(Updated March 7, 2016)

(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

|

|

Editor’s Note: Blog #128 (Part 2) may be easier to follow if you take the time to review Blog #127 ( Part 1) assuming you haven’t already done so. |

Continuing our study of the Leveraged Executive Bonus Plan for Alex Demas as described in Blog #127, let’s next examine a feature that can be added to it that could guarantee Alex’s continuing employment for at least the next 10 years.

In Blog #127 we discussed that Hawthorne Construction, Inc., decided that part of a new benefit plan for Alex will include a Leveraged Executive Bonus Plan funded with $2,875,000 of indexed universal life (IUL). The policy is max-funded with five level premiums of $100,000 paid for with deductible bonuses by the company paid to Alex. Alex will offset the resulting income tax liability on each bonus by way of a bank loan secured against the IUL.

This is an impressive executive benefit! No out-of-pocket cost for Alex coupled with $4.8 million in after tax retirement cash flow, all provided by Hawthorne Construction for an after tax cost of $65,000 a year for five years.

Click here to review Alex’s Leveraged Executive Bonus Plan from the InsMark Premium Financing System. (Pages 8 and 9 show the Summary numbers.) We used the Income Tax Financing module in the InsMark Premium Financing System to prepare the illustration.

Controlled Executive Bonus

If a Controlled Executive Bonus feature is added to Alex’s benefit plan, it means he would be required to repay all (or, perhaps, only part of) the bonuses if he were to voluntarily terminate employment within a certain number of years. It could also be based on a certain event like reaching retirement or achieving a specific company goal.

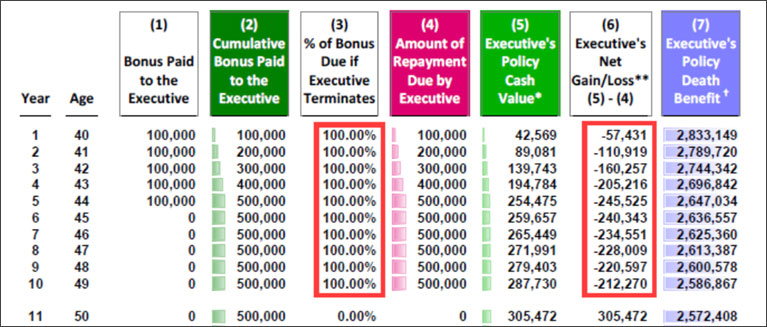

With this feature, Hawthorne Construction can select a certain percentage payback of the bonus (e.g., 100% in all 10 years) or schedule a variable percentage payback, e.g., 100% during year 1, declining by 10% a year over the next 9 years.

Below is an example of a Controlled Bonus repayment schedule for Alex using “voluntary termination prior to 11 years” as the duration in which a 100% repayment is required. Please understand that Column (3) is an example of only one of many possible repayment schedules.

Possible Repayment Schedule

**Negatives in Column (6) are in excess of policy cash values. The financial gain in Alex’s favor between the 10th and 11th year is in excess of $500,000 ($212,270 + $305,472), a powerful incentive to remain employed.

† The typical Controlled Bonus Plan agreement provides that the repayment obligation is waived at the executive’s death if it occurs during years of a repayment obligation.

The repayment obligation could be extended longer than 10 years — perhaps until retirement. Instead of that, I suggest it would be much more productive for Hawthorne Construction to launch a similar plan for Alex when he is age 50 assuming the firm remains anxious to retain him.

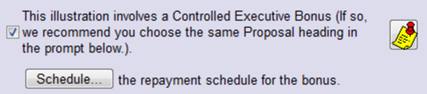

Click here for a review of the details of the bonus repayment feature from the InsMark Illustration System.

Note: The Controlled Executive Bonus repayment feature is not currently available in the Income Tax Financing module in the InsMark Premium Financing System. It is available in the Executive Bonus Plan and Executive Security Plan modules in the InsMark Illustration System — and that is the source I used for the screen shot above and the link in the prior paragraph. We will be adding this feature to the Income Tax Financing module in the InsMark Premium Financing System in the near future.

Suppose Alex elects not to participate. In this case, the company will have discovered that he may be considering alternative employment and is not interested in a benefit plan with such a short-term contingent liability. Clearly, Alex’s decision not to participate would uncover valuable business information that might otherwise be difficult to determine, and this could allow the firm to plan accordingly.

Alternative Benefit Plans

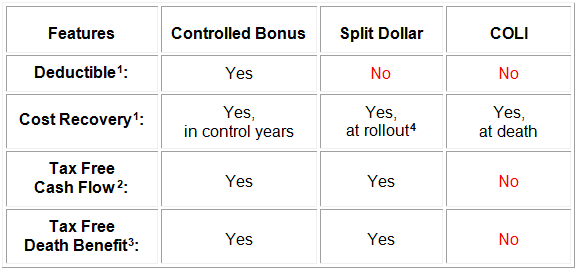

In many ways, a Controlled Bonus is superior to loan-based split dollar and salary continuation (COLI) plans:

1 to employer 2 to executive 3to executive’s family 4 typically at retirement

Since the loss of equity split dollar in 2003, Executive Bonus Plans have become one of the premier go-to executive fringe benefits. Using a bank to finance the executive’s income tax on bonus plans takes them to a new and better level. Adding the Controlled Bonus features adds a new dimension to retention of important non-owner executives and minority shareholders.

Sarbanes-Oxley eliminates the use of Loan-Based Split Dollar for executives of public corporations; however, this does not apply to loans made by an executive where no corporate liability exists for the loan. The Leveraged Executive Bonus Plan featured in this three-pronged Blog series should be usable by any private or public business entity.

Licensing InsMark Systems

To license the InsMark Illustration System, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

After you open the workbook in your system, the prompts to use for the Controlled Bonus are on this section of the Plan Details tab shown below:

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials

“Standard bank financing illustrations produce much in the way of great data, but it takes the InsMark Premium Financing System to really present compelling numbers; however, the integration of that data into InsMark’s comparative modules like Various Financial Alternatives and Wealthy and Wise is really what makes premium financing sizzle.”

Chris Jacob, CFP, SFI-Cadeau, St. Louis, MO, InsMark Platinum Power Producer®

“As with all of the InsMark software, InsMark’s Premium Financing System has proven to be an indispensable addition to my ability to show my clients the advantages in using bank loans to solve their financial needs. Because of this, I was able to close three large financed cases easier and faster than ever before. As always, InsMark has delivered again. I encourage all who use bank financing as a solution to their clients’ needs to purchase this system. The cost of the system is not an expense, but rather an investment in your business.”

William Moates, Jr., Trilennium Financial Alliance LLC, Fort Smith, AR, InsMark Platinum Power Producer®

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, International Forum Member, InsMark Platinum Power Producer®, Encino, CA

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

![]()

More Recent Blogs:

Blog #127: Leveraged Executive Bonus Plan with

Bank-Funding of the Income Tax (Part 1 of 3)

Blog #126: The Leverage of Bank-Funded Estate Liquidity

Blog #125: Web Supported Resources for You

Blog #124: More on the Siren Song of “Buy Term and Invest the Difference”

Blog #123: The Siren Song of “Buy Term and Invest the Difference”

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

Hi Bob,

I have been eagerly awaiting Blog #129 which, I understand, will be the final installment of the introduction to your hybrid premium financing, executive bonus plan.

I sincerely hope my earlier remark to you about a reduced commission due to your use of an Enhanced Liquidity Option (ELO)–type rider has not soured you on this remarkable idea. Below is a typical commission breakdown on a 100% ELO:

35% of the target premium commission in the first year followed by five years each at 15% of the target premium commission results in 110% of the commission over a period of five years. There is typically no commission on the excess premium.

On your illustrated case for an agent with a 100% target premium commission, the compensation would be: roughly $12,500 the first year, and $5,500 for each of the next five years for a total commission of $40,000 over a five-year period. This is based on the policy remaining in force for at least six annual premiums.

For a greedy agent, this may be too much first year commission to give up, but it is a slam dunk for the policyholder!

Which begets the following questions:

1. If there is cliff vesting due to the Controlled Bonus feature, would each payment to the policy be fully taxable to the executive as it is made?

2. Again, with cliff vesting, I think the potential financial obligation of 100% liability for ten years of bonuses would be too daunting for the executive to take on. After all, who knows where we will be ten years from now? Proportionate vesting should not only be palatable to the executive, it should also provide the owners with valuable information about how serious the executive is as to remaining employed.

3. Finally, why limit this to non–owner executives and minority shareholders? This should easily beat any qualified plan, and should make any owner drool!

Be well.

Stan Belikoff, CLU, CWPP

Hi Stan,

I couldn’t agree more with your conclusions about the Leveraged Executive Bonus plan funded by the Income Tax Financing (ITF) illustrations in Blog #127. Using the ITF module in our Premium Financing System has dynamic new possibilities for the elimination of gross–up bonuses to fund an Executive Bonus Plan. Typically, for an executive to have $0 cost, a gross–up bonus is needed. With ITF, a single bonus is sufficient thereby significantly reducing the employer cost. In addition, the Controlled Bonus aspect of the plan outlined in Blog #128 provided the employer with a recovery option not unlike loan–based split dollar but without the minutia of federal split dollar regulations –– particularly the Applicable Federal Rate.

Re the “cliff vesting” caused by the Controlled Bonus, I don’t think it changes the tax treatment of the bonus –– the bonus will be taxed as paid. I agree that the 100% bonus repayment over ten years that I illustrated is a little much although it only applies to voluntary termination by the covered executive. With a ten–year repayment obligation, maybe use 100% for the first five years followed by 40%, 30%, 20%, 10%, 0%. If a terrific offer comes along for the covered executive during any of the repayment years, I think that would be a fair repayment schedule. But in the end, that schedule is up to the employer. Wouldn’t it be an interesting part of the interview with the business owner as he works out the desired repayment schedule? I am glad you caught the unusual management technique of uncovering a potentially departing executive due to his refusal to participate in the plan due to the repayment obligations of the plan.

One of the main advantages of the Enhanced Liquidity Option (ELO) re policy cash values which creates close to 100% cash values in year 1 is the very likely ease with which bank financing can be obtained for loans for the income tax, (including accrual of loan interest as illustrated in Blog #127). In that Blog, the loan never exceeds 50% of the policy cash value. Even with an executive in a 50% tax bracket, there would be plenty of collateral in the policy. A greedy agent might try to put the case together without the ELO, but then he/she is tagged with a seriously different kind of bank negotiation. With the ELO, you could likely talk a local bank into offering such a fully collateralized loan –– perhaps with a little encouragement from the owner of the business. (Stay away from the business guaranteeing the loan –– particularly for a publicly-owned company as Sarbanes Oxley could well cause problems re loans to executives.) Also, a guarantee of the loan by the business is totally unnecessary in view of the high policy cash. An occasional executive might be so shoddy financially that a bank won’t make any kind of loan –– collateralized or otherwise.

Another edge to ITF is this: It applies to executives of any business type who has taxable income. Take me as owner of InsMark, Inc., an S corporation. The last $100,000 I take out from the business could be used in this fashion. Change the word “Bonus” to “Compensation” in the Income Tax Financing module in the Premium Financing System, and the illustration works for an owner of any business type: C corporation, S corporation, LLC, Sole Proprietor, or Tax Exempt Organization. It’s a monster market.

Finally, I agree with your comment that ITF “easily beats any qualified plan, and should make any owner drool”. I have added some text to the Prospecting section of Blog #127 to reflect this. Thanks for the recommendation.

I am considering forming a producer unit to promote, illustrate, and sell this concept. Do you want to learn more about it as it develops?

Incidentally, Blog #129 illustrates the power to heirs of an Inherited Roth. As you will recall, a Roth conversion was part of Blog #127. The Inherited IRA vs. Inherited Roth IRA comparison in Blog #129 shows how the Demas family is generationally enhanced by tens of millions of dollars due to the lynch pin of the Leveraged Executive Bonus Plan funded with Income Tax Financing.

Thanks so much for the informative comment.

Best regards,

Bob Ritter

President and Founder, InsMark, Inc.