(Click here for Blog Archive)

(Click here for Blog Index)

This is a re-release of Blog #214 due to several needed edits.

So what is it?

It’s an analysis of a Roth Conversion with the income tax paid by a Reverse Mortgage coupled with Indexed Universal Life — all illustrated with Wealthy and Wise®.

Case Study

The decision to convert an IRA to a Roth IRA is often waylaid by the client’s negative view of the income tax issues resulting from the conversion. Let’s examine this concern.

This case study involves a current one-year1 conversion of $2,000,000 in IRA funds to a Roth IRA to enhance the retirement results for Robert Baxter, a family physician, and his spouse Ann, a registered nurse. Both are currently age 60 and planning to retire at age 75.

| 1 | Typically, I would spread the Roth conversion over several years to take advantage of lower tax brackets. However, the Baxters’ current 37% top tax rate will likely spike next year to 39.6%, so, if possible, their conversion should take place during 2021. I am also a little out on a limb, assuming a 28.8% capital gains and dividend tax rate up from 23.8%, a relatively small increase well below what Biden wants. Special thanks are likely due to Democrat Senators Joe Manchin (W-VA) and Krysten Synema (AZ) should 28.8% hold as the maximum. |

Note: Many of you may have noticed that the minimum age for a jumbo reverse mortgage was recently reduced to age 55. Read about it here.

Click here for a summary of the Baxters’ current net worth.

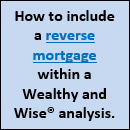

The results of the Roth analysis are significant. The Baxters can efficiently fund the $740,000 income tax on their Roth conversion using a reverse mortgage on their home. They can also meet their annual, spendable, retirement cash flow goal of $250,000 (indexed at 3.00%) while also providing an increase of $2,466,801 in their long-range net worth.

The presence of the Roth conversion with its tax funded by cash flow from the reverse mortgage is what greases the wheels for the increase in long-range net worth.

See the summary graphic below.

| Image 1 |

| (Net Worth) |

| Strategy 1: Status Quo – Keep the IRA |

| vs. |

| Strategy 2: Roth IRA + Reverse Mortgage |

Important Note: InsMark’s Wealthy and Wise® does not contain a Reverse Mortgage calculator. For that, see any of the approved Reverse Mortgage specialists with this capacity. Wealthy and Wise® can illustrate the results of any reverse mortgage in the Illiquid Asset category.

Indexed Universal Life (IUL)

Let’s see if there is a way to add a similar increase in net worth by injecting $1,000,000 of IUL. We will direct Wealthy and Wise® to fund the premiums by asset withdrawal, so the Baxters pay no premiums out-of-pocket.

IUL premiums are $100,000 for 15 years (until the Baxters’ retirement). The policy generates $150,000 of after-tax policy loans starting in year 16.

Click here to review the policy.

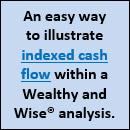

Below is the revised Wealthy and Wise® net worth analysis, including the IUL with premiums paid via asset withdrawal.

| Image 2 |

| (Net Worth) |

| Strategy 1: Status Quo – Keep the IRA |

| vs. |

| Strategy 2: Roth IRA + Reverse Mortgage |

| vs. |

| Strategy 3: Roth IRA + Reverse Mortgage + IUL |

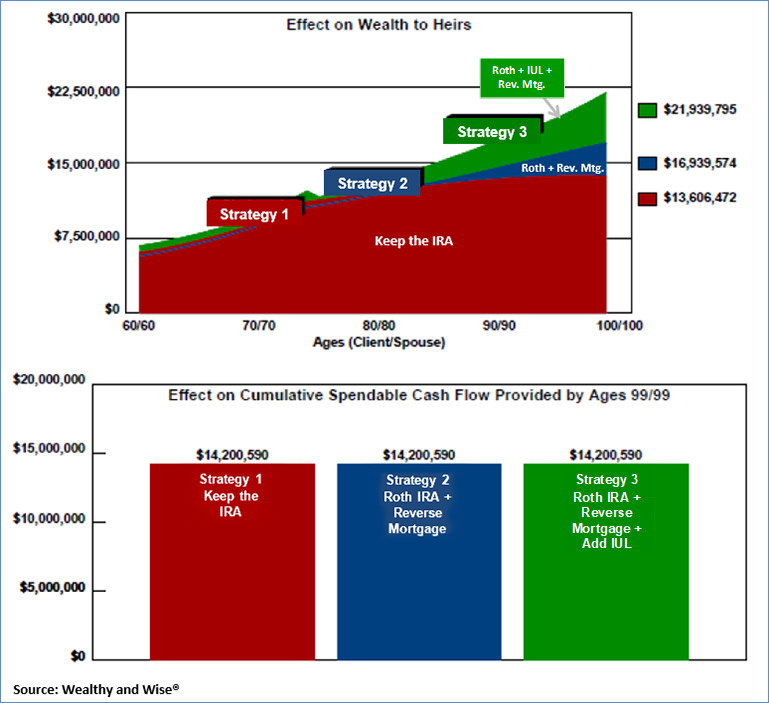

What is most interesting to me is that good as the Roth conversion turns out, the IUL produces an even better incremental increase in net worth. The $2,466,801 gain in net worth illustrated in Strategy 2 over Strategy 1 (Image 1) is seriously exceeded by the $6,135,572 gain in Strategy 3 over Strategy 1 (Image 2). All this occurs without requiring any additional out-of-pocket cost by the Baxters while also providing them with $14.2 million of after-tax retirement cash flow.

Below is the makeup of the Baxters’ $21,939,795 long-range net worth in Strategy 3.

| Image 3 |

| Components of Long-Range Net Worth (Strategy 3) |

-taxable-and-tax-free-retirement-769x743-revised.jpg)

Over 60% of net worth in a liquid Roth IRA assets represents superior planning.

There is so much additional net worth in Strategy 3 that the Baxters could easily increase their $250,000 of indexed, after-tax retirement cash flow by $120,000 a year while still ending up with over $15 million for their long-range net worth.2

| 2 | To produce this result, if you are, or become, licensed for Wealthy and Wise®, note that I selected Additional Spendable Cash on the Desired Cash Flow tab in Scenario 4 in the digital Workbook available below. I used the Cash Flow Availability Calculator available in that selection. I then directed the Calculator to come close to the long-range net worth in Strategy 1 while also delivering additional after-tax cash flow of $3,000,000. This feature is valuable for situations where clients are unsure of their ability to make substantial gifts, for example, to help fund college for grandchildren or fund charitable contributions. |

Concerns?

These values may have some readers wondering, “What am I missing? What has the Blog left out — or overstated?”

All the assumptions for the Baxters are reasonable:

- 37.00% top income tax bracket for 2021;

- 39.60% top tax bracket for 2022;

- 6.00% for growth of the IRA and Roth IRA;

- 3.00% for yield of the tax-exempt account;

- 6.00% for growth of the equity account;

- 1.00% for dividends of the equity account;

- 28.6% tax bracket for capital gains & dividends;

- 0.05% management fee for IRA, Roth IRA, and equity account;

- 6.00% growth assumption for the IUL;

- 4.95% reverse mortgage loan interest rate;

- $12,060,000 inflation-adjusted estate tax exemption in 2022 for a married couple subject to further inflation increases. (I used a 3.00% inflation assumption in the evaluation.)3

3As I write this, I believe there is a good chance the 2022 estate tax exemption may not be reduced to $12,060,000 for a married couple but will, instead, stay at twice that at $24,120,000 through 2025, also assumed to be growing at 3.00% annually. Neither number would affect the outcome of the Baxters’ case as even the lesser $12,060,000 exemption does not produce an estate tax liability for the Baxters.

Click here for comments on Yield, Sequence of Returns, and Monte Carlo simulations.

Estate Values

A question that may occur to you is: what is the impact of the growing reverse mortgage on the Baxters’ heirs? Click here for a significant tax reason why Strategies 2 and 3 work so well with the reverse mortgage.

Below is another graphic showing the advantages of Wealth to Heirs.

| Image 4 |

| (Wealth to Heirs) |

| Strategy 1: Status Quo – Keep the IRA |

| vs. |

| Strategy 2: Roth IRA + Reverse Mortgage |

| vs. |

| Strategy 3: Roth IRA + Reverse Mortgage + Add IUL |

Comparative Analysis

Click here to review the details of all three Strategies.

The analysis contains 74 graphic and numerical pages. Wealthy and Wise® backs up all its numbers, and I recommend you have all relevant reports with you when visiting with a client or client’s attorney or CPA to be able to answer this often-asked question:

What is the source of this column of numbers?

If you like, put some of the reports in Sections, but have all of them with you.

I used this selection at the bottom right of the Wealthy and Wise® digital Workbook home page to include a Table of Contents and Section pages:

If all you want is a shortcut review, examine the Comparison section (starting on Page 1 of 8); then go to Strategy 3 (starting on Page 51 of 73).

Conclusion

So, is this a fair description?

It’s InsMark’s Wealthy and Wise® analysis of a Roth Conversion with the income tax paid by a reverse mortgage coupled with indexed universal life.

The extraordinary mathematics of Wealthy and Wise® have analyzed a challenging tax issue and proved that some taxes can be an excellent investment. The analytical advantage of using a “Compared to What?” evaluation also makes Wealthy and Wise® unusually effective. I am unaware of any other software that takes this complex approach to produce an easily understandable assessment for you, your clients, and their advisers.

Note: If a client plans to do a Roth conversion, complete it in 2021, as it looks likely that it will no longer be available starting January 1, 2022.

Licensing

If you aren’t licensed for Wealthy and Wise®, please contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) or visit us online. Institutional inquiries should go to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

Your Comments

Please add your comments to this Blog. (Your email will be kept confidential.)

InsMark’s Digital Workbook Files

If you would like some help creating customized versions similar to the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

If you would like highly qualified, illustration design assistance with no commission split required, contact LifePro Financial, InsMark’s Referral Resource, discussed below.

Digital Workbook Files For This Blog

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

For other help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner, and the Wealthy and Wise software has helped me supplement my LEAP skills and increase my commissions. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it.”

Vincent M. D’Addona, CLU, ChFC, MSFS, AEP, InsMark Power Producer®, New York, NY

“If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale.” In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

“Wealthy and Wise allows us to reflect practically ANY planning scenario we have encountered with clients. The ability to flow data easily into the program (without being so granular as to be unwieldy) is, in my opinion, one of the core strengths of Wealthy and Wise. Modeling alternate planning scenarios and being able to present the results in both graphical and numerical formats is certainly welcome, and I can’t imagine doing cash flow and estate growth projections without Wealthy and Wise.”

Mark A. Trewitt, CLU, ChFC, CAP, CFP, AEP, InsMark Platinum Power Producer®, Plano, TX

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer®, Minneapolis, MN

“InsMark®”, the InsMark® logo and Wealthy and Wise® are registered trademarks of InsMark, Inc.

© Copyright 2021 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical life insurance illustrations and alternative investments referred to in this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations of life insurance are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more – often significantly more – than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type are utilized. It can be avoided, and you, the producer, are key to making sure your clients are aware of how to sidestep it.

A tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The foundation of this special treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component whether loans exist or not.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender, and you would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.

![]()

More Recent Blogs:

Blog #213: Missed our May 2021 Virtual Symposium?

Blog #212: InsMark’s Introduction to the Ultimate Professional Coach

Blog #211: CheckMate® Selling Revisited

Blog #210: Expert Advice on Estate Planning in a Biden Environment

Blog #209: Dealing with Termites

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive