(Click here for Blog Archive)

(Click here for Blog Index)

(There are no InsMark presentations used in this blog. It is a an informational blog only)

Guest Blog by Scott Keffer

|

Note from Bob Ritter: Scott Keffer is an internationally-recognized Coach, Best-Selling Author, and Keynote Speaker, who you may have seen on ABC, NBC, CBS, FOX, and PBS, or in Huffington Post, Worth, Wall Street Select, Money Show, Small Business Trendsetters, Research, National Underwriter, Resort Living, and Dynamic Business, among others. His latest books include the #1 Amazon Best Selling Double Your Affluent Clients® 47 FAST TIPS! You Can Have Greater Success With Affluent, High Net Worth Clients! and Giving Transforms YOU! I am really pleased to have Scott join us for a Guest Blog. |

Let me share with you why it’s so hard to be an adviser, why it’s not (totally) your fault, and how you can take action now to avoid being left further and further behind.

If you are like most advisors, the challenges, frustrations and roadblocks that you face today are the same that you faced three years ago… only they seem greater. And you may not be quite sure what is going on.

You are not alone.

The other day, I pulled the car out of the garage and out onto the street in front of our house. Something was weird. I was giving it more gas, but it wasn’t responding. Oops. The emergency brake was on.

Does your business feel like the emergency brake is on? There are reasons. Doing more of the same is not the answer.

There is a clear answer on how to unlock the “emergency brake” from your business. More on that in a minute.

In the meantime, let’s look at what is “dragging” your progress down. The 5 Cs:

- Competition

Competition has confused the marketplace and created confusion among prospects about the difference between financial advisors. With over 900,000 financial and insurance advisors in the US and over 76,000 in Canada, prospects no longer are equipped to understand the difference. Add to that the banks, attorneys, accountants…

- Clones

Every Tom-Dick-and-Mary with less experience, wisdom, experience and skill are using the same brochures, invitations, website templates and marketing pieces that you are, promising the same level of advice as you, and even offering the same products and solutions.

- Commoditization

When every advisor looks the same on the surface, prospects default to the only way to tell them apart… price. The result of competition and clones is that advisors are commoditized – you, your practice and your “same-as-every-other-advisor” traditional, advisor marketing. There is constant downward pressure on fees and commission.

- Clutter

Advisors’ marketing messages are being drowned out, awash in the marketing clutter that is a part of the 21st century over-communicated world. The Tuesday edition of the New York Times has more information in it than the average 17th-century individual encountered in their entire lifetime. According to a recent CBS report, today we receive over 5,000 marketing messages a day versus 500 in the 1970’s. It used to be like drinking from a firehose… today it’s like drinking from Niagara Falls.

- Compliance

You are being vilified, because of a few bad apples in the financial services industry and the corporate scandals. Now, all advisors are painted with the same brush. The President has called for new rules that, according to the recent USA TODAY, would require “financial advisers to put their client’s interests above their own, especially when it comes to retirement savings plans.”

As a result, you face increasingly intrusive and crushing compliance. Which adds not only money and time, but stress and pressure as well. In addition, compliance seeks to neuter every marketing effort.

The bottom line is that these factors are killing your profit!

The answer? Create an Arc of Distinction® that allows you to rise above the competition, clones and clutter so that prospects actually seek you out.

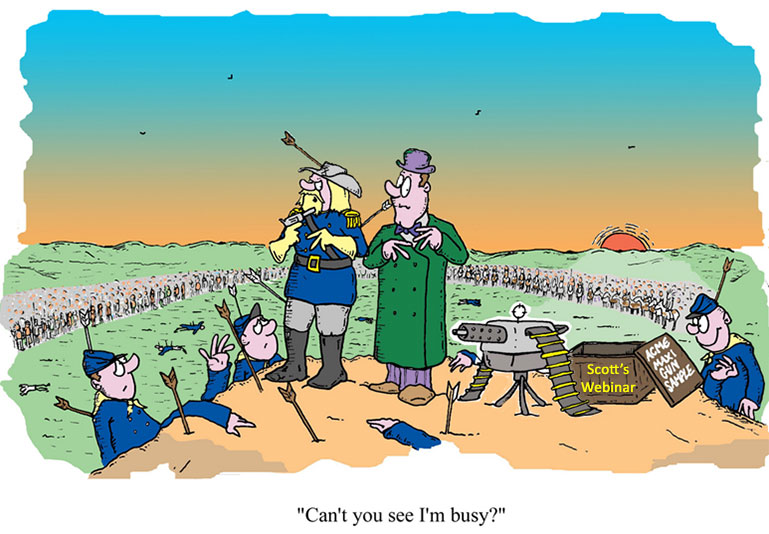

Bob Ritter has asked me to share ALL the details on an upcoming LIVE online webinar training that he and InsMark are hosting on Wednesday, October 7th at 11:00 a.m. Eastern. It’s entitled, “How To Have Qualified Prospects Contact You… Without Hard Selling!” and it’s FREE.

Simply click here to register. You’ll receive all the details on how to discover:

- How to EASILY rise about every competitor in your market!

- The ONE core strategy that will create MULTIPLE STREAMS OF GREAT PROSPECTS without traditional sales tactics (which everyone hates)!

- How to INSTANTLY STOP WASTING boatloads of money on traditional financial marketing (that sends affluent prospects running the other way)!

- How to FINALLY GET PAID for your wisdom and expertise… and take home the money you need and deserve!

It’s time to take the brake off your business and enjoy the success you’ve earned!

I look forward to your joining me on the webinar.

More About Scott Keffer

Scott is as an authority on marketing and positioning, Scott has been interviewed on radio and TV and spoken at The Forum 400, AALU, United Way, National Network of Estate Planning Attorneys, InsMark’s Symposium, Ed Slott’s Elite IRA Advisor Training, among others. He has been hailed as an "industry transformer," as the creator of innovative processes, including Double Your Affluent Clients® Boot Camp, The Donor Motivation Program®, The Seminar Money Machine™, The Affluent Engagement System®, The 7X Advisor Model®, and The Arc Of Distinction®.

Through his top-rated speaking and coaching, Scott has trained tens of thousands of financial advisors, estate planners, money managers and other business owners from the U.S., Canada and Australia. As a Continuing Education Instructor, Scott has instructed thousands of attorneys, accountants and other financial advisors at universities, tax conferences, national accounting firms, Estate Planning Councils, and Bar Associations.

Scott has been profiled in a number of books and publications, including Research magazine, Creative Destruction and two of Strategic Coach founder, Dan Sullivan’s books: The Advisor Century and Unique Process Advisors.

Scott shows financial advisors, estate planners, money managers and other business owners how to attract a steady stream of Right Fit clients, so that they can take home more income, take off more time and have a bigger impact on their family, friends, clients and causes they care about deeply. He believes that every single person has been put on this earth to live a life of BIG Impact.

Scott is a warm communicator with a passion for helping people transform their futures. He lives in Pittsburgh, Pennsylvania with his wife, Beth, and their chocolate Lab, Max, and they enjoy walking, fitness, cycling, reading, and spending time with their grown children, Josh and his wife Andrea, and Anni.

What InsMark Brings to the Table

InsMark Systems

To license any of InsMark Systems, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

![]()

More Recent Blogs:

Blog #115: Part 2 of Leveraged Deferred Compensation (Is Arthur Better Off With Term Insurance?)

Blog #114: Leveraged Deferred Compensation (Part 1)

Blog #113: Life Insurance Alternatives to a 401(k)

Blog #112: Retirement Planning Strategies Using Indexed Universal Life

Blog #111: Part 2 of the Impact of New Regulations on Indexed Universal Life

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive