Joe Tanner, age 35, is making an annual contribution of $17,500 to his company’s 401(k) plan, and his employer matches the first $2,500. Can you make a case for diverting the after tax cost of the $15,000 beyond the employer’s match into a personal retirement plan?

|

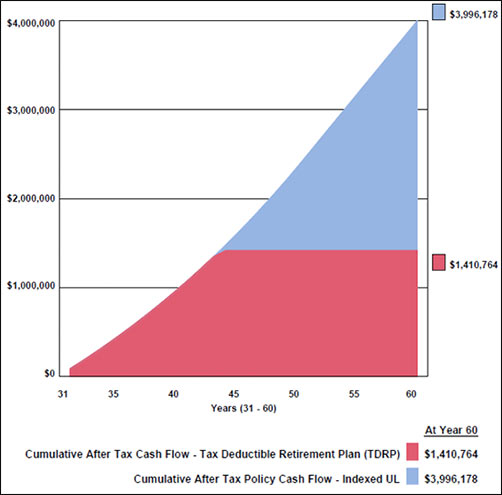

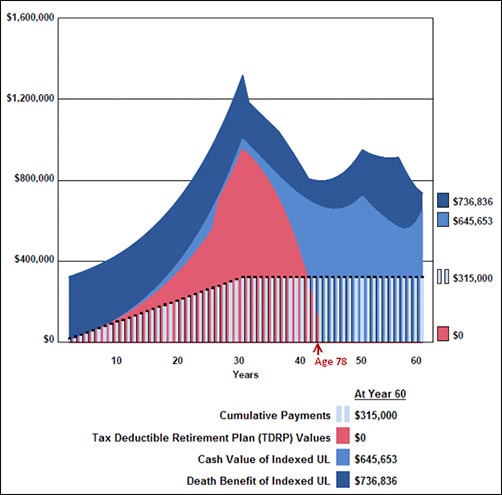

Check out the two graphics below:

Click here to view the full illustration.

The IUL has the same $10,500 premium as the after tax deposit to the 401(k) in excess of the employer’s match. Beyond that, the differences are significant:

- Unlike the 401(k), the IUL provides a significant death benefit for Joe’s family.

- Unlike the 401(k), a waiver of premium can be attached to the IUL in the event of disability.

- Unlike the 401(k), tax free cash flow (loans) from the IUL can be accessed prior to age 59 1/2 with no 10% premature distribution tax.

- Unlike the 401(k), the IUL is illustrated to maintain its values through age 95. At the end of the analysis, the IUL illustrates 283% more after tax cash flow plus remaining cash value in excess of $645,000 wrapped up in over $736,000 of death benefit.

The 401(k) doesn’t stand a chance of competing once you evaluate two issues:

- 30% of the money in Joe’s 401(k) belongs to the IRS;

- IUL with participating loans is a very powerful financial instrument.

Conclusion:

Every client with a 401(k) contribution in excess of the company match should consider the IUL alternative.

Further, it does not just apply to a 401(k). Anyone with an IRA, a Keogh, or a 403(b) plan is a candidate for the life insurance alternative. In addition, any employer with a classic profit sharing plan should consider personally-owned IUL as an alternative.

Important Note: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Licensing

To license Wealthy and Wise and/or the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com, and we will provide you with recommendations. This might not be a bad idea for your first couple of cases like the Callahans’.

Testimonials:

"InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me."

Doug Peete (Past President, Top of the Table), InsMark Power Producer®, Overland Park, KS

"As a top national brokerage firm representing many insurance companies, the InsMark Illustration System has everything we need in an advanced marketing presentation system."

Gary M. Baker, President/CEO, Bloom-Baker/Asensus of New England, Boston, MA

"I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark."

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Power Producer®, Financial Planner, Denver, CO

![]()

More Recent Blogs:

Blog #60: Coupling College Funding With Retirement Planning

Blog #59: The InsMark Business Valuator

– A Powerful Tool For Financial Advisers

Blog #58: A New Retirement Planning Strategy

Blog #57: Messages from Washington Are Often Unpleasant

Blog #56: An Easy Charitable Legacy

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive