(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this Blog were created using the Loan-Based Split-dollar System and Wealthy and Wise®)

-493x203.jpg)

|

Blog #221 follows up on Blog #220, which described coupling Premium Financing with Wealthy and Wise® to produce a powerful wealth planning concept called “Zero Estate Tax.” Loan-Based Private Split-Dollar works well for the clients described in this Blog #221 who prefer using their personal asset base as a premium source rather than dealing with the bank loans and loan interest associated with premium financing. |

For clients with substantial liquid assets, loan-based private split-dollar is more efficient than premium financing since the Applicable Federal Rate associated with split-dollar loans is significantly less than bank loan interest. Unlike bank loans, personal loans can remain in force for indefinite periods.

Case Study

Robert and Alexandra Cartwright, ages 50 and 45, are considering a Loan-Based Private Split-Dollar arrangement owned by an irrevocable trust formed on behalf of their four children.

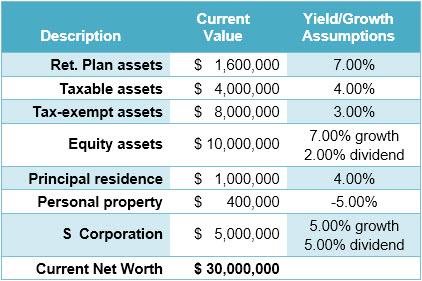

Below are details of the data used in the evaluation:

Insured: Robert Cartwright, age 50.

Policy Type: Indexed Universal Life (IUL) illustrated at a conservative 6.20%. The IUL has a high first year cash value of $834,340.

Face Amount: $12,535,284.

Policy Owner: Cartwright Irrevocable Family Trust (a grantor trust).

Premiums: $1,000,000 for seven years.

Level Interest Rate Assumption for the Loan: 2.66%, the long-term Applicable Federal Rate (AFR) for May 2022. Loan interest is imputed.

Note: This low rate is one of the main advantages of a Loan-Based Private Split-Dollar strategy. For the Premium Financing illustration in Blog #220, I illustrated a bank loan interest rate of 3.00%, gradually increasing to 5.00% over the 15-year term of the loan.

Premium Reserve Account (PRA): This account is a one-time loan of $6,075,092 that escrows the funds for the seven premiums. It provides for the use of the current Long-Term AFR of 2.66% for all years of the loan. Click here to review the PRA.

Security for the PRA: Policy cash values.

Loan Repayment: This is illustrated to occur at Robert Cartwright’s death. Payment at an earlier date can occur by accessing policy cash values.

Cash Gifts Funding the Policy: $0.

Other Funding: $25,000 a year indexed at 5.00% gifted into an investment account in the trust for each of their four children.

Zero Estate Tax: This goal is achieved through a testamentary donation to the Cartwright Family Charitable Foundation in their Wills at the second of their deaths, so their taxable estate is never higher in any year than their available unified credit. Regardless of how far the credit is reduced by politicians, this result is good news for clients wary of Joe Biden’s desired estate tax adjustments. Wealthy and Wise is unique in providing this calculation.1

1Wealthy and Wise licensees can click here for simple instructions for generating a zero estate tax plan.

Net Worth, Retirement, and Wealth to Heirs and Charity

| Image 1 |

| Current Net Worth |

| Robert and Alexandra Cartwright |

Click here for comments regarding yields, sequence of returns, and Monte Carlo simulations.

Retirement Cash Flow

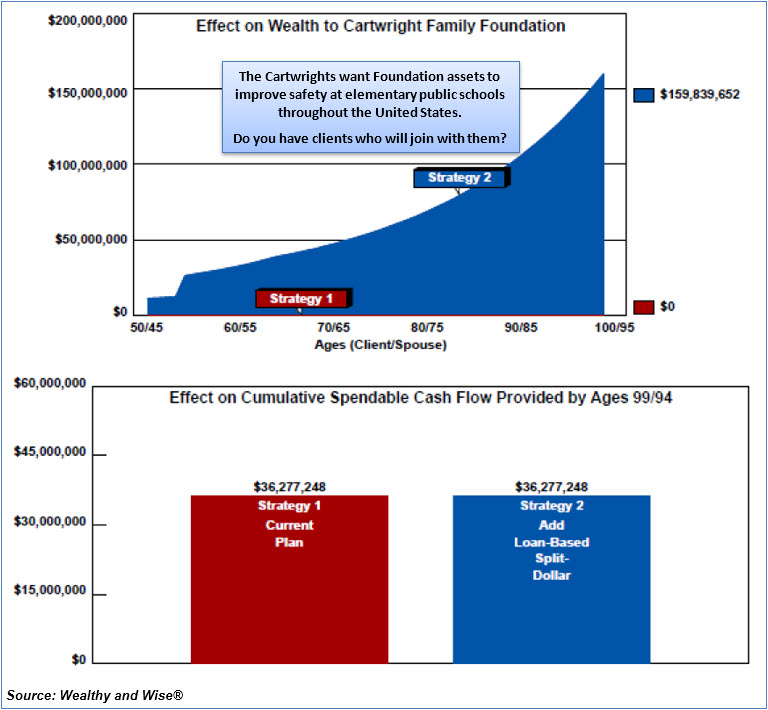

The Cartwrights want $600,000 in after tax, retirement cash flow indexed at 3.00% beginning at their ages 65/60 all funded from their assets. (This spendable cash flow totals $36,277,248 over 35 years including the 3.00% indexing.)

Gifts

They will also make annual gifts to the trust of $25,000 indexed at 5.00% for each of their four children, all funded from their assets.

Results

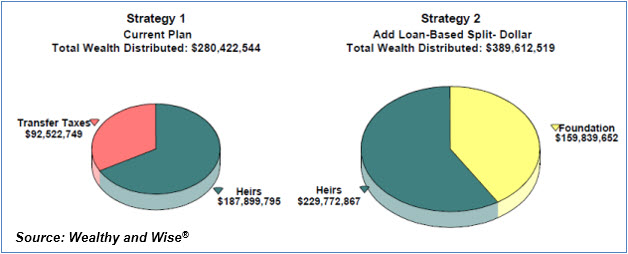

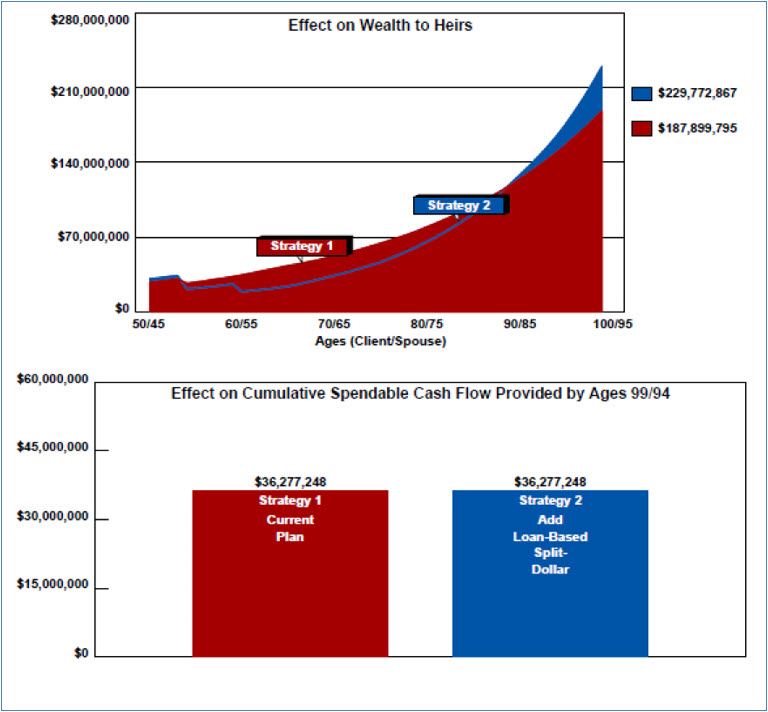

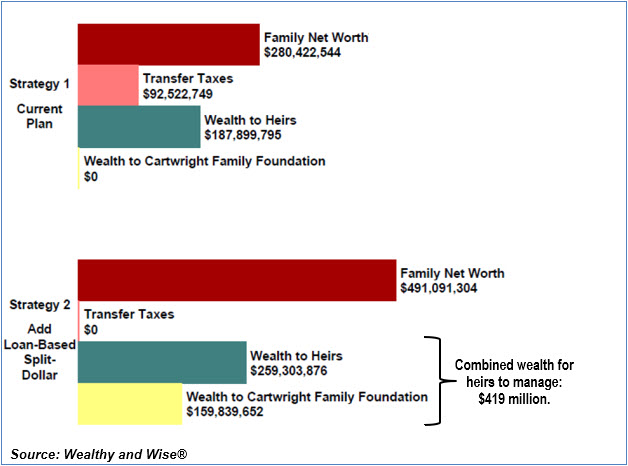

Let’s measure the impact of their decisions on the wealth passed to their children and the Cartwright Family Charitable Foundation. As you can see from the graphic below, the split-dollar arrangement provides for a significant increase to heirs even after accounting for the Cartwrights’ personal cash flow requirements.

| Image 2 |

| Comparison of the Distribution of Wealth at Ages 100/95 |

“Control of wealth is the virtual equal of ownership of wealth.”

“Control of wealth is the virtual equal of ownership of wealth.”

Dr. John Rutledge, PhD, Chief Investment Strategist, Safanad

Robert and Alexandra’s four adult children can become seriously involved with the Cartwright Family Charitable Foundation. If so, the long-range combination of their inherited wealth and their controlled wealth may exceed $389 million.

Rollout of the Split-Dollar Loan

Unlike the bank loan in Blog #220, there is no need to rollout the loan associated with loan-based split-dollar until the death of Robert Cartwright occurs. (Repayment can voluntarily occur at any time before that through a policy loan).

Net Worth Comparison

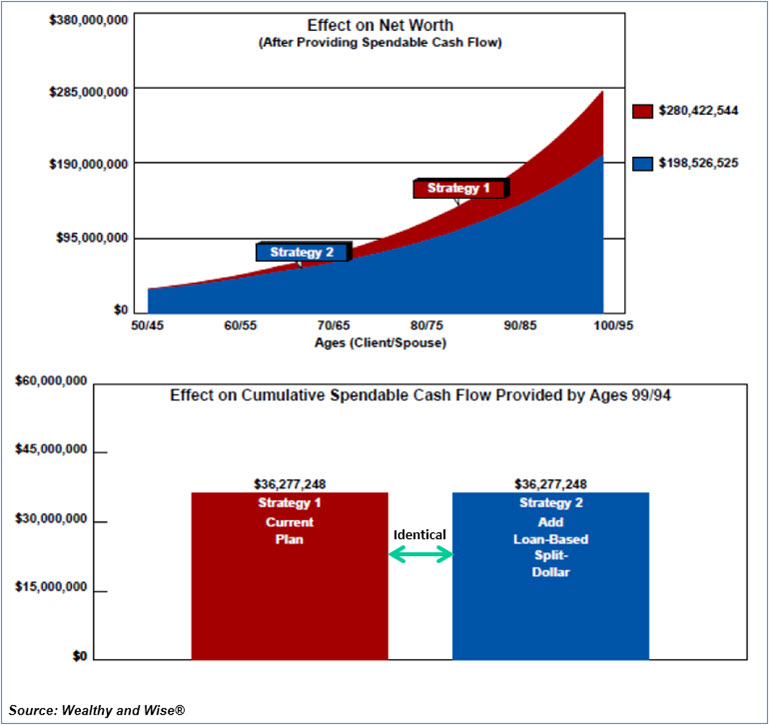

The loan-based split-dollar arrangement produces a 29.2% long-range reduction in the Cartwrights’ personal net worth as shown below in the do-it-versus-don’t-do-it™ analysis.

| Image 3 |

| Net Worth Comparison |

Note that there is no reduction in their spendable retirement cash flow.

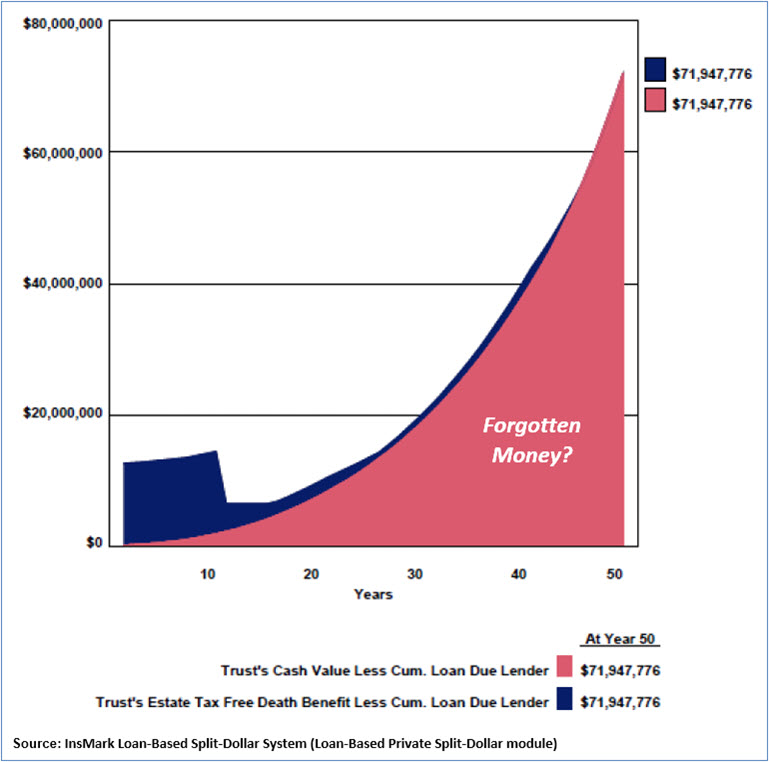

Forgotten Money

Let’s see what we can do to improve the net worth further, or at least the perception of net worth.

Have we overlooked anything? What about the cash value of the life insurance in trust (net of the outstanding loan to Robert and Alexandra)? So far, that net value does not appear anywhere as a component of net worth for anyone; however, it is part of the Family Net Worth before the death of the Cartwrights.

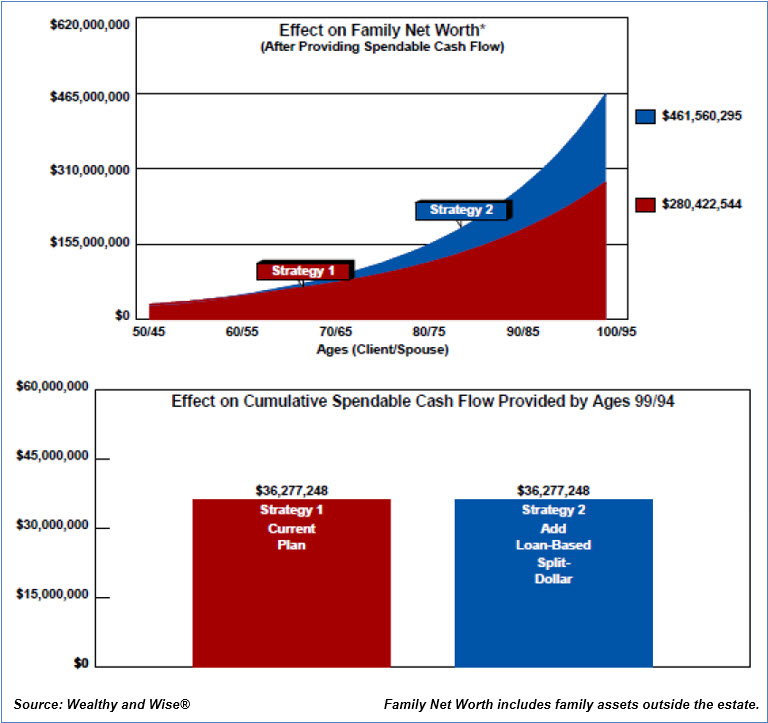

Family Net Worth™

This strategy combines the net worth of more than one generation (i.e., a family group). It is not historically associated with wealth management and estate planning. Still, it is an important concept when assessing the short-, mid-, and long-term potential of wealth accumulation and asset transfer. It has a particular application when a significant portion of the parents’ wealth passes to children in trust during the parents’ lives.

The net worth projection caused by such transfers illustrates more efficiently when using an overall multi-generational Family Net Worth analysis. This approach is critical when considering changes to assets or the addition of new financial techniques in a do-it-versus-don’t-do-it scenario.

Note: You can elect to use the Family Net Worth concept in all or none of your Wealthy and Wise reports. I included it throughout this Blog.

| Image 4 |

| Trust’s Life Insurance |

The trust’s net cash value appears nowhere in the illustrations or graphics. How should we account for it? I believe it is best understood as part of Family Net Worth. This designation also works because it exists within a grantor trust known commonly as a Wrap Trust2. Based on the terms of the trust and subject to the trustee’s acceptance, Robert and Alexandra can use it as collateral for secured personal loans, making the designation of Family Net Worth even more appropriate.

| 2 | Specimen Trusts are available in InsMark’s Cloud-Based Documents On A Disk™ in the Family Trusts section of documents called Irrevocable Total Return Unitrusts or Irrevocable Incentive Total Return Unitrusts. The trustee can loan funds from the trust to either or both parents — at a fair market loan interest rate. Interest may be accrued, and hard assets (perhaps a mortgage) must secure the loan. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of this planning technique and the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans. |

Below is a graphic of the Cartwrights’ revised net worth. Assets outside the estate (the cash value of the trust’s policy and the gift account established for their children) make up part of this new category called “Family Net Worth.”

The Family Net Worth designation adds no additional value to Strategy 1 as there are no assets outside the estate.

| Image 5 |

| Family Net Worth Comparison |

The long-range Family Net Worth for Strategy 2 is $83 million greater than Strategy 1, an astonishing increase. I try not to use words like “astonishing” in my Blogs, but this time I can’t help myself.

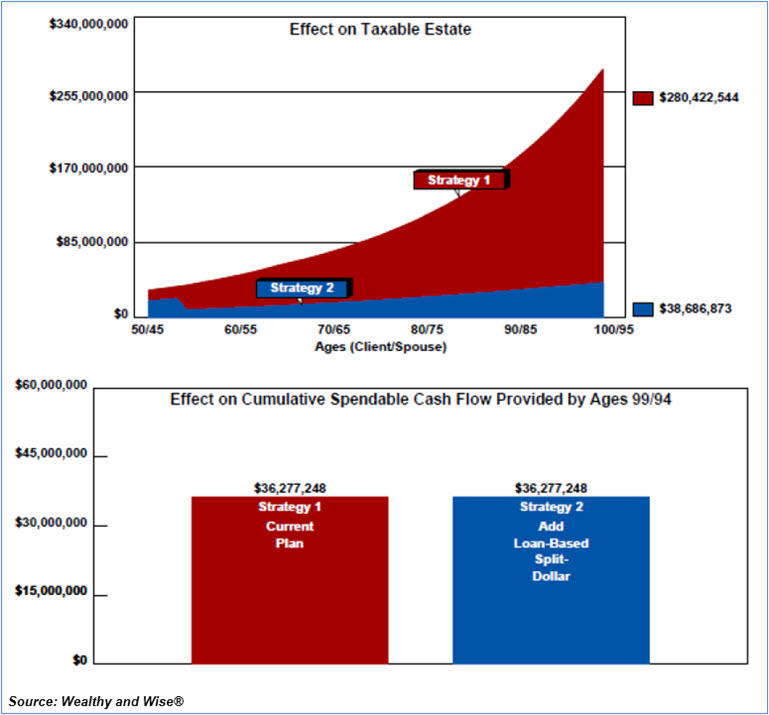

Note the difference in the Taxable Estate below, where Strategy 2 reduces it by more than $241 million. The taxable portion of the estate remains well below the Cartwrights’ remaining lifetime exemption in all years.

| Image 6 |

| Taxable Estate |

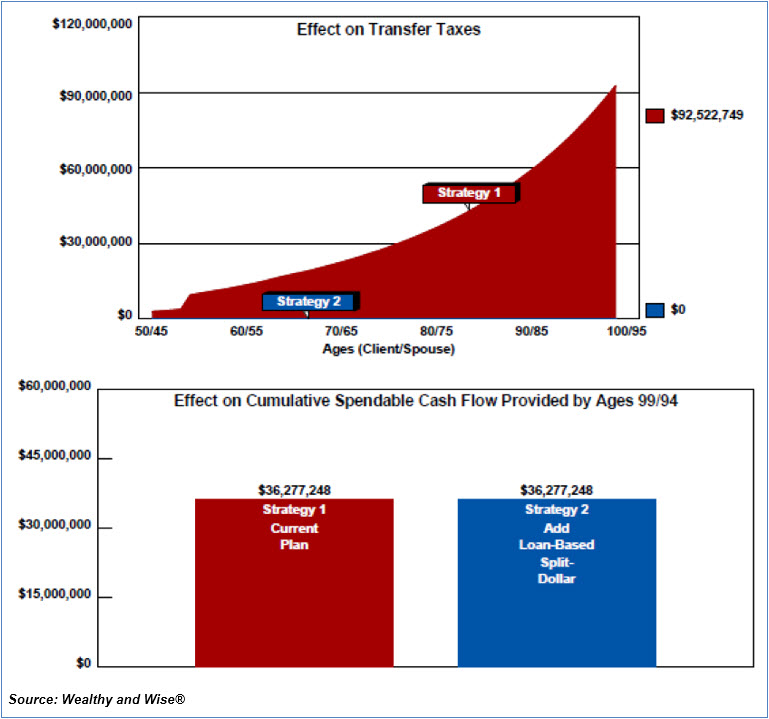

As you can see in Image 7 below, all transfer taxes (estate tax and income tax on the retirement plan) are eliminated with Strategy 2 — a compelling Zero Estate Tax plan caused by the coordination of the charitable part of the strategy. In addition, no matter how much the Democrats in Congress fiddle with the unified credit, all estate taxes are effectively voided for the Cartwrights.

| Image 7 |

| Transfer Taxes |

Click here for a Wealthy and Wise illustration of Transfer Taxes showing how “Zero Estate Taxes” works for the Cartwrights. (Compare Column 5 with Column 6 and the result in Column 9 to see the effect.) Read on to learn the charitable factor that makes this happen.

Strategy 2 reflects a long-range increase in Wealth to Heirs of almost $42 million over Strategy 1.

| Image 8 |

| Wealth to Heirs Comparison |

All this results in no additional out-of-pocket cost for the Cartwrights. Requirements for retirement cash flow plus loans and gifts to the trust have been funded by asset allocation, producing what is known as a cash flow neutral comparative analysis.

Almost $160 million of long-range capital goes to the Foundation.

| Image 9 |

| Wealth to Cartwright Family Foundation |

One last Summary graphic — the results of Strategy 2 are impressive when viewed this way.

| Image 10 |

| Robert and Alexandra Cartwright |

| Age 100 / 95 |

Click here to view the 89-page Wealthy and Wise evaluation.

That is a lot of reports; however, with a Wealthy and Wise presentation, I recommend that you have all the pages for a given analysis with you when you are visiting with a client or client’s attorney or CPA. The system backs up every number shown, and you may be asked repeatedly, “Where did this number come from?”

Most Wealthy and Wise users select a few key illustrations for the main report and put the balance in supplemental sections or an Appendix. More elaborate organization can be accomplished (Table of Contents and Section pages) through use of the following prompt which I used for this Blog—located on the bottom right of the Main Workbook Window:

Note: You can download the digital Workbook files below if you have licenses for the Loan-Based Split-Dollar System and Wealthy and Wise and want to see exactly how I entered the data for this case study.

Conclusion

Integrating the Loan-Based Private Split Dollar into Wealthy and Wise provides a contextual analysis that reinforces the value of split-dollar. If the available assets can support the loan to the trust, Loan-Based Private Split-dollar is clearly superior to Premium Financing.

Split-dollar, private split-dollar, premium financing, GRAT, SCIN, private annuity, and family limited partnership all lend themselves to Family Net Worth as an innovative new tool for comparative evaluations.

It is challenging to present these alternatives as effective family planning devices for your clients without integrating the data within a do-it-versus-don’t-do-it Wealthy and Wise analysis. The stand-alone numbers of each option need an overall family wealth context to make the most sense and the most significant impression on your clients and their advisers.

Documentation

InsMark’s Cloud-Based Documents On A Disk™ (DOD) includes specimen documents for a Zero Estate Tax plan. These documents have provisions so a bequest to a charity of the taxable estate is never higher in any year than the available unified credit — even if the unified credit changes. If you are licensed for DOD, you can review all six of the documents for a Zero Estate Tax plan in the Wealth Transfer section of documents.

Click here to review just the Highlights of our Zero Estate Tax plan from that location.

Click here for a Wealthy and Wise illustration (Transfer Taxes) showing how this works for the Cartwrights. (Compare Column 5 with Column 6 and the result in Column 9 to see the effect of Zero Estate Tax.)

If you are not licensed for DOD or would like to be, this link will take you to the DOD product site for more information or licensing.

If you are not licensed for InsMark’s Wealthy and Wise or Loan-Based Split-Dollar System, and would like to be, these links will take you to the appropriate website.

You can also contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries — contact David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

Other InsMark Illustrations that coordinate with Wealthy and Wise are:

Executive Trifecta®

Executive Bonus

Executive Security

All Plans listed on the Split-Dollar tab

Loan-Based Split-Dollar System

Executive-Owned Split-Dollar

Trust-Owned Split-Dollar

Trust-Owned Private Split-Dollar

Leveraged Executive Bonus

Leveraged Deferred Compensation

Leveraged 401(k) Look-Alike

Premium Financing

Premium Financing Split-Dollar

InsScribe®

All InsMark illustration Systems contain InsScribe that automatically produces graphics and text descriptions of the data illustrated. There is no additional licensing fee for use of InsScribe.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files. Also, our Referral Resource listed below can help you with illustrations with no commission split required.

If you are licensed for InsMark’s Wealthy and Wise and InsMark’s Loan-Based Split-Dollar System and want to see exactly how I entered the data for this case study, import this Zip file which includes the two digital Workbooks I used for Blog #221:

|

Before importing either downloaded file into the appropriate InsMark System, be certain to update your InsMark Loan-Based Split Dollar System and your Wealthy and Wise System. Do this using Live Update available under Help on the main menu bar of either System or this icon on the main menu bar in either System:

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Click here for design directions for Zero Estate Tax Planning with Wealthy and Wise.

Click here to learn how to export data from InsMark’s Loan-Based Split-Dollar System to Wealthy and Wise.

For general help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I have been using their software for almost 30 years, and it has changed my career. This unique and user-friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“Wealthy and Wise allows us to reflect on practically ANY planning scenario we have encountered with clients. The ability to flow data easily into the program (without being so granular as to be unwieldy) is, in my opinion, one of the core strengths of Wealthy and Wise. Modeling alternate planning scenarios and presenting the results in graphical and numerical formats is welcome, and I can’t imagine making cash flow and estate growth projections without Wealthy and Wise.”

Mark A. Trewitt, CLU, ChFC, CAP, CFP, AEP, InsMark Platinum Power Producer®, Plano, TX

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

InsMark, InsMark logo, Wealthy and Wise, InsScribe, and Executive Trifecta

are registered trademarks of InsMark, Inc.

Testing Financial Tolerance, do-it-vs.-don’t-do-it,

Family Net Worth, and Documents On A Disk

are trademarks of InsMark. Inc.

Copyright © 2022 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical life insurance illustrations and investments referred to in this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations of life insurance are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique and the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are concerned about the potential tax bomb in life insurance that a careless policyowner can accidentally trigger. This problem can occur when policy loans are present, and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life with policy loans of any type. It’s avoidable, and you, the producer, are crucial to ensuring your clients know how to sidestep it.

You can avoid the tax bomb if the policy is neither surrendered nor allowed to lapse since the policy death benefit wipes away the income tax liability. The foundation for this particular treatment is IRC Section 101. This statute provides that life insurance proceeds maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component, whether loans exist or not.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy — something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, talk to your financial adviser before surrendering or lapsing the policy to anticipate unexpected tax consequences that may otherwise be avoided.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender. You would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that, ultimately, the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies. This suggestion applies to policies with 50% or more of the gross cash value subject to outstanding loans.

See Blog #51: Avoiding the Tax Bomb in Life Insurance.

![]()

More Recent Blogs:

Blog #220: Testing Financial Tolerance for Zero Estate Tax™

Blog #218: Attracting and Retaining Key Executives

Blog #217: Tax Bombs That Never Exploded (More on Grantor Trusts)

Blog #216: Cost of Waiting (Delay is the Deadliest Form of Denial)

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

![]()