(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using InsMark Illustration System and Wealthy and Wise®.)

Jennifer Haven, age 45, is an author of popular detective novels. She is vitally interested in supplementing her personal retirement income beyond what can be provided by her $18,000 annual deposit into her Solo 401(k) plan (see Blog #131 for details of such plans). She is recently divorced and has custody of her daughter Kelsie, age 7.

Jennifer has two primary financial goals:

- Funding for Kelsie’s college tuition at age 18: $40,000 a year for four years;

- Annual, spendable, retirement cash flow for herself starting at age 65: $180,000 indexed at 3.00% as an inflation offset.

There are approaches for Jennifer illustrated in this Blog, each one using $1,320,000 of Indexed Universal Life (“IUL”) max-funded with five premiums of $50,000.

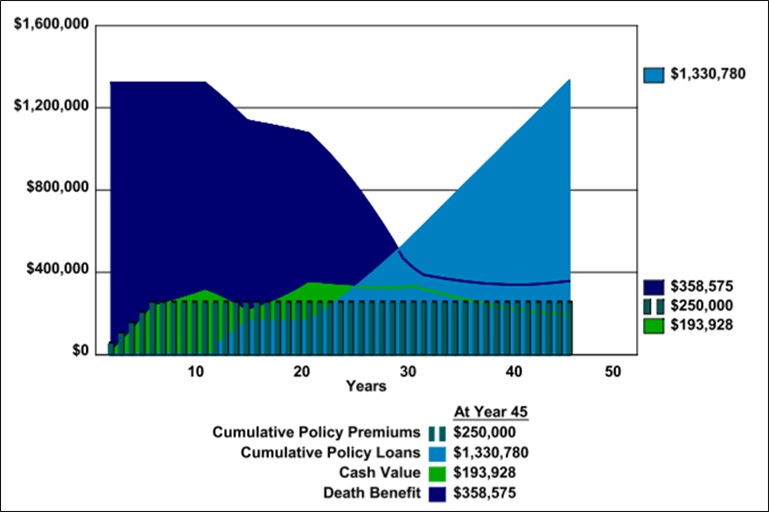

First is a simple illustration of values with policy loans producing tax free college funds and retirement cash flow. The graphic below shows the effect of this approach:

| Image 1 |

| Indexed Universal Life |

Click here to review the year-by-year numbers of the illustration.

It is a good presentation of the IUL’s current values - but compared to what? Most prospects and clients make far better decisions by comparing alternatives. If you don’t show them, your client may look elsewhere.

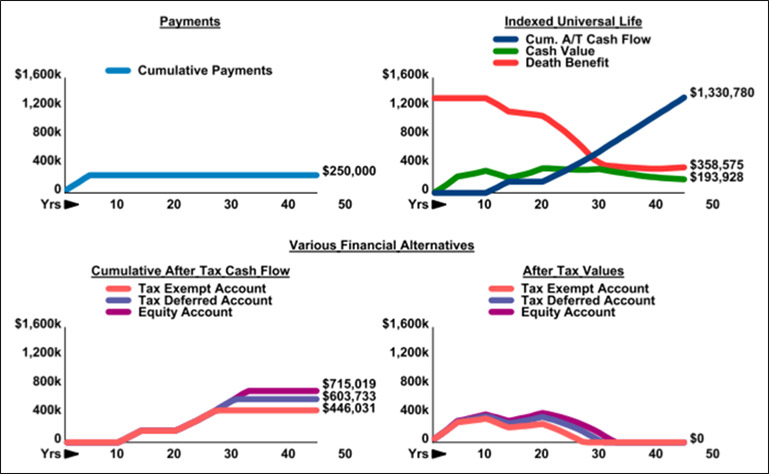

To address this issue, we’ll compare the policy to the following financial alternatives -- all with the same deposit pattern as the IUL and matching the after tax college funds and retirement cash flow of the IUL:

- Tax exempt account (4.00% yield);

- Tax deferred account (7.00% yield);

- Equity account (7.00% growth; 2.00% dividend).

The graphic below summarizes the results:

| Image 2 |

| Various Financial Alternatives (VFA) |

Click here to review the year-by-year numbers of this comparison. VFA is certainly a more effective presentation than just the policy illustration shown in Image 1. While powerful, the IUL needs context to be most effective. What is missing is a comprehensive integration of the IUL within Jennifer’s overall net worth and cash flow goals.

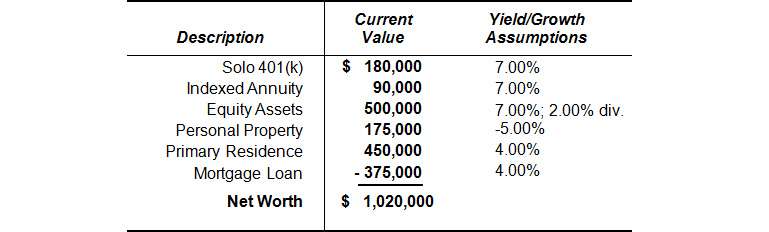

Below is a summary of her current net worth.

| Net Worth |

| Jennifer Haven |

Click here for comments regarding yield, growth, and Monte Carlo simulations.

Next is a Wealthy and Wise analysis including both a pre- and post-retirement evaluation of goals versus available assets to meet those goals:

- Strategy 1 is Jennifer’s current assets meeting her two goals of college funds for Kelsie’s tuition and retirement cash flow for herself.

- Strategy 2 duplicates Strategy 1 plus the addition of the values from the IUL policy featured in Image 1 and Image 2. The source of the IUL’s five $50,000 premiums are withdrawals from her assets not an out-of-pocket expense she has to absorb, a major difference from the perception of premium cost she has with Image 1 and Image 2. Strategy 2 also includes a conversion of her Solo 401(k) to a Solo Roth 401(k) spread over 16 years to minimize the tax bite. (The conversion taxes are also funded by withdrawals from her asset base.)

Below is the graphic summary comparing Strategy 1 with Strategy 2.

| Image 3 |

| InsMark Wealthy and Wise® Analysis |

The inclusion of the IUL and the Roth in Strategy 2 produces over twice the long-range net worth as Strategy 1. It is still increasing while Strategy 1 is in a death spiral. Note again that this increase does not require Jennifer to pay the IUL premiums out-of-pocket; they are withdrawn from her asset base with values of the IUL more than replacing them. For both Strategies, we used InsMark’s unique Max Net Worth™ algorithm to establish which assets are the most efficient to use for both college and retirement cash flow.

Note: Jennifer’s life expectancy is age 83. I ran this analysis for 45 years to her age 90 to make sure there are sufficient assets to provide her cash flow requirements past age 83. (Don’t forget, life expectancy means half that age group is still alive at life expectancy.) The reason I illustrated the Wealthy and Wise analysis only to age 90 is that so much of her remaining net worth in Strategy 1 (the current retirement plan) at that point is made up of illiquid assets that Jennifer’s retirement cash flow from Strategy 1 will shortly fall below $100,000, reason alone to discard Strategy 1 as an option.

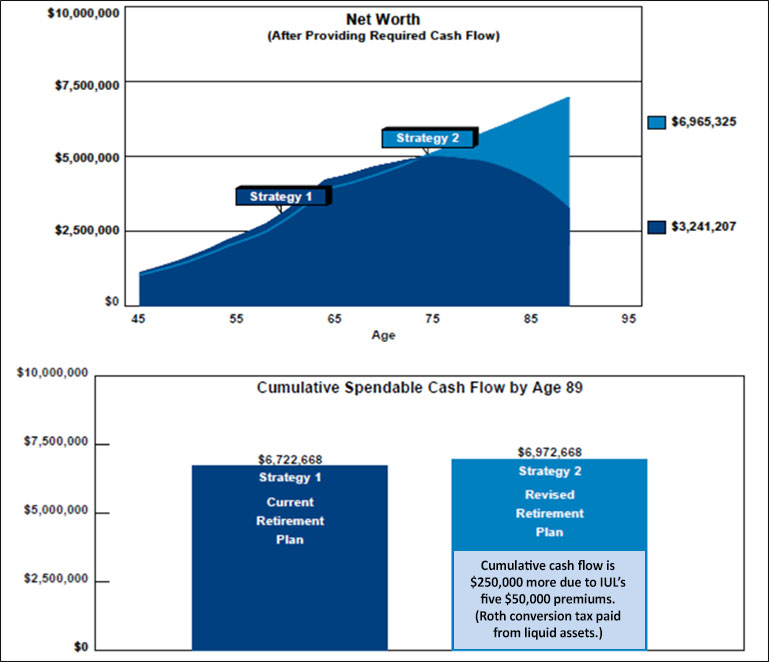

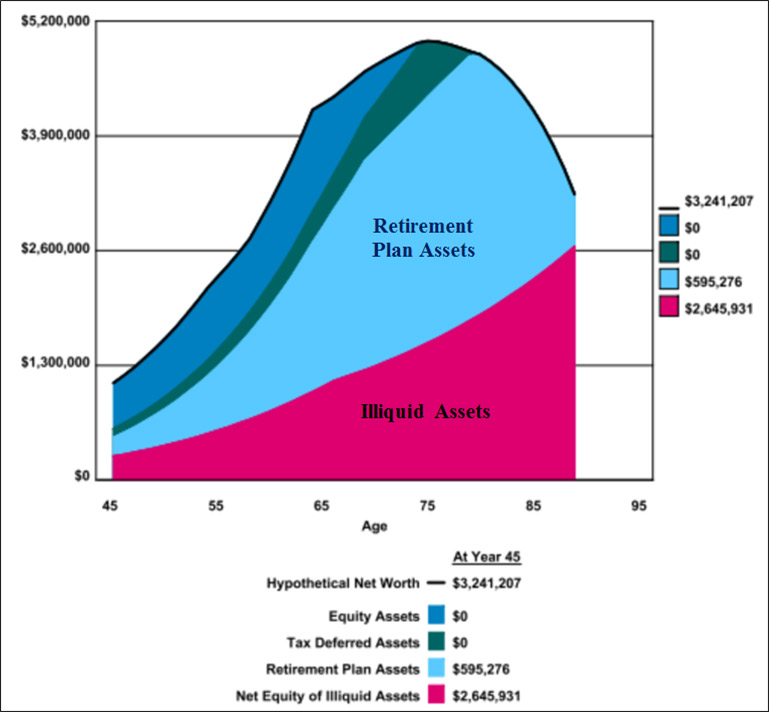

Below is a graphic of Jennifer’s Strategy 1 net worth at age 90:

| Image 4 |

| InsMark Wealthy and Wise® Analysis |

| Strategy 1 - Net Worth at Age 90 |

With only $595,276 of liquid assets remaining in her retirement plan, it is barely enough for one more year’s after tax cash flow.

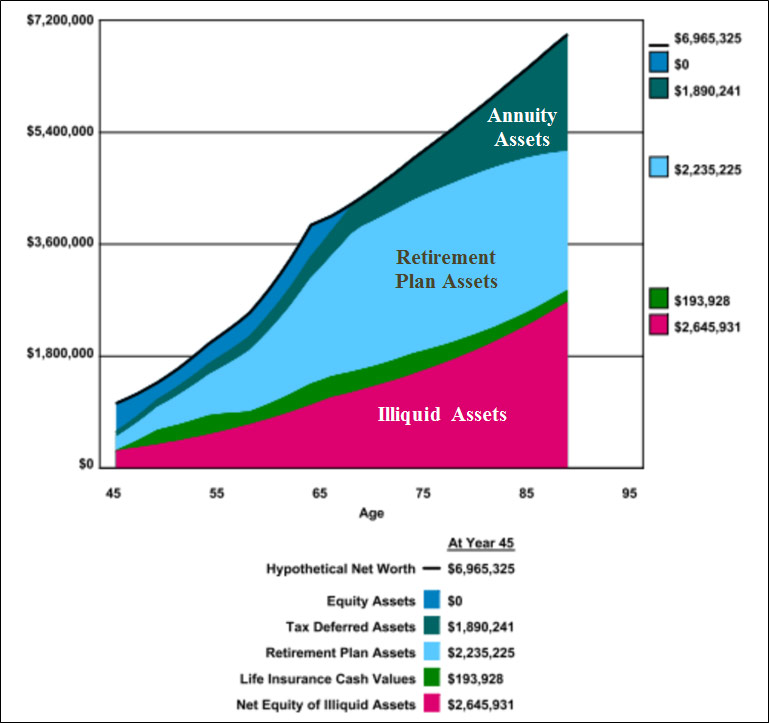

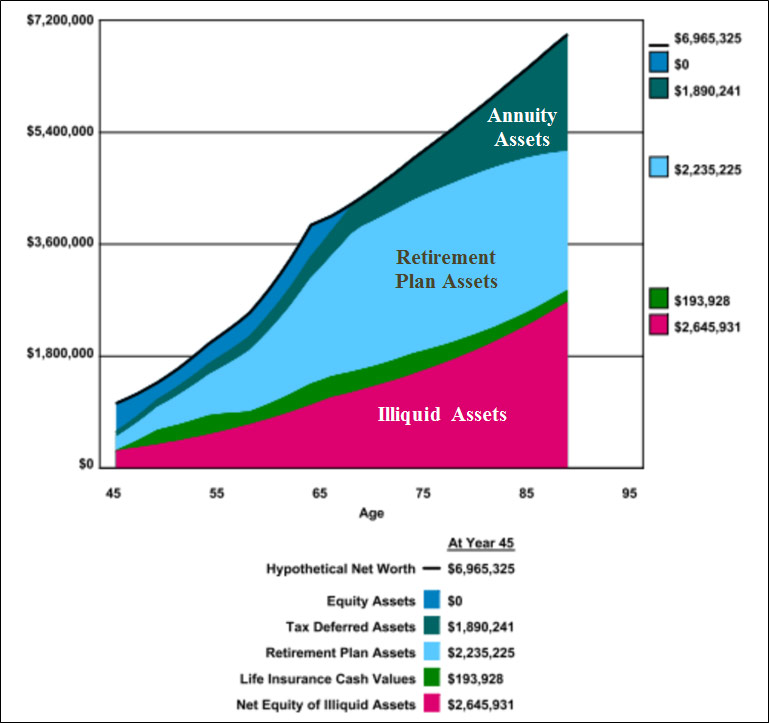

Below is an alternate graphic of Jennifer’s Strategy 2 net worth at age 90:

| Image 5 |

| InsMark Wealthy and Wise® Analysis |

| Strategy 2 - Net Worth at Age 90 |

|

Image 5 shows substantial liquid assets remaining with Strategy 2. With Jennifer’s life expectancy of age 83, is cash flow through age 90 a good enough cushion? Maybe; maybe not. Why take the chance if a longer duration is needed? The 3.00% indexing of her $180,000 of after tax cash flow has grown to $354,000 by age 89, and there are sufficient liquid assets remaining for similar growth thereafter. Strategy 2 means she can thrive financially well past age 100. |

|

| Image 5 |

| InsMark Wealthy and Wise® Analysis |

| Strategy 2 - Net Worth at Age 90 |

Strategy 2 also means more of an inheritance for Kelsie as you can see below:

| Image 6 |

| InsMark Wealthy and Wise® Analysis |

Conclusion

Strategy 2 is all good news for Jennifer and Kelsie.

Details of the Analysis

Click here to review the detailed reports in the Wealthy and Wise analysis of Strategy 1 vs. Strategy 2. The important pages are the first six, and most everything after that is necessary backup. There are 103 pages in the file. That is lot to review, but the reason I included them all is to emphasize the need for backup so, when a client’s CPA or attorney asks, “Where did this number come from?” you will be in a position to show its specific source because every number produced in Wealthy and Wise is backed up in detail.

Maybe Bad News for Some

The bad news for some of you is that a comprehensive analysis like this requires you to gather all of a client’s financial data. Many of you are used to doing this. For those of you who are not so comfortable with it, how do feel about asking a prospective client to reveal complete details of financial data? Clearly, you have to earn a prospective client’s trust to do that.

My suggestion for the best way to gain that confidence is to share examples of how this concept works for others -- this Blog, for example, highlighting the Comparison graphics -- or similar graphics you prepare on your own perhaps with help from an InsMark Referral Resource (more on this below). We promise you will get a ‘Wow” reaction from most prospective clients.

Questions and Answers

Q. How difficult is it to gather financial data from prospective clients?

A. There are typically only two reasons why you can’t get information about financial assets/benefits from what appear to be valid prospects: 1) they don’t trust you (yet) or 2) they don’t have very much in reserve and are embarrassed about it. Two couples, both of whom appear affluent, may be in quite different financial shape. You can’t easily spot those in the latter category who are often high livers and spenders but swamped in debt. Pressing for financial data can often uncover those who aren’t financially sound.

And if you can’t develop a trusting relationship with valid prospective clients, you’ll never get them to reveal very much of their financial data. A Fact Finder is available in Wealthy and Wise to guide you in your data gathering (see Tools on the main menu bar). The Fact Finder is best filled out with the client’s active participation.

At first glance the Fact Finder may look intimidating, but on most pages, you will be entering data in only a few of the listed categories. To acquaint yourself with it, try filling one out for your own situation. Then, if you enter your data in your copy of Wealthy and Wise -- you may be pleasantly surprised.

Q: Should college funding always be included in a retirement analysis?

A: Yes, assuming the parents are involved in paying all or some of the costs. They are a drain on retirement funds and should be accounted for.

Q: Why were policy loans used on the IUL for the $40,000 a year for Kelsie’s college tuition funding?

A. I wanted to use the arbitrage leverage of participating policy loans available with the IUL. (See Blog #52 for a comparison of participating vs. fixed policy loans.)

Q. Is cash flow from Social Security always included?

A. Only if clients believe it will be available based upon their sense of the government’s financial ability to pay it. In Jennifer’s case, she wanted it included. Wealthy and Wise includes an after tax Social Security calculator available on any of the arrays on the Expected Cash Flow tab.

Q. How can a Wealthy and Wise evaluation be reliably projected so far into the future?

A. It can’t be reliably projected if you perceive retirement planning as a “one and done” analysis. To be a dependable adviser to your clients, you must meet with them at least once a year and bring all the data current. Each year represents a fresh look at the future, and this is what turns prospects into clients, not just policyholders. If you follow this procedure, soon your clients won’t make a significant financial move without asking you to run it through Wealthy and Wise. Otherwise, changes in finances will make your original evaluation obsolete, and you will lose clients to other advisers.

This approach also gives you a good basis for charging an annual monitoring fee for the analysis. If you can develop fee revenue from clients who are glued to you for service, it has a significant impact on the value of your practice. These days, recurring revenue is hard to develop, and monitoring fees are an excellent way to do so. Blog #98 covers this issue in detail including how to include such fees within a presentation so they are paid for out of plan assets not by addition out-of-pocket costs by the client. Be sure to check with compliance if you are considering monitoring fees.

If you prefer a “one and done” solution, comprehensive retirement planning is not for you. That is not to say there isn’t plenty of opportunity for you -- just not in this field.

Q: What if there are not sufficient assets and benefits to produce the desired cash flow?

A: This will occur, and when it does, your clients have several options, and Wealthy and Wise can deal with any of them:

- Commit more to savings and investments;

- Defer including inflation on desired cash flow;

- Reduce the amount of desired cash flow;

- Reduce the number of years of desired cash flow;

- Defer the starting date for desired cash flow;

- Manage assets more aggressively.

Reducing cash flow goals doesn’t necessarily mean there will always be a shortage. Each year as you develop the annual review, add back some of what’s missing, typically by committing more to IUL.

Licensing InsMark Systems

To license the InsMark Illustration System or Wealthy and Wise, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“InsMark is the Picasso of the financial services world – their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Silver Power Producer®, Overland Park, KS

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

![]()

More Recent Blogs:

Blog #134: Best Strategy for an IRA (Part 2 of 2)

Blog #133: Best Strategy for an IRA (Part 1 of 2)

Blog #132: The Calculation Magic of Wealthy and Wise®

Blog #131: Don’t Burn the Nest Egg™

Blog #130: Should I or Shouldn’t I?

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive