.

Click here to review the full illustration.

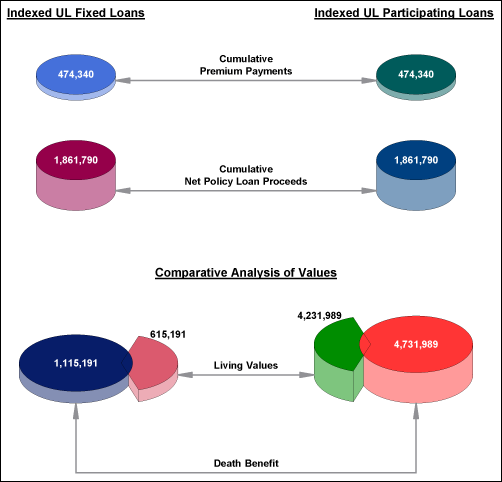

Another way to look at it would be to schedule the same level of participating loans as the fixed loans ($53,914). The difference is dramatic — 411% more cash value with participating loans. As you can see, the cash flow ends up exactly the same.

With this strategy, you get the following comparison.

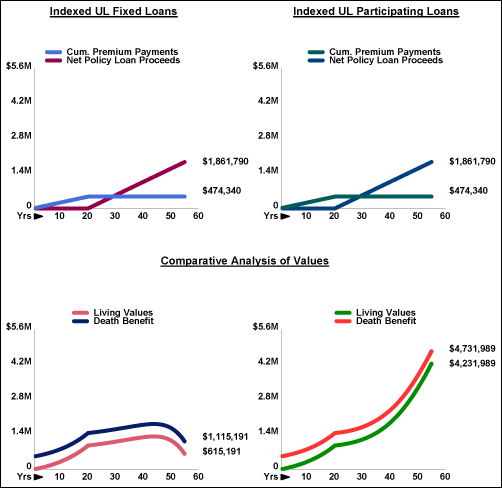

This next graphic reflects the trend lines for all 55 years with cumulative loans the same.

Click here to review the full illustration.

Conclusion

Participating loans are a very significant development in the life insurance industry. Their long-range consequences are difficult to appreciate fully without the mathematical comparisons illustrated in this Blog. Whether you are presenting a large or small amount of insurance, the impact of such loans is considerable.

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or 925-543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com, and we will provide you with recommendations.

Testimonials:

“I have been using InsMark since it was a C:> prompt back in the early 1980s. The new Jazz release is the most exciting upgrade to the system I’ve seen in 28 years! With unlimited options for customization, you can now be as creative as you want when producing illustrations. I downloaded it last night, and used it successfully with my first appointment this morning.”

Chris Jacob, CFP, InsMark Power Producer, SFI-Cadeau, St. Louis, MO.

"The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it."

Rich Lindsay, CLU, AEP, ChFC (InsMark Power Producer, Top of the Table, International Forum) Pasadena, CA

![]()

More Recent Blogs:

Blog #51: Avoiding the Tax Bomb in Life Insurance

Blog #49: More CheckMate® Selling

Blog #48: Dollars of Benefits for Pennies of Cost

Blog #47: Tom and Kristin’s Retirement Planning

3 Reasons Why It’s Profitable For You To Share These

Blog Posts With Your Business Associates and

Professional Study Groups (i.e. “LinkedIn”)

” Hello,

I love InsMark Wealthy & Wise and your blog. Thank you for doing this.

I have to say I don’t understand the detailed differences between Participating and Fixed loans. I think I understand the big picture difference (participating loans continue to be credited interest like the rest of the policy assets).

However, I am asking if the major disparity in performance is due to what I will call “ illustration error”. Does using a participating loan allow for some unreasonable long term assumption to be exaggerated? I am not accusing, I am asking.

The idea that the insurance companies would allow such a big benefit is really the core of my question. It looks too good to be true. Can you straighten me out?

Sincerely,

Christian”

————————————————–

Christian,

I’m not sure what you mean by “major disparity in performance is due to what I will call “ illustration error”. The interest credited to the cash value supporting a participating loan is the same interest rate credited to unborrowed cash values. If any carrier credited less, I would avoid them.

You may have been referring to the interest assumption used in an IUL illustration (Blog #52 used 7.50%) in which something less, like 6.50%, might be more in line with your thinking. In that event, the participating loans would still outperform a fixed loan so long as the loan interest rate on the policy is less than the interest credited.

The potential problem involving IUL is an extended term of years in which the credited rate of whatever index is selected is less than the loan interest rate as that would cause a real drag on cash values during periods when policy loans represent a substantial percentage of policy cash values. This is best handled if the carrier has a guaranteed loan interest rate of 5.00% to 6.00. The more dangerous IULs are those that have a guarantee of an index for loan rates, such as one of Moody’s Bond indexes. While this guarantees the source of the loan interest rate, it does not cap it. I would only acquire an IUL with a cap on loan interest rates. I understand why an issuing life insurance company might desire it, but a policy owner should avoid it.

Click here to review my Blog #25 (Is Indexed Universal Life Too Good To Be True?) in which I interviewed Todd Petit, AVP, Actuarial Product Development, the key designer behind the development of Allianz’s IUL. It has useful information it.

If I missed the point of your question, please elaborate further.

Bob Ritter

InsMark President

Firstly I am a strong believer in the participating loan structures, and I believe carriers dont do a good job explaining there. However in the blog above, it would be good to know the loan rate assumptions used and the illustrated rate. As you are aware one of the concerns that carriers who are negative on index loans is the assumption of positive arbitrage in all years between policy return rate and loan rate. Statistically there is but only on average over time, alas the illustration software does not reflect volatility nor does it give points on what the average loan rate should be- so if the index loans where done using the current low default rates I would argue that is optimistic- if however you set the loan rates to something like 6.5% (closer to moody’s historical bond average) and assuming you are not using a product with a guaranteed index loan rate like Allianz etc then I think that would be representative. Also because the product does not illustrate volatility I think it prudent to ensure loans (wash or index) are taken too soon from the policy. Thoughts?

Dean,

Thanks for your thoughtful comments on this important subject.

The illustrated interest rate in Blog #52 is 7.50%, and the guaranteed loan interest rate is 5.00%.

I don’t want to illustrate an uncompetitive loan interest rate in my Blogs merely because it is representative of many IUL carriers. If a presentation illustrates serious policy loan activity, companies like Allianz that offer a guaranteed rate (as opposed to a guarantee of a rate pegged to a variable index like Moody’s) are likely a better choice for the client.

One way to deal with your concerns about illustrations with positive arbitrage in all years is to include a backcasting illustration as part of the client presentation assuming the carrier involved has a sufficient history to do this effectively. If not, I would suggest using another carrier that does.

Bob Ritter

InsMark President