(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

|

“Don’t Burn the Nest Egg” is a trademark of InsMark, Inc.

Andy MacGregor is the managing member of MacGregor Cars, LLC, a luxury car search company for upscale clients. The LLC has no other members or employees.

Andy, age 40, is about to install what he considers the beginning of his “nest egg”, an Individual 401(k) -- also known as a Solo 401(k) -- with a $50,000 annual, deductible contribution. In his 40% marginal state and federal tax bracket, it will cost him $30,000 to make the $50,000 contribution.

|

According to Investopedia, a nest egg is a substantial sum of money that has been saved or invested for a specific purpose and is generally earmarked for longer-term objectives, the most common being retirement. Andy’s nest egg would be significantly better-funded if the after tax cost of the $50,000 contribution to the 401(k) -- $30,000 in his case -- were placed in max-funded indexed universal life (“IUL”). The proof of this follows. |

|

|

The Mathematics

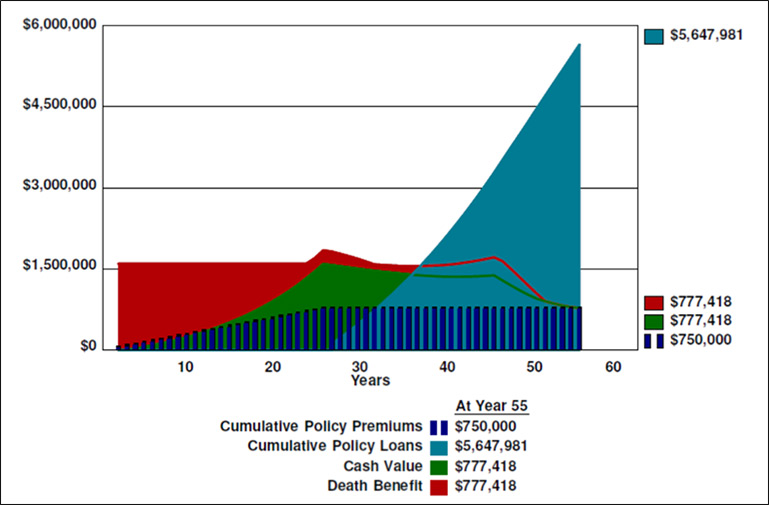

Below is a graphic of the results of the IUL.

| Image 1 |

| Indexed Universal Life |

Click here to review the full IUL illustration from the InsMark Illustration System.

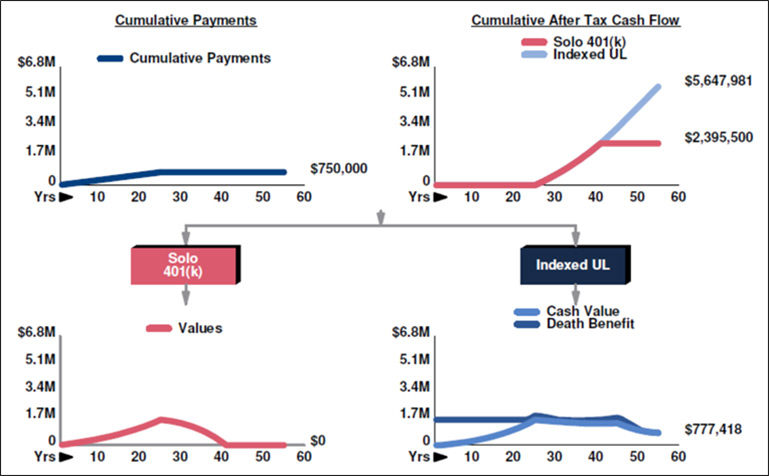

A Solo 401(k), however, is a tax deferred investment, so let’s match that against the IUL using the same crediting rate of 7.00% as the IUL. Below is a graphic of the customized comparison from the Other Investments vs. Your Policy module in the InsMark Illustration System:

| Image 2 |

| Solo 401(k) |

| vs. |

| Indexed Universal Life |

Click here to review the full comparison of a Solo 401(k) vs. IUL. As you can see on Page 3. the Solo 401(k) crashes and burns at Andy’s age 85 which is another good reminder for your clients -- Don’t Burn the Nest Egg™.

As you can see on Page 4, Andy needs an annual, pre-tax equivalent rate of return of 9.04% on the Solo 401(k) to match the long-range values of the IUL. That’s 204 basis points more than the 7.00% illustrated for the IUL.

Roth Solo 401(k)

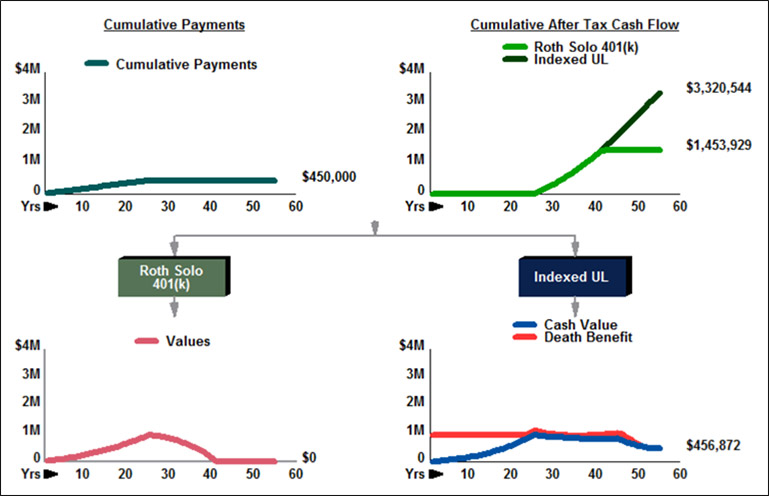

A Roth Solo 401(k) is also an available option for Andy. His non-deductible annual contribution for 2016 for this plan is limited to $18,000 so let’s compare that with an $18,000 annual premium for the IUL. As the analysis below proves, any funds considered for the Roth Solo 401(k) should be directed to IUL.

| Image 3 |

| Roth Solo 401(k) |

| vs. |

| Indexed Universal Life |

Click here to review the full comparison of a Roth Solo 401(k) vs. IUL. Andy needs a rate of return of 8.96% on the Roth Solo 401(k) to match the long-range values of the IUL.

Conclusion

Comparing the after tax costs of funding and the after tax retirement cash flow, IUL is significantly better than any of the following retirement plans:

- IRA;

- Roth IRA;

- Keogh;

- 401(k);

- Solo 401(k);

- Roth Solo 401(k);

- 457 plan;

- Profit sharing plan.

Other Important Advantages to the IUL

Unlike the alternative retirement plans noted above:

- IUL provides a significant death benefit for Andy’s family in all years.

- IUL requires no complex client calculations to establish the funding level because there are no contribution limits to IUL.

- Waiver of premium can be attached to IUL in the event of disability.

- There is no 10% premature distribution tax on cash flow from IUL.

- Tax free loans can be taken from the IUL with no IRS limits or payback requirements.

- IUL can maintain its “Nest Egg” qualities throughout the years illustrated.

The Challenge

Total U.S. retirement assets are close to $30 trillion. Are you getting your share of contributions to those plans redirected to IUL? An entire career could be based on this project.

Life insurance has been traditionally viewed as “expensive”, but the client’s perception is markedly different when the results shown in this Blog are achieved. Once again, here is Bill Boersma’s comment from his article in the December 2014 issue of Trusts & Estates in which he discusses life insurance as an asset class:

“I can only wonder if another asset with the same qualities would be implemented more frequently if it wasn’t called life insurance.”

IUL vs. Defined Contribution Plans

Below are links to other Blogs on this general subject that may be of interest to you:

- Blog #61: Sacrificing Cash Flow with a 401(k) Plan

- Blog #68: A Pretend 401(k) Plan vs. Indexed Universal Life

- Blog #113: Life Insurance Alternatives to a 401(k)

- Blog #106: Profit Sharing Plan vs. Indexed Universal Life (Part 1 of 3)

- Blog #107: Profit Sharing Plan vs. Indexed Universal Life (Part 2 of 3)

- Blog #108: Profit Sharing Plan vs. Indexed Universal Life (Part 3 of 3)

Note: These links are easily found in the Blog Index which is a resource you should use to identify Blogs on specific subjects that interest you. To identify the ones listed above, I selected Blogs By Sales Concept followed by Retirement Planning and Wealth Management.

Licensing InsMark Systems

To license the InsMark Illustration System, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials:

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“Thanks to InsMark, we recently set business goals in our firm that I basically thought were ridiculously unachievable - until now.”

Brian Langford, InsMark Platinum Power Producer®, Plano, TX

“InsMark is an absolutely mind blowing experience.”

Larry Gustafson, InsMark Platinum Power Producer®, Denver, CO

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

![]()

More Recent Blogs:

Blog #130: Should I or Shouldn’t I?

Blog #129: Leveraged Executive Bonus Plan with Bank-Funding of the Income Tax (Part 3 of 3)

Blog #128: Leveraged Executive Bonus Plan with Bank-Funding of the Income Tax (Part 2 of 3)

Blog #127: Leveraged Executive Bonus Plan with

Bank-Funding of the Income Tax (Part 1 of 3)

Blog #126: The Leverage of Bank-Funded Estate Liquidity

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive