(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark® Illustration System)

Other than the principal owners, who are the key executives of any business?

Minority-owner executives. These are often the firm’s key personnel. Anyone else? Several non-owner executives can also qualify.

What are the benefit plans available for them? Consider the following strategies that work for both groups:

- Salary Continuation and Deferred Compensation;

- Split-Dollar;

- Premium Financing Split-Dollar;

- Bonus.

They all have attractive possibilities, and InsMark illustrates each one. The most important features to consider are:

- Employer’s costs and perception;

- Executive’s costs and perception;

- Ease of preparing the illustration;

- The simplicity of plan documentation;

- Ongoing plan administration.

The benefit that is most interesting to me is the controlled version of a Bonus plan — for both public- and privately-owned companies — because it offers:

- Deductible employer funding;

- Windfall recovery of the employer’s funding costs if the covered executive voluntarily terminates employment within five to ten years;

- No out-of-pocket cost for executives who do not terminate;

- Full vesting after the “control” period expires;

- Full vesting in the event of death or disability;

- Access to cash flow from policy values by the executive in pre-retirement years (unless “deferred access” is included as part of the plan documentation);

- Tax-free retirement income for executives;

- Tax-free death benefits for families of executives.

The Controlled Executive Bonus is the clear winner when considering these seven features. The critical distinction between it and a regular bonus is that a covered executive who voluntarily terminates employment during the “controlled” years must pay back all, or a portion of, the cumulative bonuses previously paid.

Note: In some ways, a Controlled Executive Bonus is similar to loan regime split-dollar but with significant advantages. Read about the comparison here.

Today’s executives are restless, and every employer has worries about losing key rainmakers and attracting replacements. Recruiting and retaining talented staff has become increasingly important in this Covid-economy. Think about asking this question of business owners you know:

“Do you have any executives who are so valuable that you would do almost anything that is financially responsible to keep or hire them?”

Case Study

Tony Jamison, age 45, is Executive Vice President and General Manager of Town and Country Auto Group, Inc. (“Town and Country”), a multi-brand, multi-city, multi-state, new car dealership based in San Diego, CA.

Tony Jamison, age 45, is Executive Vice President and General Manager of Town and Country Auto Group, Inc. (“Town and Country”), a multi-brand, multi-city, multi-state, new car dealership based in San Diego, CA.

Town and Country, a family business, operates as an S Corporation.

Tony is a serious rainmaker, but he is not a stockholder. The company wants to provide him with a significant retirement plan to ensure he stays with the firm. Tony’s plan uses a Controlled Executive Bonus arrangement.

Tony is in the top federal income tax bracket of 37%, plus California adds another non-deductible 13.3% for a total of 50.3%. The owners of Town and Country (an S corporation) are in the same brackets.

Note: This plan also works well in states with only a federal income tax.

Click here to review the indexed universal life (IUL) illustration we are using for Tony (increasing death benefit for 20 years; minimum level amount after that).

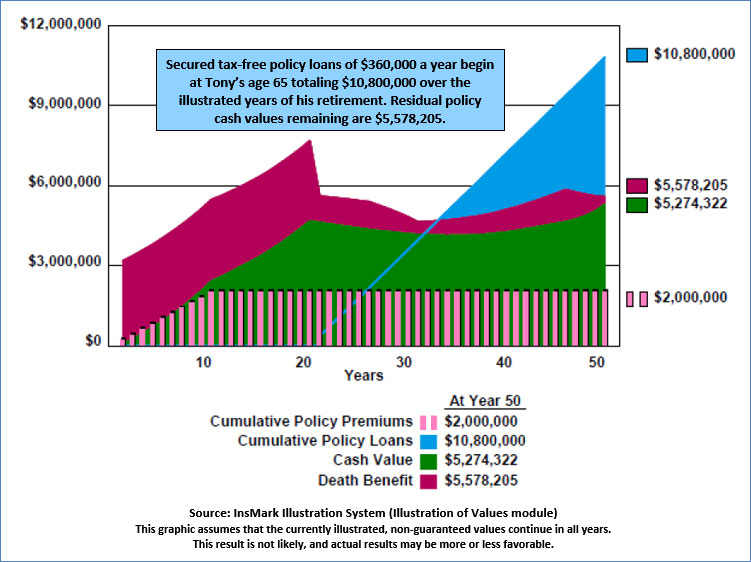

| Image 1 |

| Illustration: Policy Values |

| Sponsor: Town and Country Auto Group, Inc. |

| Insured and Policyowner: Tony Jamison |

Click here to review details of the Controlled Executive Bonus illustration.

Printing Note: Starting in year 30 on Page 3 of 7 of the illustrations, I used our option to show values every five years using the automatic “Short Print” selection on the Print menu to illustrate 50-years of numbers on one page.

Details of the Plan

Below is how Tony’s Controlled Executive Bonus works.

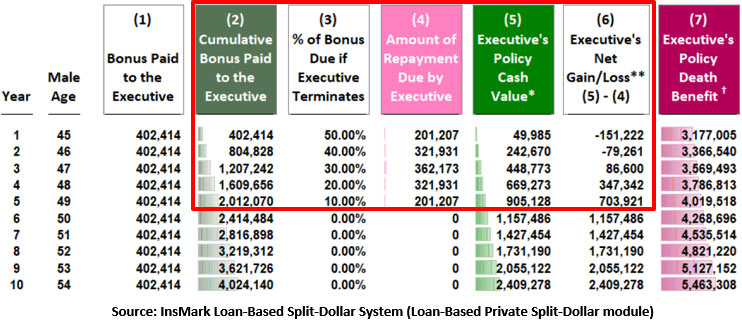

| Image 2 |

| Illustration: Controlled Executive Bonus |

| Sponsor: Town and Country Auto Group, Inc. |

| Insured and Policy Owner: Tony Jamison |

If Tony voluntarily terminates his employment during the next five years, he must repay his employer the numbers in Column (4) — based on Column (3) percentages of the bonuses illustrated in Column (2). After five years, no repayment is required if termination occurs. The cash values in Column (5) could help Tony with repayment.

Why the extra five years of employer bonus in years 6 -10? Those additional five years add considerably to Tony’s long-range results, thus adding another element to induce retention.

Why not extend the repayment requirement to ten years? Executives are more focused today on shorter time horizons than stretched-out dates. The employer establishes the percentages in Column (3). Some go for 100% repayment for several years; others lighten the load to a level percentage, say, 20%. There are no federal rules to follow, only the agreement between Tony and his employer. (You will learn a way to entice Tony to stay longer than five to ten years in the Plan Option section below.)

Management Tool

The Controlled Executive Bonus with a gross-up bonus provides additional management information. If Tony accepts the plan with its five-year contingent liability, the owner may be reasonably sure that this executive intends to remain with the company for at least the next five years.

Alternatively, suppose Tony elects not to participate in the plan. The employer has discovered that he may already be considering alternative employment and is not interested in a benefit plan with short-term personal liability. Tony’s decision not to participate turns up valuable information that would otherwise be difficult to determine.

Documentation

Particular documents are needed to support a Controlled Executive Bonus. It may require a special Resolution and Employment Agreement (or, perhaps, an amendment to a current employment agreement) outlining the employer’s bonus commitment and the executive’s repayment requirements.

If an executive’s death or disability occurs before the end of the bonus repayment period, the plan provides for the immediate vesting of all benefits.

The benefit may also need an Endorsement of Policy Ownership Rights Agreement. Its purpose is to restrict Tony’s access to policy values before retirement without the express written permission of the employer. The employer registers the Endorsement with the issuing insurance company, so the executive cannot take any action on the policy other than that allowed by the Endorsement. One of life’s frustrating experiences involves an executive who starts a competing business using funds from an employer’s benefit plan designed to provide retirement benefits.

InsMark’s Cloud-Based Documents On A Disk™ (DOD) has specimen Controlled Executive Bonus documents. If you are or become licensed for DOD, you have access to them in the Executive Bonus Plans section of Key Employee Benefit Plans. If you have no license for DOD, click here to acquire one or learn more about it.

InsMark’s Cloud-Based Documents On A Disk™ (DOD) has specimen Controlled Executive Bonus documents. If you are or become licensed for DOD, you have access to them in the Executive Bonus Plans section of Key Employee Benefit Plans. If you have no license for DOD, click here to acquire one or learn more about it.

![]()

Plan Options

Town and Country can entice Tony to stay longer than ten years by duplicating the benefit starting in year 11 when the original plan’s funding is finished. There will be fewer years to retirement remaining than in the initial strategy. Still, it should be reasonably easy to develop combined annual after-tax retirement cash flow with both plans of more than $500,000.

Note: The two plans could coordinate from the get-go with twenty premiums of $200,000. I did a quick calculation for this, and it produces $650,000 a year in after-tax, retirement cash flow for Tony from age 65 to 95 — almost $20,000,000 total. Wow!

Conclusion

The Controlled Bonus Plan is easy to understand, has minimal plan administration, and sponsors/participants value it.

It is likely the best executive benefit plan ever.

Your Comments

Please add your comments to this Blog. Your email address will not be published.

Licensing

To license the InsMark Illustration System, Loan-Based Split-Dollar System, or Cloud-Based Documents on a Disk, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions similar to the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

If you would like highly qualified, illustration design assistance with no commission split required, contact LifePro Financial, InsMark’s Referral Resource, discussed below.

Digital Workbook Files For This Blog

Click on Blog 218.zip to download the Digital Workbook File used to prepare this presentation.

|

Before downloading and reviewing any files, be sure to install the most current updates to your InsMark Systems. Do this using InsMark Live Update available under Help on the main menu bar of the System or this icon on the main menu bar:

Note: If you see this message on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook file to your PC where your InsMark System(s) reside. |

If you download the digital Workbook file for Blog #218, click here for a user guide to its content.

For other help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

InsMark’s Referral Resources We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software. Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees. Save time and get results with any InsMark illustration. Contact:

(Put our Illustration Experts to Work for Your Practice)

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I have used their software for almost 30 years, and it changed my career. This unique and user-friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, and InsMark Power Producer, Overland Park, KS

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer®, Financial Planner, Denver, CO

InsMark and the InsMark logo

are registered trademarks of InsMark, Inc.

Documents On A Disk is a trademark of InsMark, Inc.

Copyright © 2022 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical life insurance illustrations and alternative investments referred to in this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations of life insurance are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more – often significantly more – than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type are utilized. It can be avoided, and you, the producer, are key to making sure your clients are aware of how to sidestep it.

A tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The foundation of this special treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component whether loans exist or not.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender, and you would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.

![]()

More Recent Blogs:

Blog #217: Tax Bombs That Never Exploded (More on Grantor Trusts)

Blog #216: Cost of Waiting (Delay is the Deadliest Form of Denial)

Blog #214: Roth Conversion Magic

Blog #213: Missed our May 2021 Virtual Symposium?

Blog #212: InsMark’s Introduction to the Ultimate Professional Coach

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

![]()