(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using Wealthy and Wise® (Advanced)

From a November 5 article by the Editorial Board of The Wall Street Journal:

“A GOP Senate would mean the end of the Biden-Bernie Sanders “unity” agenda. No death to the legislative filibuster, no new U.S. states, no Supreme Court packing, no confiscatory tax increases, no Green New Deal. If Mr. Biden wins and he wants to get something done, he would have to go through Mitch the Knife.”

With Joe Biden apparently the winner of the 2020 presidential election, what is the effect on estate planning? This issue is unknown until we know the results of two Georgia Senatorial runoff races on January 5, 2021.

Currently, the new Senate is split 50-48 with the Republicans ahead. If the two Georgia runoffs in early January 2021 split between Republicans and Democrats, the Senate vote will favor the Republicans 51-49. If both go Republican, the split increases to 52-48. If both favor the Democrats, the Senate votes will tie at 50-50. If 50-50, occurs, Kamala Harris, Vice President, as the ex officio president of the Senate, will break any ties in favor of the Democrats. As a result, Democrats will control the House, the Senate, and the presidency for at least the next two years (and who knows for how much longer if the Democrats perform as promised regarding killing the legislative filibuster, packing the Supreme Court and adding two states to the Union, Washington, DC and Puerto Rico).

Biden has promised the immediate repeal of Trump’s Tax Cuts and Jobs Act (TCJA) of 2017. This development means the current estate tax exemption for couples will reduce from $23,160,000 to $7,000,000 (inflation-indexed, one would hope). Some commentators believe the Democrats will reduce it even further in 2021.

This Blog assumes that Biden’s tax promises will occur. The Blog’s title, “Effective Wealth Planning Regardless of Biden’s Tax Promises,” is intended to show how estate planning for wealthy clients can operate in this environment. The only requirement for action in 2020 is to establish an intentionally defective Grantor Trust (IDGT)1 and fund it with a current gift of the available estate tax exemption: $23,160,000 for couples ($11,580,000 for singles), less any portion of the exemption gifted previously.

| 1 | An analysis published by the law firm of Knox McLaughlin Gornall & Sennett, P.C., (a comprehensive, easily understood explanation of Grantor Trusts). |

Most legal and financial experts recognize that an IDGT is a cornerstone of planning for wealthy families. Many such families in America who haven’t taken advantage of gifting all or part of their current estate tax exemption prior to 2021 may soon wish they had.

So, if Anthony and Anita Favaro (featured in Blog #205) are concerned, is there really a hurry? Some say there should be plenty of time to do estate planning in 2021 before the Democrats have time to change the tax law, right?

Not exactly, due to the likelihood of retroactive tax law. Congress has adopted retroactive tax changes since the 1913 Revenue Act, the first one with an effective date prior to the date of the actual enactment. Any increase or decrease in taxes will likely apply retroactively to the beginning of the year in which it is enacted. Therefore, if the goal of a wealth plan involves the use of the current lifetime gift exemption, clients should do it in 2020, probably within an IDGT.

So let’s assume Anthony and Anita Favaro make the changes recommended in Blog #205. These are:

- Establish the IDGT.

- Transfer (retitle) $23,160,0002 of their personally-owned equity account to the IDGT as a tax-free gift.

- Sell their $10,000,000 S Corporation to the IDGT at a valuation of $6,500,0003 financed as a loan.

- Acquire $25,000,000 of non-correlated indexed universal life insurance owned by the IDGT, with 15 scheduled premiums of $1,500,000 paid from IDGT assets.

- In 2020, arrange a bequest at death so that any taxable portion of the Favaro estate goes to the Favaro Charitable Foundation (thus establishing a zero estate tax plan).

| 2 | The 2020 maximum estate tax exemption for married couples. |

| 3 | The sale is at a 35% discount (typical for such transactions). The loan of $6,500,000 is at 1.17%, the long-term Applicable Federal Rate for November 2020. Since the planning for the Favaros in Blog #206 takes place starting in November 2020, we used the November 2020 long-term applicable federal rate of 1.17% instead of the September rate of 1.00% used in Blog #205. |

Case Study

Click here for a quick review of:

- Biden’s promised tax rates;

- Details of the Favaros’ Net Worth.

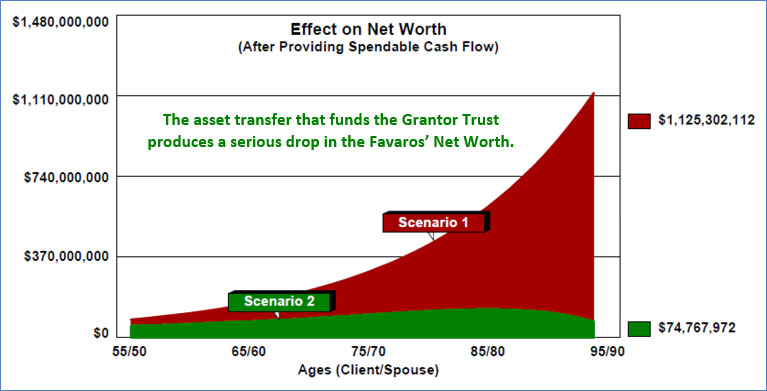

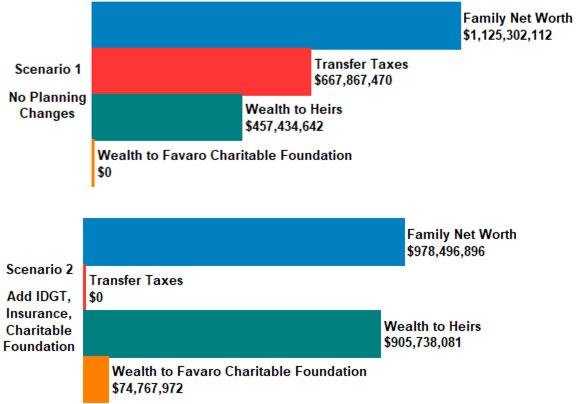

Below is a graphic of the Favaros’ Net Worth using one year of Trump’s taxes in 2020, followed by Biden’s promised taxes starting in 2021. All values shown are after accounting for $600,000 of annual, spendable, after-tax cash flow for the Favaros, including a 2.00% cost of living adjustment.

| Image 1 |

| Effect on Net Worth |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

Source: Wealthy and Wise® (Advanced) System

This graphic assumes that the currently illustrated, non-guaranteed values continue in all years. This result is not likely, and actual results may be more or less favorable.

Net Worth is the value of the parents’ assets minus any liabilities. It is an important metric to gauge financial health and provides a useful snapshot of their current and future financial positions.

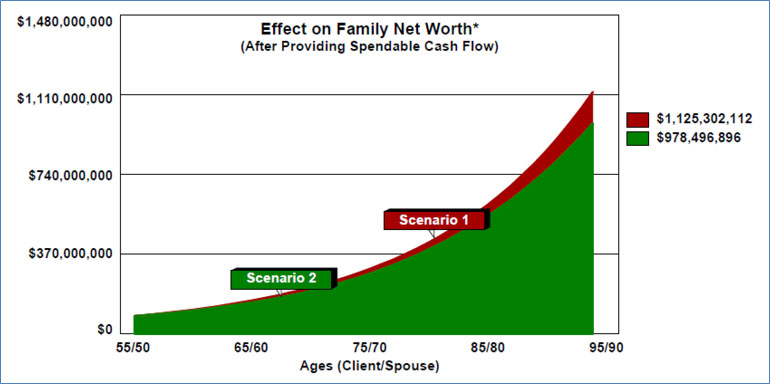

Family Net Worth involves the combined Net Worth of more than one generation (i.e., a family group), and it is not historically associated with wealth management and estate planning. It is a crucial concept when assessing the short-, mid-, and long-term potential of wealth accumulation and asset transfer. It has specific application when a significant portion of the parents’ wealth goes to children or grandchildren — or in trust for them — while their parents remain alive.

Is Family Net Worth a fundamental distinction? The reduction in the parents’ Net Worth caused by such transfers presents itself more clearly in the context of overall, multi-generational Family Net Worth. It is particularly applicable for assets in an IDGT, especially when parents can access that wealth using distributions or loans.

Below is a graphic of the Favaros’ Net Worth using Trump’s taxes in 2020, followed by Biden’s promised taxes effective January 1, 2021. All values shown are after accounting for $600,000 of annual, spendable, after-tax cash flow for the Favaros, including a 2.00% cost of living adjustment.

| Image 2 |

| Effect on Family Net Worth |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

Source: Wealthy and Wise® (Advanced) System

This graphic assumes that the currently illustrated, non-guaranteed values continue in all years. This result is not likely, and actual results may be more or less favorable.

Family Net Worth is indeed a useful technique for evaluating wealth planning.

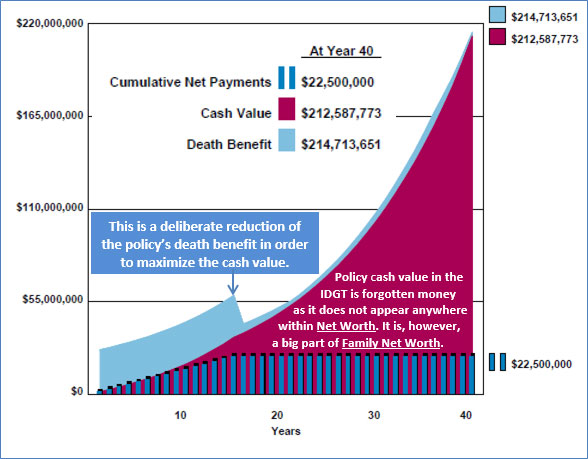

Below is a graphic of the $25,000,000 non-correlated, cash value life insurance policy owned by and paid for by the IDGT.

| Image 3 |

| $25,000,000 Life Insurance Policy Insuring Anthony Favaro |

| Premiums: $1,500,000 for 15 years |

| (paid from Grantor Trust funds) |

Source: InsMark Illustration System (Illustration of Values module).

This graphic assumes that the currently illustrated, non-guaranteed values continue in all years. This result is not likely, and actual results may be more or less favorable. This graphic is not valid unless accompanied by a basic illustration from the issuing life insurance company, which details both current and guaranteed values and other important information.

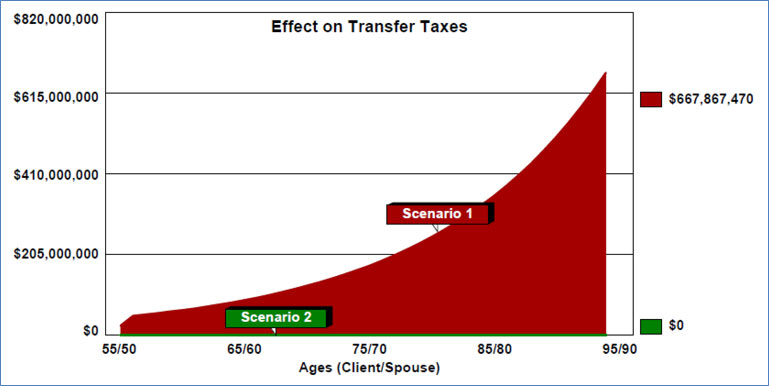

The procedures used in Scenario 2 have eliminated all Transfer Taxes permanently.

| Image 4 |

| Effect on Transfer Taxes |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

Source: Wealthy and Wise® (Advanced) System

This graphic assumes that the currently illustrated, non-guaranteed values continue in all years. This result is not likely, and actual results may be more or less favorable.

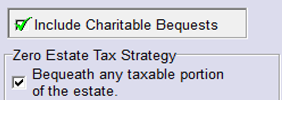

Note to Wealthy and Wise® (Advanced) licensees: To accomplish the Transfer Tax objectives of a Zero Estate Tax plan in Scenario 2, we used the following two selections available on the Charitable Bequests sub-tab located on the Illustration Details tab:

This option provides that any assets remaining in their estate become a charitable bequest to the Favaro Charitable Foundation. This bequest includes the Favaros’ personal residence and the promissory note of $6,500,000 owed to the Favaros by the S Corporation in the Grantor Trust.

This option provides that any assets remaining in their estate become a charitable bequest to the Favaro Charitable Foundation. This bequest includes the Favaros’ personal residence and the promissory note of $6,500,000 owed to the Favaros by the S Corporation in the Grantor Trust.

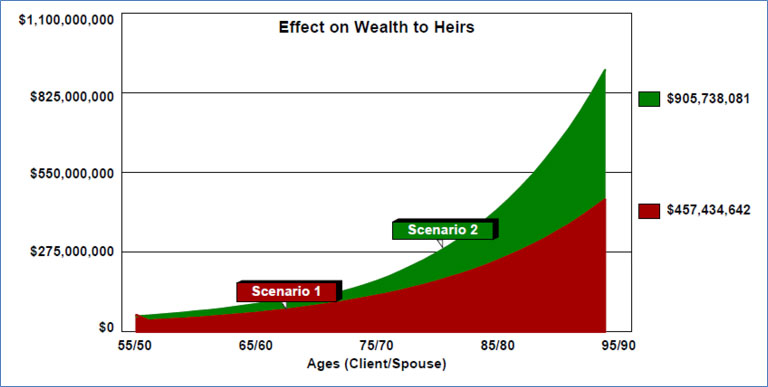

Favaro heirs’ superb result appears below — Strategy 2 produces a long-range 98% increase over Scenario 1.

| Image 5 |

| Effect on Wealth to Heirs |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

Source: Wealthy and Wise® (Advanced) System

This graphic assumes that the currently illustrated, non-guaranteed values continue in all years. This result is not likely, and actual results may be more or less favorable.

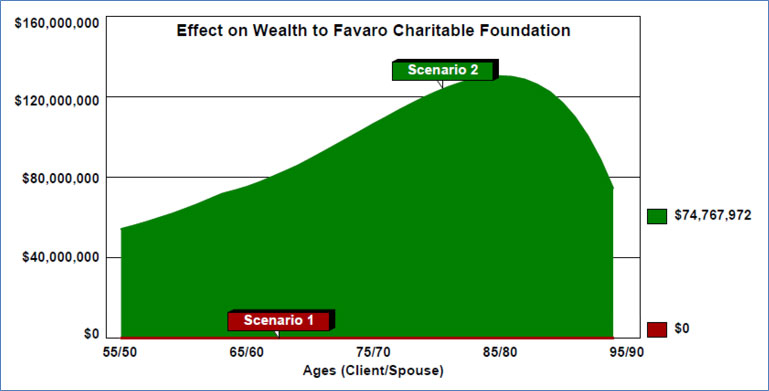

To accomplish the results shown above, the Favaro Charitable Foundation is also generously funded with Scenario 2.

| Image 6 |

| Effect on Wealth to Charity |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

Source: Wealthy and Wise® (Advanced) System

This graphic assumes that the currently illustrated, non-guaranteed values continue in all years. This result is not likely, and actual results may be more or less favorable.

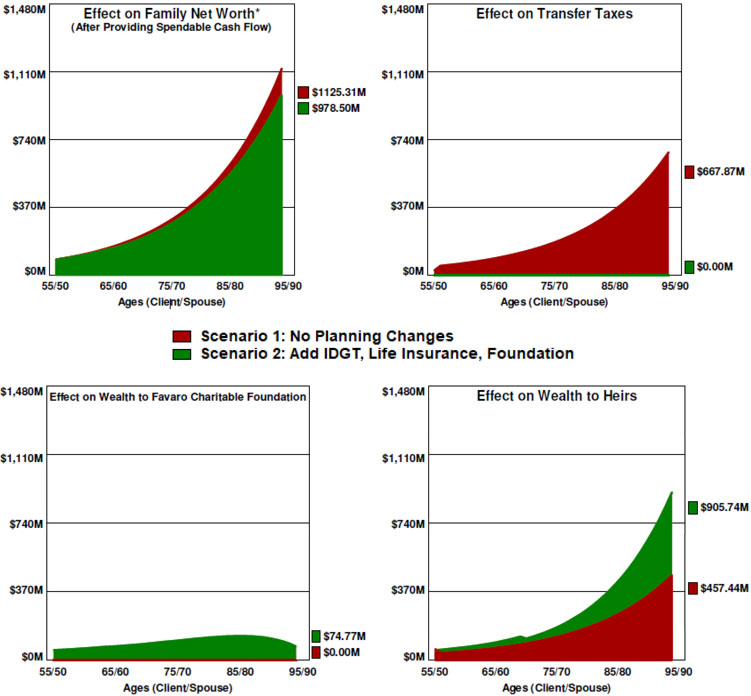

Below is a summary of the prior graphics:

| Image 7 |

| Overall Results |

| Scenario 1: No Planning Changes |

| vs. |

| Scenario 2: Add IDGT, Life Insurance, Charitable Foundation |

Source: Wealthy and Wise® (Advanced) System

This graphic assumes that the currently illustrated, non-guaranteed values continue in all years. This result is not likely, and actual results may be more or less favorable.

The difference between long-range Wealth to Charity and long-range Wealth to Heirs in Image 7 is almost $831 million ($905.77 million less $74.77 million). You can make these two benefits work any way you’d like. To get more for the Foundation, you can reduce the amount going to heirs. If you would like more for heirs, you can reduce the Foundation’s share. You can develop client-directed results with a minimum of software changes.

Below is a final summary analysis of the alternatives featuring Biden’s tax promises in both Scenarios. Nasty as Biden’s taxes are, including them in Scenario 2 still produce substantial family net worth, eliminates transfer taxes, doubles the amount of wealth to heirs, and provides almost $75 million to the Foundation. I can’t imagine the Favaros selecting Scenario 1, can you?

| Image 8 |

| Ages 95/90 |

Source: Wealthy and Wise® (Advanced) System

This graphic assumes that the currently illustrated, non-guaranteed values continue in all years. This result is not likely, and actual results may be more or less favorable.

The Senate Runoff

Should the Democrats win both Georgia Senate seats on December 5, President Biden can likely realize most of his promised tax increases. This Blog assumes that occurring, and it is the biggest downside for wealthy clients.

Should the Republicans win at least one of the two Senate seats, it is unlikely that President Biden gets any of his increases. This result is the most significant upside for wealthy clients, and the Favaros will have enhanced net worth and family net worth, wealth to heirs, and wealth to their Foundation. If this occurs, I will re-do the Images for you.

Wealthy and Wise (Advanced) Reports

Click here to review the 51-page Wealthy and Wise® (Advanced) evaluation of the comparisons presented in this Blog. There are 10 Comparison Pages, 18 Scenario 1 pages, 24 Scenario 2 pages, and 2 Disclosure pages.

I don’t know how you can present the comparison professionally without revealing all its components. I recommend that you have all the reports for a given analysis with you when visiting with a client or client’s attorney or CPA. The System backs up every number shown, and you never know which report you’ll need to have handy to answer this inevitable question, “Where did this number come from?”

You may run across a prospective client with a “just give me the facts” mindset. If so, emphasize the comparison graphics. However, you will surely end up in front of this client’s attorney or CPA, so be prepared to present all the reports.

Most Wealthy and Wise users select a few critical comparison graphics for the main section and include supplemental reports in separate illustrations or an Appendix. More elaborate report organization can be accomplished (Table of Contents and Section pages) through the use of the following prompt — located on the bottom right of the Workbook Main Window:

Conclusion

The ability to illustrate the use of IDGTs for many of your clients is valuable. For those currently presenting IDGTs, I think our Wealthy and Wise (Advanced) overall capacity will provide you with a more comprehensive analytical tool.

Also, I would show it to every estate planning attorney and CPA you can contact, as I don’t believe there is any other software that can illustrate the use of IDGTs as effectively as Wealthy and Wise (Advanced). We expect attorneys to be among many of our new licensees for it. How about this: After you present it to attorneys, offer to help them put their cases together using it. You will be surprised by the new clients you will develop.

My good friend, Vince D’Addona, who convinced me to develop InsMark’s Wealthy and Wise (Advanced), said, “If only I had this tool when I first entered the business, I would have spent all my time building my business by demonstrating it to estate planning attorneys and CPAs.”

Specimen Trust

InsMark’s Cloud-Based Documents On A Disk™ (DOD) has dozens of specimen trusts. The most important one related explicitly to IDGTs is entitled Multi-Purpose Irrevocable Life Insurance Trust (MILIT). It is available as the last entry under Other Trusts in the Family Trusts section of documents. For those licensed for DOD, click here to go to that location; otherwise, contact InsMark’s Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) for more information about DOD.

Licensing Fees for Wealthy and Wise® (Advanced)

Any current licensee of Wealthy and Wise® (including Power Producers) can upgrade to the Advanced version for an initial fee of $600 with monthly maintenance increasing by $40.00 a month.

Any current licensee of Wealthy and Wise® (including Power Producers) can upgrade to the Advanced version for an initial fee of $600 with monthly maintenance increasing by $40.00 a month.

For those not currently licensed for Wealthy and Wise®, the fees for Wealthy and Wise® (Advanced) are $2,250 with monthly maintenance of $99.95 a month.

Click here for individual, online purchases of licenses for Wealthy and Wise (Advanced).

Note: Maintenance fees provide specific enhancements and free technical support.

For more information or licensing questions about Wealthy and Wise Wealthy and Wise® (Advanced), contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275).

Institutional inquiries — contact David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

Your Comments

What are your thoughts and conclusions after reviewing this material? Please add your comments to this Blog.

Creating Similar Presentations

Assuming you are licensed for Wealthy and Wise® (Advanced), you can download the same Digital Workbook File below that I used to prepare the Case Study for this Blog. It will prove invaluable to you in getting acquainted with Wealthy and Wise (Advanced).

The video below can also acquaint you with the general subject of downloading and using InsMark’s Digital Workbook Files.

If you would like highly qualified design assistance with no commission split required, contact LifePro Financial, InsMark’s Referral Resource discussed below.

Workbook file for Blog #206 Wealthy and Wise (Advanced)

|

Before downloading and reviewing any files, be sure you have installed the most current updates to your InsMark Systems. Do this using InsMark Live Update available under Help on the main menu bar of the System or this icon on the main menu bar:

Note: If you see this message on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook file to your PC’s appropriate directory where your InsMark System(s) reside. |

If you download the Digital Workbook File for Blog #206, click here for a Guide to its content. It will be invaluable to you as you design similar illustrations.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner, and the Wealthy and Wise software has helped me supplement my LEAP skills and increase my commissions. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it.”

Vincent M. D’Addona, CLU, ChFC, MSFS, AEP, InsMark Power Producer®, New York, NY

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“Wealthy and Wise allows us to reflect practically ANY planning scenario we have encountered with clients. The ability to flow data easily into the program (without being so granular as to be unwieldy) is, in my opinion, one of the core strengths of Wealthy and Wise. Modeling alternate planning scenarios and being able to present the results in both graphical and numerical formats is certainly welcome, and I can’t imagine doing cash flow and estate growth projections without Wealthy and Wise.”

Mark A. Trewitt, CLU, ChFC, CAP, CFP, AEP, InsMark Platinum Power Producer®, Plano, TX

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer®, Minneapolis, MN

“InsMark helps us help our clients understand their money and their choices. I always learn something new that changes what we do and how we can do it more efficiently. That translates to a better bottom line for us and for our clients. It’s making more money for everyone – just by pushing InsMark buttons on the computer.”

Kay Corbin, CLU, ChFC, InsMark Platinum Power Producer®, Phoenix, AZ

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“The net worth and cash flow modeling that Wealthy and Wise provides is one of the best financial planning tools in the market place. In and of itself, it delivers tremendous value to the client. Moreover, when advisers update it annually, they deliver that tremendous value year after year. However, until advisers have sold themselves on the value proposition of charging fees, they will avoid them — either to their financial detriment or in reduced service to clients. That is why advisers must be encouraged to believe the value they will create is worth far more than the fees they can charge.”

Mark Pace, CLU, RHU, ChFC, Creator of the Life Insurance Performance Management System, InsMark Gold Power Producer®, President, ObjectiView, Inc., Ridgeland, MS

“InsMark’s referral resource, Brian Manderscheid from LifePro, has been a gem to work with! He helps us use InsMark with every one of our cases. The genius factor is InsMark’s commitment to “Compared to What.”

Glenn Main, InsMark Platinum Power Producer®, McMurray, PA

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“InsMark”, the InsMark Logo and “Wealthy and Wise” are registered trademarks of InsMark, Inc.

Cloud-Based Documents On A Disk is a trademark of InsMark, Inc.

Copyright © 2020 InsMark, Inc.

All Rights Reserved

Important Note #1:

The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2:

The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3:

Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. This is mainly a problem when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is significantly more than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type have been utilized. It is avoidable, and you, the producer, are crucial to making sure your clients know how to sidestep it.

A tax bomb is avoidable if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The basis of this particular treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This treatment applies to the full death benefit, including any cash value component, whether loans exist or not.

Note: It is best to design the policy with no premiums scheduled after retirement if you anticipate loans in retirement years. This suggestion may require higher premiums during pre-retirement years, but a policy with no premiums scheduled is much more tolerable at advanced ages than one with continuous premiums.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans, be sure to talk to your financial adviser before surrendering or lapsing the policy to anticipate unexpected tax consequences that may otherwise be avoided.

Does this note make it harder or easier to deliver the policy? It’s more challenging if you haven’t discussed it with your client, easier if you have. And that’s the point – you should discuss it.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender. You would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.

![]()

More Recent Blogs:

Blog #205: Escaping an Oncoming Financial Nightmare

Blog #204: Leveraged Executive Bonus (Part 2 of 2)

Blog #203: Anybody Want A Free Dog? (Part 1 of 2)

Blog #201: Awesome LLC Buy-Sell Strategy for Owners of C or S Corporations (Part 1)

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive