(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System)

|

Note from Bob: I’m swamped with designing and testing some major enhancements to our illustration software coupled with preparing for the 2016 InsMark Symposium in Las Vegas scheduled for November 4 & 5. Consequently, I will be releasing my Blog a little less often for a while. I think you will like this one. |

Ron Grove, an attorney friend practicing in San Francisco, is very concerned that Washington will severely increase taxes to cover the monstrous, hyper-growth of the current federal deficit of 19+ trillion? He brought the following Letter to the Editor to my attention that appeared in the August 12, 2016, edition of The Wall Street Journal:

My quick internet search revealed that the total of the U.S. federal debt, plus the unfunded liabilities (Social Security, Medicare, etc.) is on the order of $120 trillion. A second search showed that the total net worth of the entire 300 million-plus U.S. population is only about $75 trillion.

You can imagine my surprise (and shock) when I realized that even if the federal government took every dime from every U.S. citizen—rich, poor and in-between—it still wouldn’t have enough money to pay everything it owes. This gave me an entirely new perspective on our country’s current financial situation.

Avoiding this catastrophe is the main theme of David McKnight’s outstanding book, The Power of Zero, in which he discusses techniques to reduce retirement income tax brackets to zero which, in the process, frees Social Security benefits from taxation. If you haven’t read it, you should.

My recent Blog #140: Zero Taxes for Social Security - InsMark Style featured how our Wealthy and Wise® users can accomplish these same results for their clients.

Let’s look at one of our most popular illustrations, Various Financial Alternatives from the InsMark Illustration System, to analyze the potential impact of skyrocketing income taxes and a simple way to avoid them -- with IUL.

Case Study – Don’t Burn the Nest Egg®

Ron Grove, my attorney friend, is age 45. As part of his retirement planning, he has decided to acquire $527,035 of indexed universal life insurance (“IUL”) with a max-funded premium of $25,000 scheduled for 20 years. At retirement (age 65), he intends to draw cash flow of $100,000 a year from the policy using participating loans. The IUL death benefit is increasing until retirement; level thereafter. Values are projected at 7.00%. You’ll see why he chose IUL in a moment.

Ron Grove, my attorney friend, is age 45. As part of his retirement planning, he has decided to acquire $527,035 of indexed universal life insurance (“IUL”) with a max-funded premium of $25,000 scheduled for 20 years. At retirement (age 65), he intends to draw cash flow of $100,000 a year from the policy using participating loans. The IUL death benefit is increasing until retirement; level thereafter. Values are projected at 7.00%. You’ll see why he chose IUL in a moment.

There are several alternatives available to Ron. He is in a 40% marginal income tax bracket and assuming stable income tax rates for the moment, let’s see how his IUL compares to these three alternatives matching the IUL premiums and the $100,000 a year in after tax cash flow starting at age 65:

- Taxable Account at 7.00%;

- Tax Deferred Account at 7.00% (an indexed annuity);

- Equity Account at 7.00% growth; 2:00% dividend.

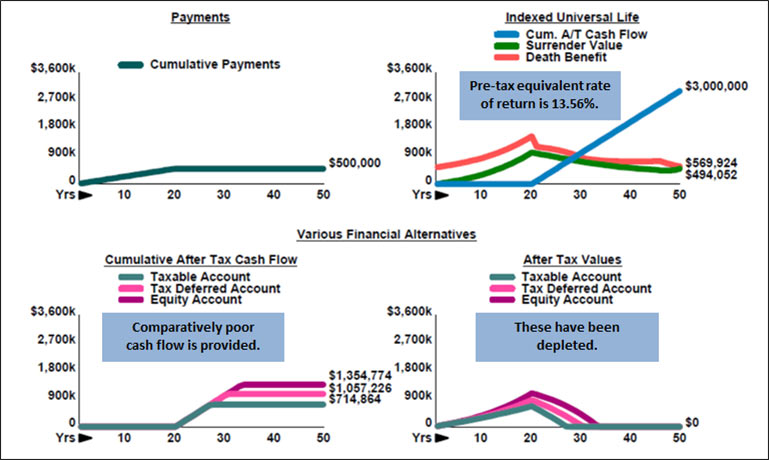

| Various Financial Alternatives |

| (Stable Income Tax Rates) |

| Image 1 |

To match the results of the IUL:

- Taxable Account needs a yield of 16.43%;

- Tax Deferred Account needs a yield of 10.55%;

- Equity Account needs growth of 9.14% plus the 2.00% dividend.

Click here to review the full illustration from the InsMark Illustration System.

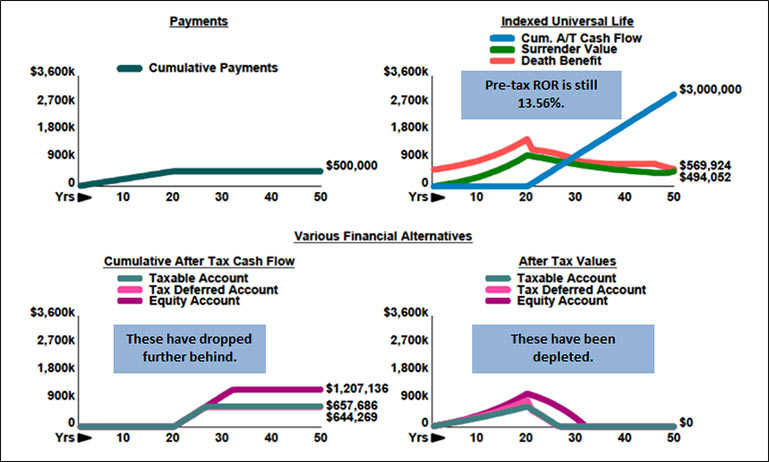

What happens if income taxes increase considerably?

Let’s next suppose that by the time Ron retires, his tax bracket has jumped to 80%, a devastating increase (but not as high as WWII when it rose to 91% and stayed that way until 1964 when it decreased to 70%.)

| Various Financial Alternatives |

| (Income Tax Rates Increase to 80% by Retirement) |

| Image 2 |

To match the results of the IUL:

- Taxable Account needs a yield of 24.38%;

- Tax Deferred Account needs a yield of 16.39%;

- Equity Account needs growth of 9.65% plus the 2.00% dividend.

Click here to review the full illustration from the InsMark Illustration System.

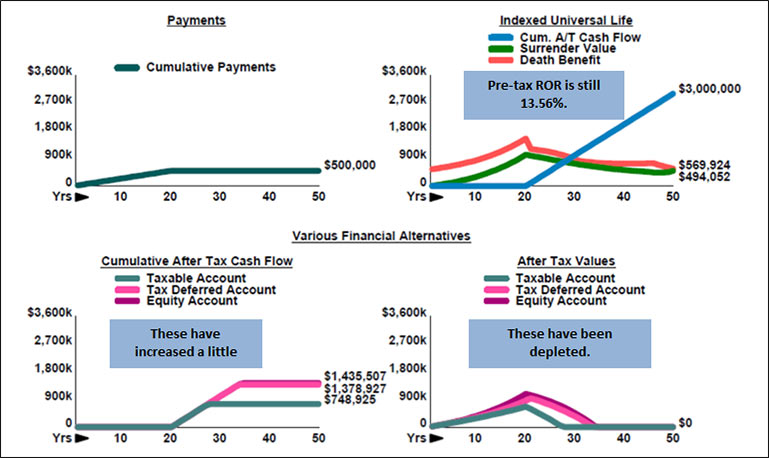

“OK,” asks the cynic, “what if income tax rates go way down?”

If we assume that Ron’s tax rates drop down to 20% at retirement (a hard-to-accept assumption), here is what happens:

| Various Financial Alternatives |

| (Income Tax Rates Decrease to 20% by Retirement) |

| Image 3 |

To match the results of the IUL with what I believe is an impractical long-range tax bracket assumption of 20%:

- Taxable Account needs a yield of 14.73%;

- Tax Deferred Account needs a yield of 9.15%;

- Equity Account needs growth of 8.91% plus the 2.00% dividend.

Click here to review the full illustration from the InsMark Illustration System.

“Wait a minute,” says the cynic, “Ron could put $41,667 a year into a Solo 401(k) and that would cost him the same $25,000. He’d then have $41,667 working for him.”

OK, let’s look at that with a Solo 401(k) yielding 7.00%.

| Various Financial Alternatives |

| Solo 401(k) Substituted for the Taxable Account |

| (Income Tax Rates Increase to 80% by Retirement) |

| Image 4 |

-substituted-for-the-taxable-account-769x461.jpg)

To match the results of the IUL, the Solo 401(k) needs a yield of 15.47%.

Click here to review the full illustration from the InsMark Illustration System.

“Now I got you,” says the cynic, “what if tax brackets drop to 20%?”

OK, let’s look at that. We’ll replace the Taxable Account with the Solo 401(k).

| Various Financial Alternatives |

| Solo 401(k) Substituted for the Taxable Account |

| (Income Tax Rates Decrease to 20% by Retirement) |

| Image 5 |

-substituted-for-the-taxable-account-769x466.jpg)

To match the results of the IUL with what I believe to be an impractical long-range tax bracket assumption of 20%, the Solo 401(k) needs a yield of 8.40%.

Click here to review the full illustration from the InsMark Illustration System.

Conclusion

With taxes stable, or taxes up, or taxes down, indexed universal life (“IUL”) is unaffected. If you don’t want to expose your retirement funds to the politicians in Washington, there is a superb way to do so - acquire a large amount of IUL.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #142, Click here for a Guide to each of the illustrations.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online at or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“InsMark’s Checkmate® Selling strategy is still one of the most compelling tools to bring a client to a definitive decision, based on their best case alternatives!!! Solid mathematical comparisons that prove the validity of our insurance solution!!!”

Frank Dunaway, III, CLU, Legacy Advisory Services, Carthage, MO

Important Note #1: The hypothetical life insurance illustration associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark”, “Wealthy and Wise” and “Don’t Burn the Nest Egg” are registered trademarks of InsMark, Inc.

![]()

More Recent Blogs:

Blog #141: Strategic Philanthropy

Blog #140: Zero Taxes for Social Security - InsMark Style

Blog #139: Finding Clients For Large Case Premium Financing… JUST GOT EASIER

Blog #138: The Quickest Way To Learn InsMark

Blog #137: More On “The Best Policy for My Client”

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive