(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

When I came into the business years ago, comparisons to “buy term and invest the difference” were easy. That’s because term was so expensive, there wasn’t much difference. One of the first things I learned was how to compare permanent with term so that the favored aspects of permanent were featured. That technique was the genesis of the popular Term vs. Permanent module in the InsMark Illustration System.

I have written several Blogs comparing term insurance to permanent insurance. Let me show you a new approach to challenging the myth of “buy term and invest the difference”.

Background

Tom and Courtney Johnson are neighbors and close friends. Tom, age 40, is a golf course architect; Courtney, age 37, owns and runs a travel agency. Their marginal state and federal income tax bracket is 45%.

Tom recently told me, “Bob, we decided to add that $1 million of life insurance we talked about. The cost is way low if we buy 25-year level term insurance — $970 a year for 25 years.”

I responded, “Would you like to compare that to an alternative that could save you millions?”

“Let’s see it!” Tom replied.

Case Study

This comparison is for those who have the cash flow to buy whatever kind of like insurance they want:

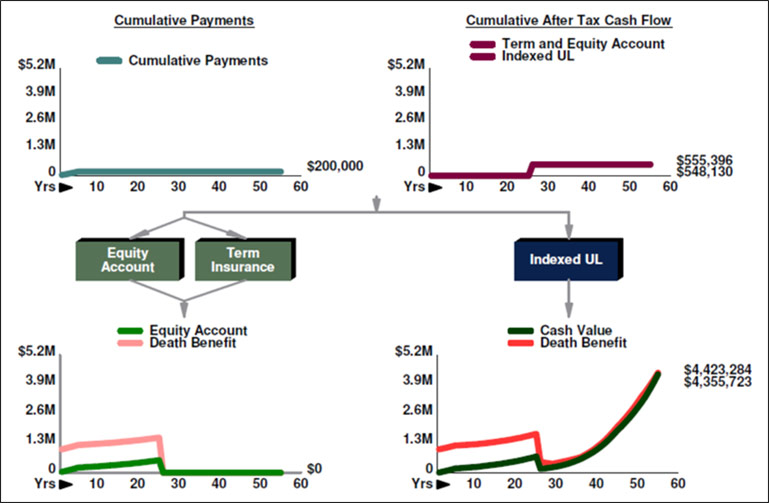

- $1,000,000 of indexed universal life (IUL) illustrated at 7.00% with five scheduled premiums of $40,000. After tax policy cash flow via a participating loan is scheduled to be $555,396 at Tom’s age 65 which leaves sufficient cash value for the policy to continue.

- versus

- $1,000,000 of 25-year level term with annual premiums of $970 coupled with a managed equity account with 7.00% growth and a 2.00% dividend using the same allocation as the IUL. At the end of 25 years when the term insurance expires, the equity account develops a value of $555,396.

Click here for comments on the fee and tax drag assumptions used for the equity account.

Click here for comments on interest, growth, and Monte Carlo simulations.

At Tom’s age 65, the participating loan of $555,396 from the IUL is matched by a withdrawal of the same amount from the equity account causing it to collapse at the same time the term insurance expires. (Due to a small amount of tax due on the equity withdrawal, the net realized from the equity account is slightly less than from the IUL ($548,130).

The participating loan provides Tom and Courtney with the identical funds that the equity account would have produced, but with the IUL still alive and well at age 65 with $176,687 of cash value remaining wrapped up in $475,992 of death benefit. Those cash values increase to $4,355,723 in the remaining years illustrated.

That $4,355,723 million is lost forever to Tom and Courtney should they believe the siren song of “buy term and invest the difference”.

Below is a graphic of the comparison.

| Indexed Universal Life vs. 25-Year Level Term Insurance and an Equity Account |

| Image 1 |

Click here to see the detailed numbers. Pages 2 and 3 show the year-by-year comparative values. Pages 9 and 11 show details of the equity account calculations with pertinent numbers outlined in red showing the cash flow occurring from the equity account at Tom’s age 65.

In order to match the cash value of the IUL, the equity account requires growth of 11.30% plus the dividend of 2.00% for a total required yield of 13.30% — 90% greater than the IUL’s 7.00% interest assumption. IUL is indeed a remarkable financial instrument.

Conclusion

For those with the cash flow to buy whatever kind of life insurance they want, it is not financially rational to buy term insurance and invest the difference.

The $4,355,723 million long-range cash value in Tom’s policy does not have to stay buried in a life insurance policy. Through participating loans, it can also be a source of additional tax free retirement cash flow, or gifts to heirs, or gifts to charity.

Note: See Blog #52 for a discussion of participating vs. fixed policy loans.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials:

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer®, Financial Planner, Denver, CO

“InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Silver Power Producer®, Overland Park, KS

“InsMark provides incredible tools to give clients a visual of how they can optimize their wealth. It’s great for deciding which road to go down.”

Jim Heafner, MBA, CFP, Heafner Financial Solutions, Inc., Charlotte, NC

Important Note #1: The hypothetical life insurance illustration associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

![]()

More Recent Blogs:

Blog #122: Term Insurance for $1.00

Blog #121: We Don’t Need the RMDs

Blog #120: How We Open and Close 30 to 35 Premium Finance Cases Per Year

Blog #119: Which is the Best Policy for My Clients? (Part 3)

Blog #118: Which is the Best Policy for My Clients? (Part 2)

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive