(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the Premium Financing System and Wealthy and Wise®.)

|

Note from Bob: This Blog describes combining our Premium Financing System and Wealthy and Wise to produce a powerful wealth and estate planning concept called “Family Net Worth”. The logic can be used similarly when our self-financing Loan-Based Private Split Dollar (“LB-PSD”) illustration is coupled with Wealthy and Wise. See both Blog #159 (Part 1 of 2) and Blog #161 (Part 2 of 2) for an LB-PSD example. The Family Net Worth logic is also effective when no special funding for the life insurance is used, and the entire policy is illustrated as trust- or heir-owned. It is also effective whenever gifts or loans to a trust or heirs are present. |

Background

Family Net Worth: The combined net worth of more than one generation (i.e., a family group) is not historically associated with wealth management and estate planning. It is an important concept when assessing the short-, mid-, and long-term potential of wealth accumulation and asset transfer. It has a particular application when a significant portion of the parents’ wealth is passed to children during the lives of the parents.

The reduction in net worth of the parents caused by such transfers is much better evaluated in the context of overall, multi-generational, Family Net Worth. This is particularly important on an ongoing basis when considering changes to assets or the addition of new financial strategies. Equally critical is establishing the best order of asset allocation for desired cash flow distributions in order to maximize the overall accumulation of family wealth.

Wealthy and Wise®: This is InsMark’s wealth planning system that is uniquely suited to gauge the effectiveness of changes to the makeup of Family Net Worth. The recent 13.0 enhancement to Wealthy and Wise adds Family Net Worth to its comparative analytics.

Case Study

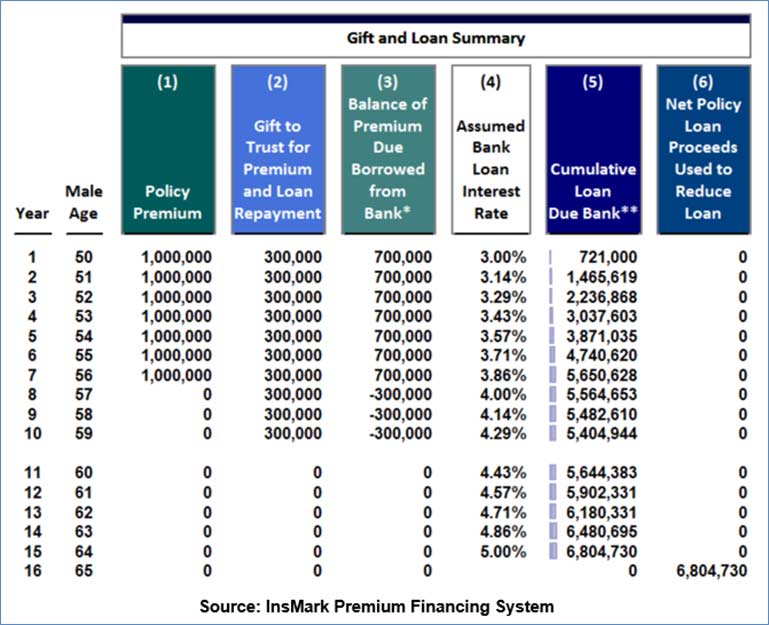

Arthur and Allison Baxter, ages 50 and 45, are considering a substantial premium financing arrangement owned by a trust formed on behalf of their four children. Below are the details of the plan:

Insured: Arthur Baxter;

Policy Type: Indexed Universal Life (“IUL”) @ 7.00%;

Face Amount: $26,681,680;

Premiums: $1,000,000 for seven years;

Policy Owner: Baxter Irrevocable Family Trust;

Funding: Bank loans except for $300,000 in annual gifts by the Baxters to the trust for ten years to apply on the premiums for seven years; thereafter, to reduce the bank loan;

Loan Interest: Accrue;

Loan Repayment: Policy loan of $6,804,730 at the beginning of year 16.

| Image 1 |

| Details of the Funding |

Click here to review the entire premium financing illustration. The transaction yields a massive death benefit for the trust – over $88 million by the Baxters’ ages 100/95.

There is much more to the transaction than the death benefit, and this is where Family Net Worth comes into play.

Let’s first examine the overall effect of the premium financing arrangement on the Baxters’ personal net worth and wealth to heirs.

| Current Net Worth |

| Arthur and Allison Baxter |

|

|---|

|

Click here for comments regarding yields, sequence of returns, and Monte Carlo simulations.

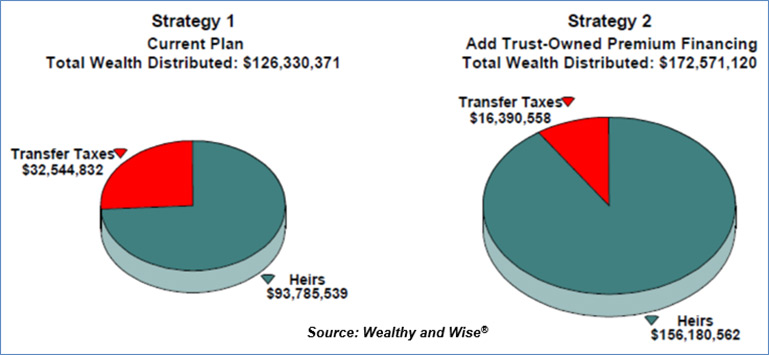

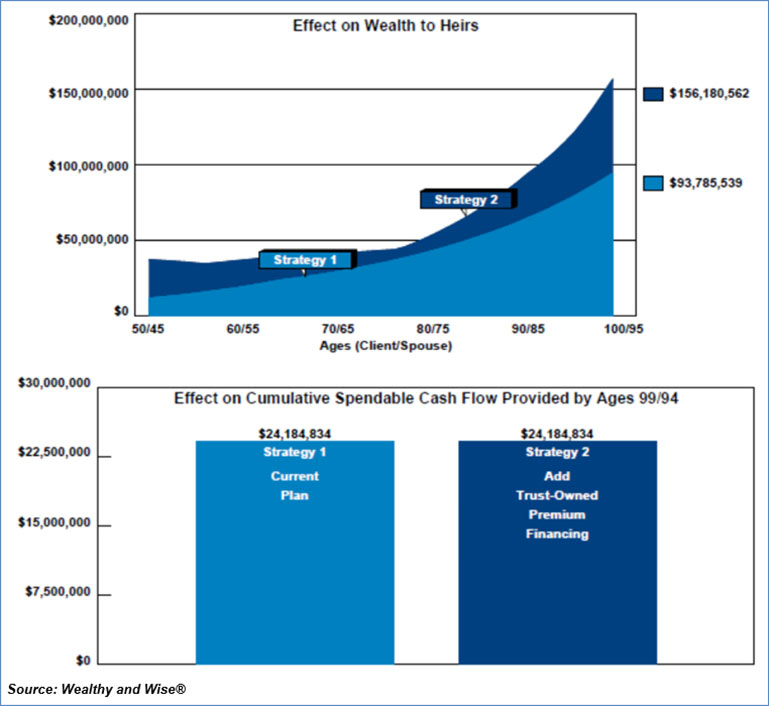

Retirement Cash Flow

The Baxters want $400,000 in after tax, retirement cash flow indexed at 3.00% beginning at their ages 65/60 for the next 35 years (totaling $24,184,834 including the 3.00% indexing). They also want the gifts to the trust for the premium financing (totaling $3,000,000) funded from their assets. Let’s measure the impact of their two financial requirements on the wealth passing to their four children. As you can see from the graphic below, the premium financing arrangement provides for a significant increase to heirs even after accounting for the Baxters’ cash flow requirements.

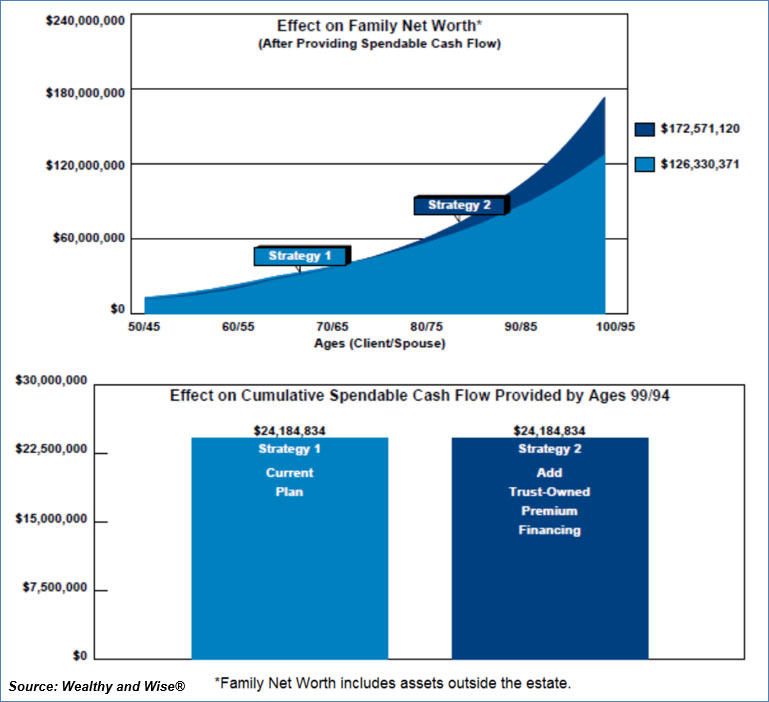

| Image 2 |

| Comparison of Alternatives at Ages 100/95 |

Wealth to heirs increases by over 166% (from $93,785,539 to $156,180,562).

Transfer taxes decrease by almost 50% (from $32,544,832 to $16,390,558).

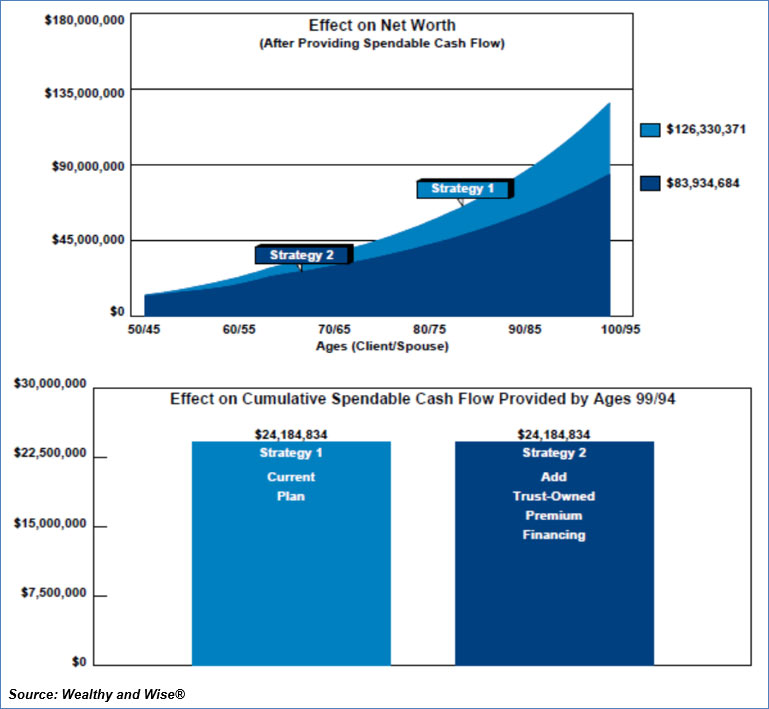

Net Worth

On the other hand, the premium financing arrangement produces a serious drop in the Baxters’ net worth. See the graphic below for the “do it vs. don’t do it” net worth comparison.

| Image 3 |

| Net Worth Comparison |

Strategy 2 produces a one-third decrease ($42+ million) in net worth caused by the increase in cash flow needed for the gifts to help fund the premium financing. That’s a huge net worth reduction. Let’s see what we can do to improve it.

