(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System and Wealthy and Wise®.)

Charles and Amanda Fuller are ages 60 and 55. They are meeting with their adviser to discuss the required minimum distributions (RMDs) associated with Charles’ IRA (current valuation $1,000,000).

After reviewing their retirement plan, they believe the taxable RMDs are not needed and wish they didn’t have to take them. They would prefer leaving the IRA intact to their daughter, Erin.

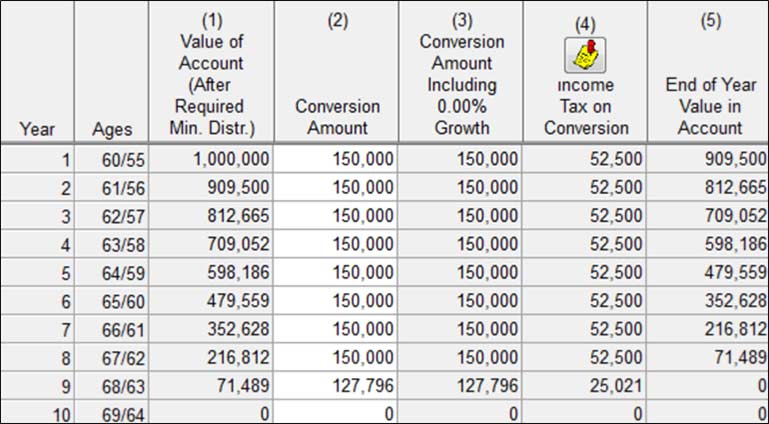

One solution to eliminating RMDs while still maintaining control of the retirement account is to convert the IRA to a Roth IRA. Below is a comparison of the tax consequences of a gradual conversion of the IRA over nine years to spread the income tax cost.

| Income Tax Cost of IRA to Roth IRA |

| 35.00% Tax Bracket |

| Image #1 |

Source of the Table: InsMark’s Wealthy and Wise®

(Roth IRA sub-tab on the Retirement Plan Assets tab)

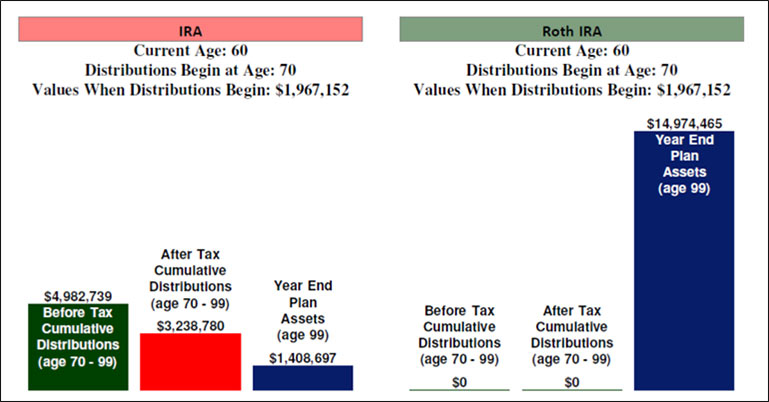

Below are the comparative results assuming growth of 7.00% for the IRA and Roth IRA. The Roth is projected to end up with 10.6 times more value for their daughter, Erin, than the IRA.

| IRA vs. Roth IRA |

| Image #2 |

Source of the Graphic:

InsMark Illustration System (InsCalc tab)

(Comparison of IRAs Calculator)

Click here to review the full comparison illustration. (Year-by-year values are on Page 3.)

“But what about the income tax on the conversion?” asks Charles.

“Let’s see if we can find an efficient way to pay that tax,” responds their adviser.

Case Study

Wealthy and Wise Retirement Planning

The key to the overall retirement evaluation that follows is a comparison of:

The current plan with the IRA versus an alternative plan with the Roth IRA converted over nine years (as shown in the Table above) with the income tax generated by the conversion paid via asset withdrawal rather than an out-of-pocket cost.

Critical to the valuation is this:

Will the use of other assets as a source for the income tax be replaced by the Roth IRA values?

Charles and Amanda plan to retire in five years at their ages of 65 and 60. Their annual, after tax, retirement cash flow goal is $120,000 indexed at 3.00% as an inflation offset.

Below are the details of their current net worth:

| $ 1,400,000 | Equity Assets @ 7.00% growth; 2.00% dividend |

| 1,000,000 | Retirement Plan Assets @ 7.00% |

| 700,000 | Taxable Assets @ 4.00% |

| 800,000 | Tax Exempt Assets @ 3.00% |

| 400,000 | Residence @ 5.00% growth |

| 250,000 | Personal Property @ -5.00% |

| $ 4,550,000 | Total Net Worth |

Click here for comments regarding yields and Monte Carlo simulations.

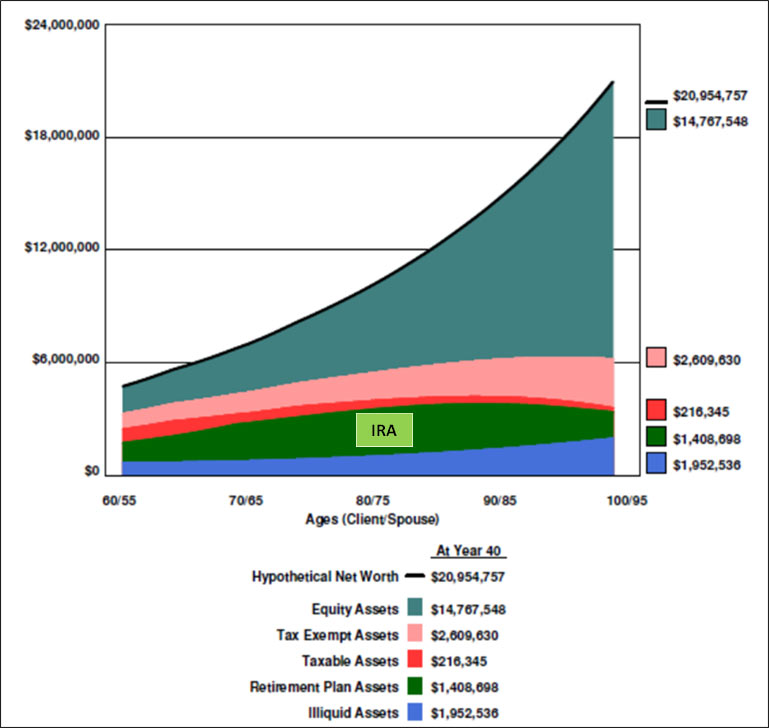

Below are two graphics of overall Net Worth, one from the Current Plan (Retain the IRA) analysis and one from the Roth Conversion analysis:

| Net Worth |

| Current Plan – Retain the IRA |

| Image #3 |

Source of the Graphic: Wealthy and Wise

(Scenario 1: Hypothetical Net Worth Graph)

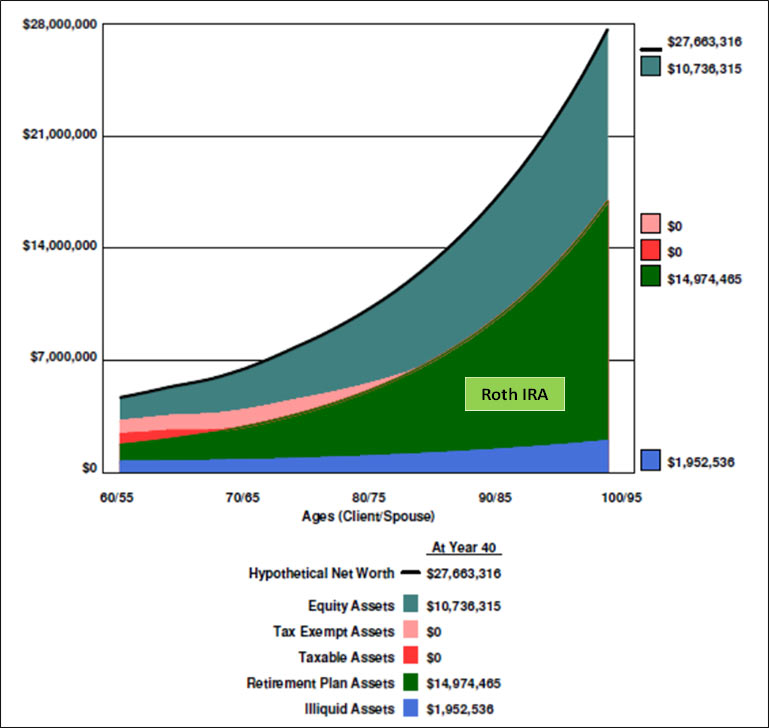

| Net Worth |

| Roth IRA Conversion |

| Image #4 |

Source of the Graphic: Wealthy and Wise

(Scenario 2: Hypothetical Net Worth Graph)

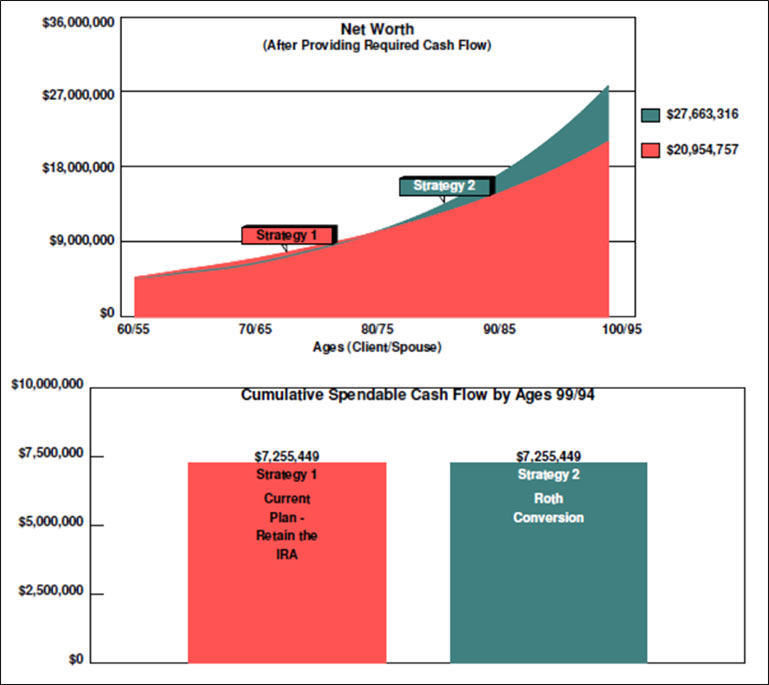

Below is a graphic comparing the net worth developed by each Strategy.

| Net Worth 1 |

| Current Plan – Retain the IRA vs. Roth IRA Conversion |

| Image #5 |

Source of the Graphic: Wealthy and Wise

(Comparison 1: Net Worth Graph)

1 The values for wealth to heirs are identical to net worth since neither Strategy produces any federal estate tax liability under current law. (3.00% indexing assumption was applied to the annual exemptions.)

The Roth produces $6.7 million more in long range net worth including accounting for the income tax cost of the conversion. Note that the cumulative retirement cash flow is identical with both alternatives. ($120,000 a year indexed at 3.00% from ages 65/60 to ages 100/95 years totals $7,255,449.)

Click here to review the full Wealthy and Wise presentation for this evaluation.

Click here for a discussion of the number of reports (50) in the presentation.

The advantages of the Roth conversion are numerous:

- No taxable required minimum distributions;

- Funds compound tax free;

- Funds can be taken out at any time — tax free;

- With proper planning, the income tax caused by the conversion can be paid from assets, and given the same investment assumptions as the IRA, the Roth should produce a significant increase over the IRA including a repayment of the assets used for the tax.

- The Roth can reduce the impact of the American Taxpayer Relief Act’s itemized deduction “phase-out” and net investment income “surtax”.

Two Important Resources

Click here for an analysis of the three steps required to duplicate the Roth conversion technique discussed in this Blog.

Click here for an eight-minute video on this vitally important subject called Good Logic vs. Bad Logic®.

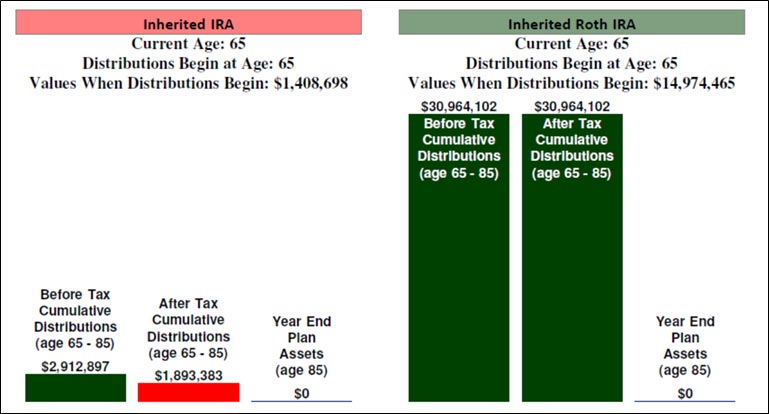

Comparison of Inherited IRA vs. Inherited Roth IRA

Valid as the Roth decision is for Charles and Amanda, a major advantage of a Roth goes to children who inherit it. An inherited IRA and an inherited Roth IRA are both subject to required minimum distributions; however, distributions from an inherited Roth are tax free producing significantly higher cash flow for heirs.

Due to the Roth’s absence of required minimum distributions for the parents, the inherited Roth IRA has a greater beginning account value than an inherited IRA. This, coupled with tax free distributions from the inherited Roth, produces an astonishing difference in wealth for heirs. From an inter-generational

perspective, a Roth for the parents transformed into an inherited Roth for children is a winner by a substantial margin for all participants.

Charles and Amanda Fuller’s daughter, Erin, is age 25. Assume she will inherit the Roth from her last surviving parent at her age 65. The comparison below is hard to believe, but using the same 7.00% yield assumptions for the IRA and the Roth, the values illustrated, while astonishing, are accurate.

| Inherited IRA vs. Inherited Roth IRA |

| (Erin Fuller at Age 65) |

| Image #6 |

Source of the Graphic:

InsMark Illustration System (InsCalc tab)

(Comparison of Inherited IRAs Calculator)

Click here to review the full comparison illustration. (Year-by-year values are on Page 3.)

The inherited Roth IRA produces 16.3 times as much after tax cash flow for Erin than the inherited IRA. And don’t overlook the fact that Charles and Amanda received the identical after tax retirement cash flow from either alternative during their retirement. (See Image 5.)

Can you think of a single reason to skip the conversion to a Roth? Only one — if a client does not have the liquid assets or other resource to absorb the income tax on the Roth conversion. For everyone else, go forth and prosper!

Note: Further down in this Blog, those licensed for the InsMark Illustration System can request the System Workbook file that includes the prompts used for Images #2 and #6. Click here for illustration tips.

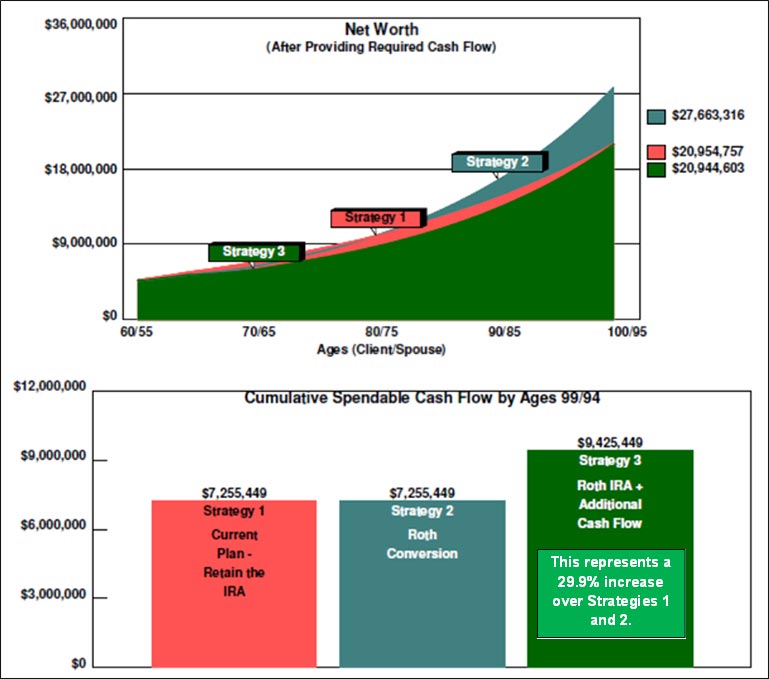

Additional Retirement Cash Flow

Imagine this comment from Charles, “There is so much additional net worth developed by the Roth conversion, would it be possible to use some of it to provide more retirement cash flow for us or maybe gifts to Erin now?”

One important feature of Wealthy and Wise allows you to determine how much additional cash flow can be obtained from liquid assets by reducing long-range net worth to, for example, the net worth of the current plan where the IRA is kept as is. Click here for illustration tips.

In the graphic below, Strategy 3 provides $62,000 a year of additional, level, after tax, retirement cash flow starting at retirement ages 65/60 for total cash flow of $9,425,449, an increase of $2,170,000 (29.9%) over Strategy 1. Note by doing so, the long-range net worth of Strategy 3 drops to within $10,000 of the original long-range net worth of Strategy 1.

| Net Worth 2 |

| Current Plan – Retain the IRA vs. Roth Conversion vs. Roth + Additional Cash Flow |

| Image #7 |

Source of the Graphic: Wealthy and Wise

(Comparison 2: Net Worth Graph)

2 The values for wealth to heirs are identical to net worth since none of the Strategies produces any federal estate tax liability under current law. (3.00% indexing assumption was applied to the annual exemptions.)

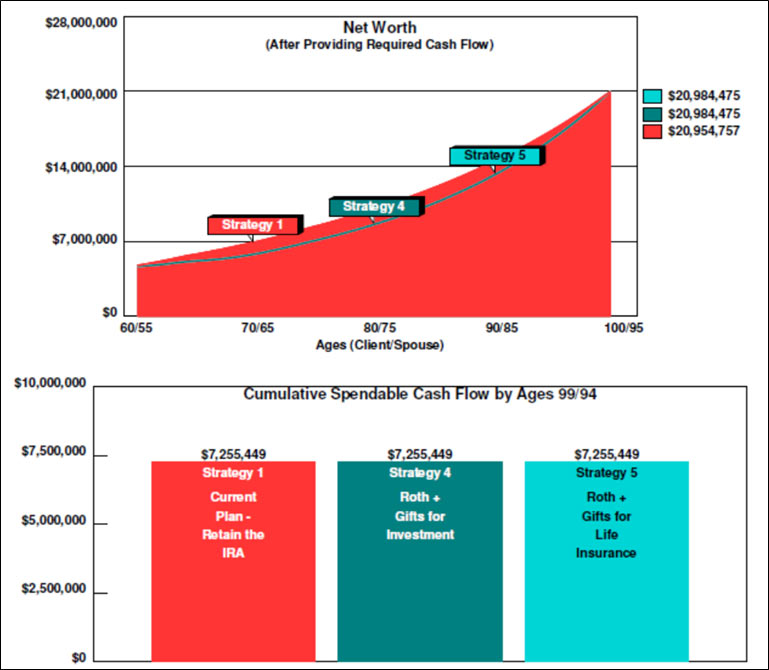

An alternative solution would be to fund a substantial gifting program for Erin of $48,000 a year of additional, level, after tax, cash flow starting now (five years before retirement at their current ages 60/55).

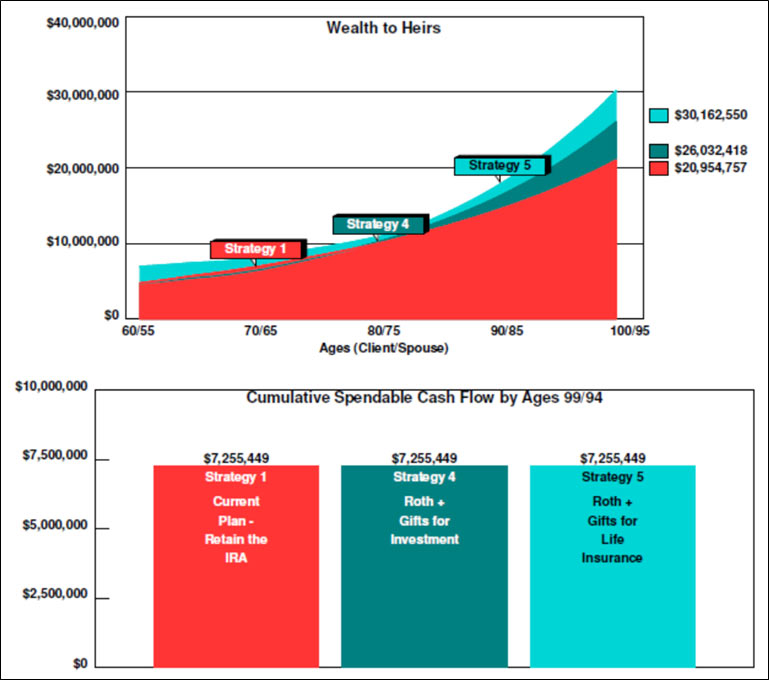

Below is a net worth and wealth to heirs comparison. Strategy 4 assumes the gifts fund an investment in a hypothetical equity account at 7.00%; Strategy 5 assumes the gifts fund $2.6 million of indexed survivor universal life at 7.00% owned by Erin insuring Charles and Amanda. (Either Strategy could be in trust if desired.)

| Net Worth |

| Current Plan – Retain the IRA vs. Roth + Gifts to Erin for Investments or Insurance |

| Image #8 |

| Wealth to Heirs 3 |

| IRA vs. Roth IRA vs. Roth IRA + Gifts for Investments or Insurance |

| Image #9 |

3 Included in the Wealth to Heirs for Erin is her inherited Roth of almost $15 million noted in Image #6. Note that the presence of the survivor life insurance has added an extra $4 million in long-range inheritance for Erin.

These results have all developed due to the presence of the Roth, the conversion of which was accomplished with no out-of-pocket cost for income tax. The Roth is truly an extraordinary financial instrument, and we believe that Wealthy and Wise is an extraordinary tool to demonstrate its effectiveness.

Note: Further down in this Blog, those licensed for Wealthy and Wise can request the System Workbook file associated with Blog #121 that was used for Images #7, #8, and #9.

Action Plan

There is no better time than near year-end to bring the power of a Roth IRA to all your IRA clients. Many (if not most) have resisted the conversion due to the income tax consequences. Powerful results come from using other assets for the funds to pay the tax, i.e., no out-pocket for the tax and typically a significant increase in net worth. Add in the extraordinary advantage for heirs and a Roth conversion becomes an irresistible financial move.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com, and we will provide you with recommendations.

Testimonials:

“As I’ve said to anyone who will listen, Wealthy and Wise is the best piece of software in the industry.”

Simon Singer, CFP®, CAP®, RFC®, International Forum Member, InsMark Platinum Power Producer®, Encino, CA

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner. The Wealthy and Wise software has helped me supplement my LEAP skills in the over age 60 client base. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it.”

Vincent M. D'Addona, CLU, ChFC, MSFS, AEP, InsMark Platinum Power Producer®, New York City, New York

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer®, Minneapolis, MN

“If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale. In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

Important Note: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

![]()

More Recent Blogs:

Blog #120: How We Open and Close 30 to 35 Premium Finance Cases Per Year

Blog #119: Which is the Best Policy for My Clients? (Part 3)

Blog #118: Which is the Best Policy for My Clients? (Part 2)

Blog #117: Which is the Best Policy for My Clients? (Part 1)

Blog #116: Advisor Marketing Break Through: How To Have Qualified Prospects Contact You

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

Bob,

Appreciate this information on the conversation of a IRA to Roth IRA… We currently have a client with similar assets in an IRA, (1.8 M). Both are age 73…. Is there an age that prohibits this strategy?

Best,

Tony

Tony –

There is no reason this won’t work at age 73. It takes a while for the Roth to absorb the tax cost of the conversion, so be sure you run the illustration long enough. Their joint LE is about 18 years. I’d run it for 20 or even to age 95. Possibly go to age 100 if they have a family history of longevity and are in good health.

Thanks for taking the time to comment.

Bob

President, InsMark