|

Editor’s Note: Blog #44 is the fourth in a series of Blogs involving several topics that are associated with the decision to sell a closely-held business, all of which provide opportunities for you to develop some serious production. If you have not done so already, you may want to read Blog #43 as this Blog #44 is a continuation of the search for the best executive benefit plan for Tom Hamilton, a key non-shareholder executive of George and Marie?s company. Below are the previous Blogs in this series: Blog #41: If We Sell Our Business, Can We Afford to Retire? |

Tom Hamilton, age 40, is the Chief Marketing Officer of George and Marie Grove’s business (a Limited Liability Company) and is largely responsible for a large portion of the bottom line. ?His current annual compensation is $300,000. He has no ownership in the firm.

Although George and Marie expect the business to be sold within five years, they want to award Tom with a special executive benefit plan to encourage him to stay with the firm for at least the next seven years. The additional time is to induce Tom to stay with the new owners for at least two years, a condition that enhances the value of George and Marie’s company to potential purchasers.

In Blog #43, we illustrated an executive benefit for Tom called a Controlled Executive Bonus Plan designed to cause him to remain with the firm during these next few critical years while the plans to sell the business are firming up. That plan, if implemented, will provide Tom with a gross-up bonus to pay the seven scheduled $60,000 premiums on a personally-owned $2,600,000 indexed universal life insurance policy. ?Included in that plan is a provision that if he terminates employment anytime within the next seven years, he owes the company an amount equal to the cumulative bonuses paid -- a serious inducement for him to stay employed. At the end of seven years, Tom no longer has any repayment liability.

The Controlled Executive Bonus Plan is a real game-changer in the world of executive benefits. ?I have been a big fan of loan-based split dollar, but this new bonus variation includes one of the main features of split dollar (recovery of premium advances), and it adds a deduction of the plan funding for the business, a major advantage. ?That said, loan-based split dollar still has plenty of use for owners of C Corporations. The Controlled Executive Bonus Plan is for non-owner executives of any business entity (C Corporation, S Corporation, Limited Liability Company, Partnership, Sole Proprietorship, and Tax Exempt Organization.)

Good as the Controlled Executive Bonus Plan is, it misses a key point: If an executive like Tom is valuable enough to be provided with a significant executive benefit, he should also be covered with a business-owned key executive policy to indemnify the business against losses created by his death.

One way to accomplish this would involve the company buying an additional policy on Tom owned by, and payable to, the company. ? Let’s see if we can be a little more creative than that. ?Let’s change the way the $2,600,000 policy illustrated in Blog #43 is utilized. ?Instead of Tom owning it and having it paid for using a gross-up bonus “controlled” bonus from the company, let’s have the company own the policy and divide its benefits in three different ways.

If Tom dies anytime during the next seven years, the $2,600,000 policy’s benefits will be shared in two of those ways. ?Step 1 is very like a survivor needs analysis that you might do for a family. ?It is, in fact, a business needs analysis.

- InsMark’s Key Executive Calculator determines that $1,525,737 of the policy’s death benefit should be retained by the firm as an offset to the loss of Tom. ?This takes into account:

- The present value of the estimated loss of sales due to the time it will take a replacement to ramp up to Tom’s performance;

- The present value of any difference between Tom and his replacement;

- The upfront costs associated with recruiting a new Chief Marketing Officer (search firm, signing bonus, and relocation package).

- InsMark’s Key Executive Calculator determines that $1,065,416 of the policy’s death benefit should be allocated to a sinking fund designed to pay Tom’s family an annual salary continuation benefit of $250,000 each year for seven years should he die anytime during the next seven years. The $250,000 is indexed at 3.50% with a COLA (cost of living adjustment) and is deductible by the company. ?The sinking fund is assumed to earn a 5.00% pre-tax rate of return. Including the COLA, the salary continuance to Tom’s family totals $1,944,852 funded by the sinking fund. (Proof of the math follows.)

- Assuming Tom survives the seven years, at the beginning of year 8, ownership of the life insurance policy will be contractually transferred to Tom. ?He will be charged income tax on the policy’s accumulation value, and the company intends to provide Tom with a gross-up bonus to pay the tax on the transfer.

In this case, the total death benefit needed is the sum of Step 1 ($1,525,737) plus Step 2 ($1,065,416) for a total of $2,591,153. ?Since we have illustrated a face amount to $2,600,000, there is a slight excess of death benefit ($8,847).

Click here to review the four-page report from the InsMark Key Executive Calculator. ?Page 1 is the summary; Pages 2, 3, and 4 back up the summary. Page 4 is instructive relative to the relationship between the survivor income benefit and the $1,065,416 sinking fund established to pay it.

|

If you are using Internet Explorer or Firefox, be sure to hover your mouse over any yellow stickies for an additional explanation. The yellow stickies are not available with Chrome, iPhones, or iPads. |

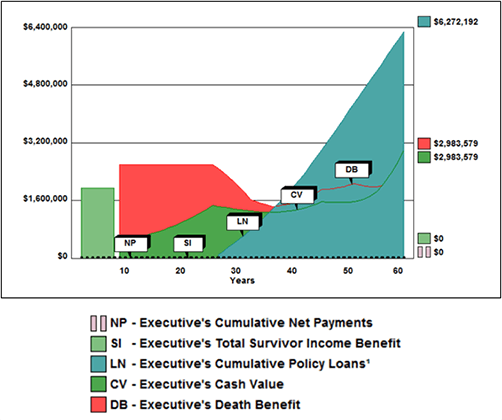

Transfer Tax Costs for the Participants Click here for transfer tax calculations. The Company’s Summary of Costs and Benefits Click here for the Company?s Summary report. Tom’s Summary of Costs and Benefits Click here for Tom?s Summary report. The graph from Tom?s summary on Page 5 is also reproduced below. |

“Trifecta” refers to a winning sequence of three and is typically associated with a pari-mutuel bet in horseracing that involves picking which horses will finish first, second, and third in a given race. ?We have given the name Executive Trifecta? to the trifecta of benefits described in this Blog, and this plan can be illustrated in the InsMark Illustration System (located on the Executive Benefits tab).

Executive Trifecta is highly suitable for non-owner key executives of any business (profit-making or tax exempt), but it is also effective for principals of C Corporations, S Corporations, LLCs, and Partnerships. ?It may surprise you that it works better for principals of an S Corporation and even better for principals of an LLC or Partnership.

|

The PowerPoint will not launch on an iPhone or an iPad since Apple does not support Microsoft?s PowerPoint. |

Click here to view a comprehensive PowerPoint that includes details on how Executive Trifecta applies in each of these organizations. Since the majority of closely-held firms are pass-through tax entities like S Corporations and LLCs, this aspect of Executive Trifecta can introduce you to a terrific benefit for owners of such firms. Most producers have pretty much given up on constructing effective fringes for such principles. |

Executive Trifecta can also be an appropriate way to reward Directors of any entity for their service.

Is the Controlled Executive Bonus Plan better than Executive Trifecta? ?In some ways, yes; others, no. The Controlled Executive Bonus Plan is simpler to illustrate, and it is also simpler to explain (and understand). ?They both benefit?Tom in very much the same way because both give him full ownership of the policy beginning in?year 8. ?Executive Trifecta one-ups the Controlled Executive Bonus Plan by providing a serious death benefit for George and Marie’s company should Tom die during the next seven years.

The simplicity of the Controlled Executive Bonus Plan should not be overlooked. ?Simple beats complex, right? ?Simple always has a place at the table, but if I were presenting the Controlled Executive Bonus Plan, I would be concerned if I discovered a competitor was presenting Executive Trifecta. ?What’s the tell-tale? ?In your initial fact-finding with the company, ask about the potential loss associated with the death of certain key executives. If the losses are not that significant, why are they key executives? ?If they are significant, consider Executive Trifecta.

To some extent your choice depends on your own illustration skills and your perception of your client, and because of this, I can’t make a recommendation. ?Both are outstanding benefit plans, and I recommend you become skilled with both of them if you are dealing with, or want to deal with, closely-held companies.

The following two Tables may help you decide which you prefer or, perhaps, which you prefer under which circumstances. ?I think one of the most interesting issues about these plans is that they each cost George and Marie’s company virtually the same cumulative amount over seven years ($420,000 vs. $429,710).

Table 1 - The Company

| Company | Controlled Executive Bonus | Executive Trifecta |

| Cost over 7 years | $420,000 | $429,710 |

| Death benefit during 1st 7 years | n/a | $1,525,737 |

| Value during 1st 7 years |

Recovery of bonuses | Policy cash values |

| Security during 1st 7 Years |

Tom?s contractual promise to repay bonus | Ownership of cash values |

Table 2 - Tom Hamilton

| Tom Hamilton | Controlled Executive Bonus | Executive Trifecta |

| Cost in all years | $0 | $0 |

| Death benefit | $2.6 million policy death benefit | $2.1 million of survivor income¹ during 1st 7 years; $2.6 million policy death benefit thereafter |

| Living value | Full policy cash value in year 8 | Full policy cash value in year 8 |

| Cumulative after tax retirement cash flow (age 65 - 100) | $6,272,192 | $6,272,192 |

| Residual cash value at age 100 | $2,983,579 | $2,983,579 |

| Liability | Repayment of the bonus in years 1-7 less policy cash value | $0 |

¹Indexed at 3.00% for a Cost of Living Adjustment.

Executive Trifecta -- the Complete Illustration

Up to now, I have been showing you only segments of Executive Trifecta. Click here to review the complete illustration. (The Flow Chart on Page 3 is very busy, and you’ll have to study it carefully.)

Conclusion

Both Executive Trifecta and the Controlled Executive Bonus Plan produce exceptional benefits for participants. ?Is this an opportunity for you with the business owners and professional advisers in your community? ?You bet it is!

Documentation

The documentation for Executive Trifecta is different than a typical Executive Bonus Plan. Version 21.0 (and higher) of InsMark?s Documents On A Disk™ has complete specimen plan documents for this plan in the Executive Trifecta category located in both the Business Owner?s Benefit Plans and the Key Employee Benefit Plans section. These specimen documents don't exist anywhere else, so if you use this concept, you will need them.

The documentation for Executive Trifecta is different than a typical Executive Bonus Plan. Version 21.0 (and higher) of InsMark?s Documents On A Disk™ has complete specimen plan documents for this plan in the Executive Trifecta category located in both the Business Owner?s Benefit Plans and the Key Employee Benefit Plans section. These specimen documents don't exist anywhere else, so if you use this concept, you will need them.

Click here to watch a short video about documentation for Executive Trifecta. (YouTube has been experiencing difficulties, if the video does not play try it again -- or try later.)

If you are licensed -- or become licensed -- for the InsMark Illustration System and would like to review the data input we used for Executive Trifecta, please email us at bob@www.robert-b-ritter-jr.com, and we will get the Case Data file (Workbook) right out to you. Be sure to ask for the Workbook associated with Blog #44: Alternative Golden Handcuffs for Tom Hamilton.

To license the InsMark Illustration System and/or Documents On A Disk, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or 925-543-0513.

Testimonial:

“My experience with InsMark’s Executive Trifecta is career changing. ?Showing this idea to a business owner is a win-win-win! ?The business owner wins by protecting and retaining one of his most valuable assets (a key executive). ?The executive wins by being recognized and rewarded for efforts, results, and loyalty. ?The financial professional wins by gaining the confidence and business of a new client. This concept can revolutionize a financial services career.”

Kerry L. Walker ?CLU, ChFC, InsMark Power Producer, The Walker Firm, Inc., ?Aurora, CO