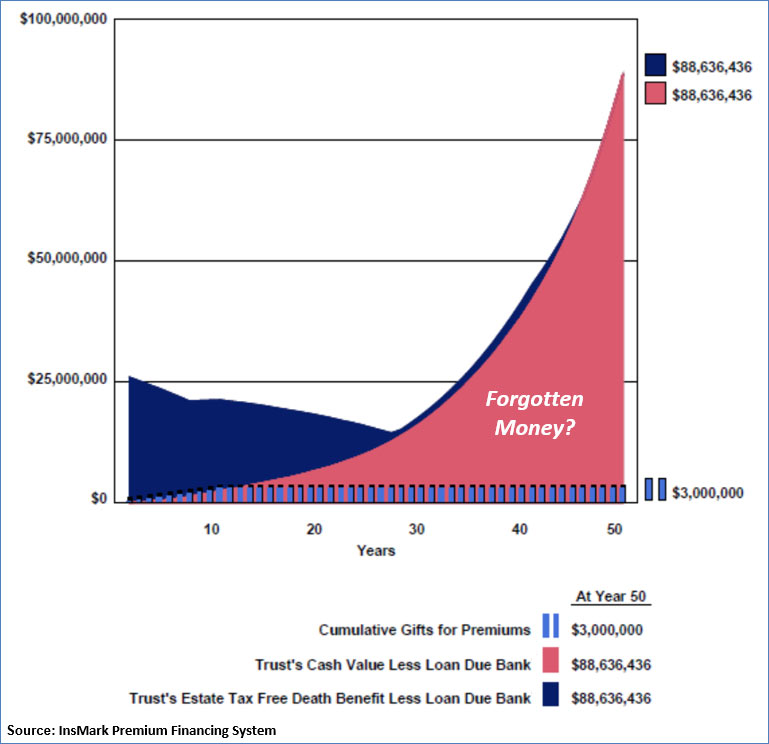

The “Forgotten Money?”

Have we overlooked anything? What about the cash value of the policy in the trust (net of the outstanding loan to the bank during the first 15 years)? So far, the trust’s net cash value has not appeared as a component of net worth; however, it is clearly part of Family Net Worth prior to the death of the Baxters.

| Image 4 |

| Trust’s 50 Year Analysis |

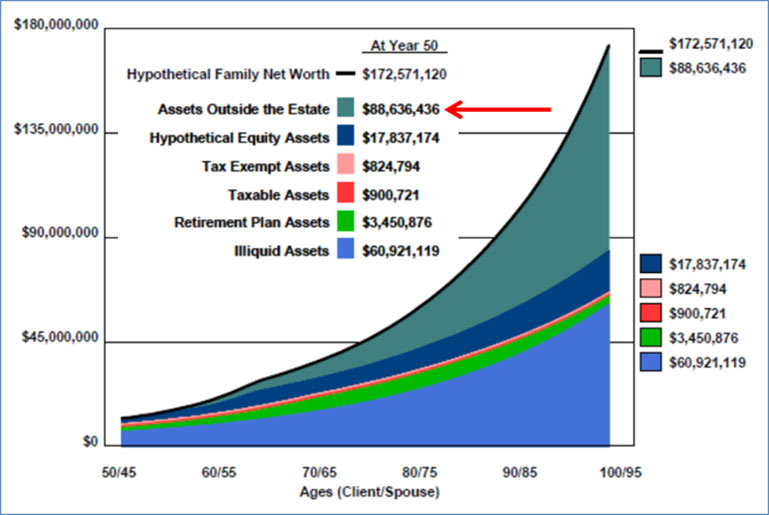

Below is a graphic of the Baxters’ net worth in which assets outside the estate (the cash value of the trust’s policy) is included in a new category called “Family Net Worth”.

| Image 5 |

| Family Net Worth Comparison |

Family Net Worth for Strategy 1 adds no additional value as there are no assets outside the estate. Family Net Worth for Strategy 2 is $46 million+ greater than Strategy 1 due to the presence of substantial life insurance cash values held in trust outside the estate.

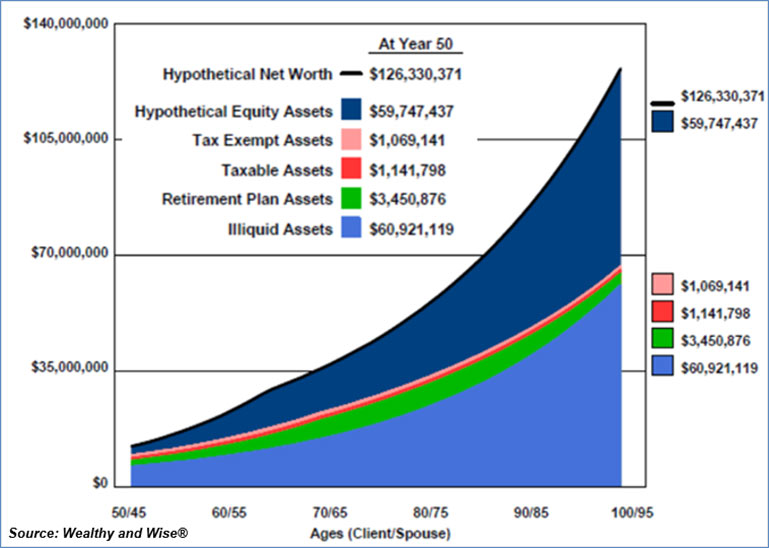

It is instructive to compare the long-range details of Net Worth for Strategy 1 with the long-range details of Family Net Worth for Strategy 2.

| Image 6 |

| Details of Family Net Worth – Strategy 1 |

| Image 7 |

| Details of Family Net Worth – Strategy 2 |

As discussed at the top of this Blog, the reduction in net worth of the parents caused by transfers to the trust is better evaluated in the context of overall, multi-generational, Family Net Worth. This is particularly true when there are ways for the parents to access funds in the trust should a need for it turn up later in life. Click here for a report on this subject.

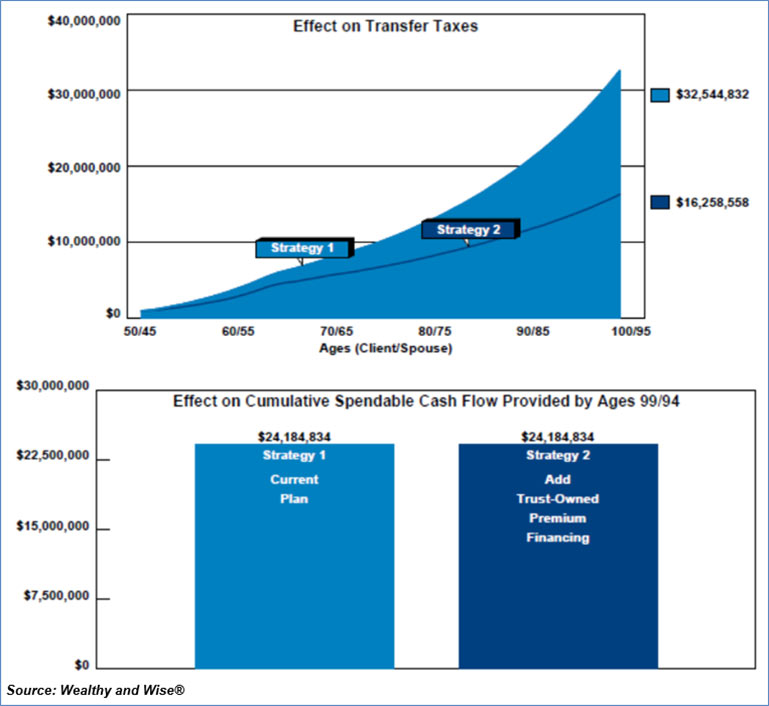

Transfer Taxes

Transfer taxes (estate taxes, income taxes on retirement plans, etc.) are substantially reduced for the Baxters as you can see from the following comparative graphic:

| Image 8 |

| Transfer Taxes |

In Blog #164 due to be posted in a couple of weeks, I’ll show you a variation that eliminates almost all transfer taxes for the Baxters.

Wealth to Heirs

Strategy 2 reflects a long-range increase of more than $62 million in Wealth to Heirs over Strategy 1 due to the death benefit of the life insurance owned by the trust.

| Image 9 |

| Wealth to Heirs Comparison |

All this has been accomplished with no additional out-of-pocket cost for the Baxters as all requirements for retirement cash flow and gifts to the trust have been funded by asset allocation producing what is known as a cash flow neutral evaluation.

Click here to view the 100-page Wealthy and Wise evaluation.

|

That is a lot of reports; however, with a Wealthy and Wise presentation, I recommend that you have all the reports for a given analysis with you when you are visiting with a client or client’s attorney or CPA. The system backs up every number shown, and you never know which report you’ll need to have handy to answer the inevitable question, “Where did this number come from?” Most Wealthy and Wise users select a few key illustrations for the main report and put the balance in supplemental sections or an Appendix. More elaborate report organization can be accomplished (Table of Contents and Section pages) through use of the following prompt which I used for this Blog — located on the bottom right of the Main Workbook Window: |

|

Conclusion

It makes little difference which estate planning technique is used (trust-owned premium financing, private split dollar, GRAT, SCIN, private annuity, family limited partnership, etc.) for the concept of Family Net Worth to be an effective new tool for your comparative evaluations.

It is difficult to present any of these alternatives as an effective family planning device for your clients without integrating the data within a “do it vs. don’t do it” Wealthy and Wise analysis. The stand-alone numbers of each option need an overall family wealth context to make the most sense – and the greatest impression on your clients and their advisers.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Before importing either downloaded file into the appropriate InsMark System, be certain to update your InsMark Premium Financing System to Version 4.0 and your Wealthy and Wise System to Version 13.0. Do this using Live Update available under Help on the main menu bar of either System or this icon on the main menu bar in either System:

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook(s) for Blog #163, click here for a guide to the content.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“Standard premium financing illustrations produce much in the way of great data, but it takes the InsMark Premium Financing System to really present compelling numbers; however, the integration of that data into InsMark’s comparative modules like Various Financial Alternatives and Wealthy and Wise is really what makes premium financing sizzle.”

Chris Jacob, CFP, SFI-Cadeau, St. Louis, MO, InsMark Platinum Power Producer®

“As with all of the InsMark software, InsMark’s Premium Financing System has proven to be an indispensable addition to my ability to show my clients the advantages in using a “Financed Premium” concept to solve their financial needs. Because of this, I was able to close three large financed premium cases easier and faster than ever before. As always, InsMark has delivered again. I encourage all who use Premium Finance as a solution to their clients’ needs to purchase this system. The cost of the system is not an expense, but rather an investment in your business.”

William Moates, Jr., Trilennium Financial Alliance LLC, Fort Smith, AR, InsMark Platinum Power Producer®

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” and “Wealthy and Wise” are registered trademarks of InsMark, Inc.

“Family Net Worth” is a trademark of InsMark, Inc.

![]()

More Recent Blogs:

Blog #162: Creative Financial Presentations

Blog #161: Self-Financed Life Insurance Meets Wealthy and Wise® (Part 2 of 2)

Blog #160: The Benefits Of Collaboration

Blog #159: Self-Financed Life Insurance Meets Wealthy and Wise® (Part 1 of 2)

Blog #158: Integrating Executive Benefit Plans with Retirement Planning

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive