(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System)

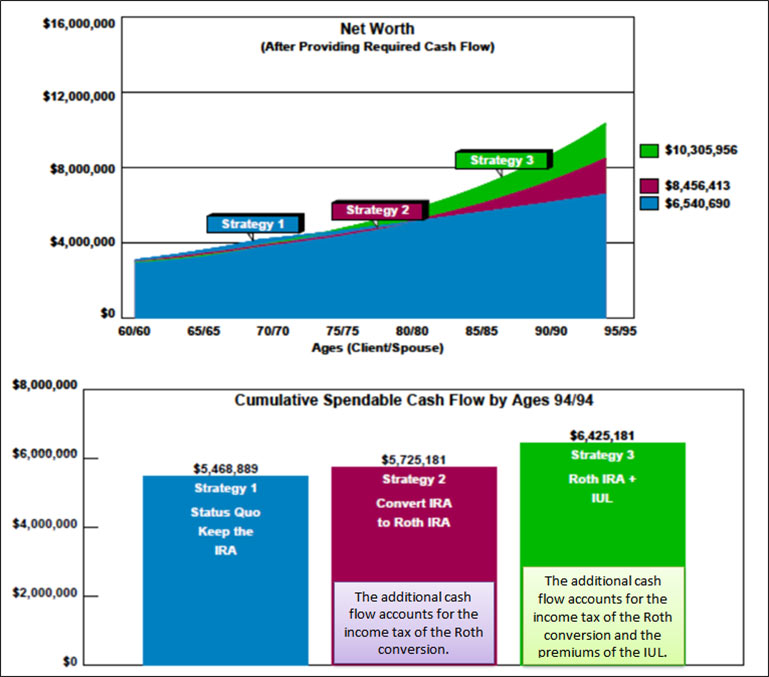

The case study in this Blog involves an extension of Blog #150: Smart Alternatives to Traditional Retirement Plans (Part 1 of 5) in which we introduced a conversion of $600,000 in IRA funds to a Roth IRA coupled with Indexed Universal Life (“IUL”) in order to amplify retirement planning for Robert and Ann Baxter, both age 60. The results were powerful as we were able to meet their annual retirement cash flow goal of $150,000 after tax -- indexed at 3.00% -- while also providing an increase of almost $4 million in their long-range net worth. You can review the results below in one of the Wealthy and Wise® graphs from Blog #150:

| Strategy 1: Status Quo - Keep the IRA |

| vs. |

| Strategy 2: Convert the IRA to a Roth IRA |

| vs. |

| Strategy 3: Convert the IRA to a Roth IRA and Add IUL |

| Image 1 |

This was all accomplished without requiring any additional out-of-pocket cost to fund the income tax on the Roth conversion and the $70,000 of premium on the $951,000 of IUL. These costs were covered using withdrawals from the Baxter’s taxable account.

Inherited IRA vs. Inherited Roth IRA

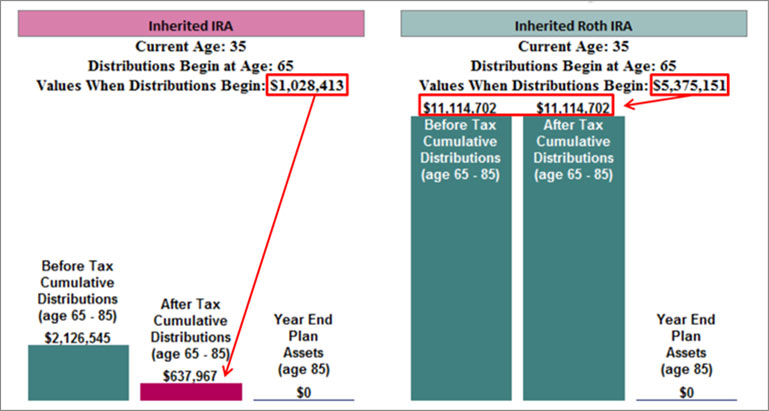

There is another significant aspect to this analysis involving a potential inheritance alternative that Robert and Ann can provide for their son, Scott, currently age 35.

For the purpose of this evaluation, let’s assume that Scott inherits either the IRA or the Roth (as calculated in Blog #150) at his age 65, 35 years hence. Examine the huge difference below.

| Comparison of Inherited IRAs |

| for Scott Baxter |

| InsMark Illustration System |

| Image 2 |

Click here to review the reports for this comparison.

Not only does the Roth add considerably to the parents’ net worth as described in Blog #150, it ends up providing Scott with over $11 million of after tax, retirement cash flow, a gain of $9.6 million over the Inherited IRA.

Click here for a discussion on obtaining the numbers necessary for the Image 2 comparison.

Conclusion

The next time you have parents considering a Roth conversion, be sure to bring the issue of inherited IRAs to their attention as it is truly a showstopper. The impact on heirs of an Inherited Roth makes the original decision to convert to a Roth almost irresistible.

Afterthought

In Blog #151, we discussed the sales opportunities that a Trump presidency provides.

Let’s assume Donald Trump is able to convince the Republican-led Congress to reduce income tax brackets. In that case, assume that Robert and Ann’s son, Scott, finds himself in a lower pre-retirement tax bracket; however, by the time he retires, the Democrats manage to hike his tax rate to 70%. In this case, how does the Inherited IRA vs. Inherited Roth IRA comparison look?

| Comparison of Inherited IRAs |

| for Scott Baxter |

| Retirement Tax Bracket: 70% |

| InsMark Illustration System |

| Image 3 |

Wow! After tax cash flow from the Inherited IRA is reduced by 57%. Anyone want to guess which is more likely to occur – long-range increases or decreases in income tax rates?

Some in Congress (the Senate Committee on Finance) are now weighing the elimination of stretch IRAs to any one other than a spouse thereby requiring distributions over, say, five years. My friend, Gonzalo Garcia, CLU, Partner, AgencyONE, had an interesting comment about this in his January 12 Blog:

For years, we have heard “save for retirement, take advantage of the IRA deduction, take advantage of your employer’s 401(k) match” and for what? So that Congress can conveniently change the laws at their discretion to accelerate the taxes due.

Both Roth IRAs and cash value life insurance avoid this issue – but keep your powder dry as we may have to fight this battle in years to come.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #152, Click here for a guide to its content.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“InsMark provides incredible tools to give clients a visual of how they can optimize their wealth. It’s great for deciding which road to go down.”

Jim Heafner, MBA, CFP, Heafner Financial Solutions, Inc., Charlotte, NC

"InsMark has important marketing information for every one of the producers in my firm — from the newly licensed to the veteran producer."

Gary Curry, President and CEO, ORBA Insurance Services Inc., InsMark Platinum Power Producer®, Gold River, CA

Important Note: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” and Wealthy and Wise are registered trademarks of InsMark, Inc.

![]()

More Recent Blogs:

Blog #151 – The Trump Presidency: How It Will Impact the Sale of Life Insurance Retirement Plans

Blog #150: Smart Alternatives to Traditional Retirement Plans (Part 1 of 5)

Blog #149: New Technology That Creates Radical Opportunities

Blog #148: More New Logic for Permanent vs. Term (Part 3 of 3)

Blog #147: New Logic for Permanent vs. Term (Part 2 of 3)

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive