(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

In Blog #117, we examined how our new InsMark Compare™ module presents clients with a clear choice of the available policy types in order to help them determine which policy — and what interest or dividend assumption — best reflects their risk profile.

Now for the other half of that suitability map . . .

The InsMark Compare™ module in the InsMark Illustration System contains an optional FINRA-approved Questionnaire which helps clients self-identify their personal risk profile. The Questionnaire is provided in our system courtesy of Back Room Technician (BRT) by Advisys, Inc. You do not need to be licensed for BRT to use it; however, you should be certain that your compliance department approves its use. (If you aren’t licensed for Back Room Technician, you are missing a terrific piece of software.)

Click here to review the Questionnaire.

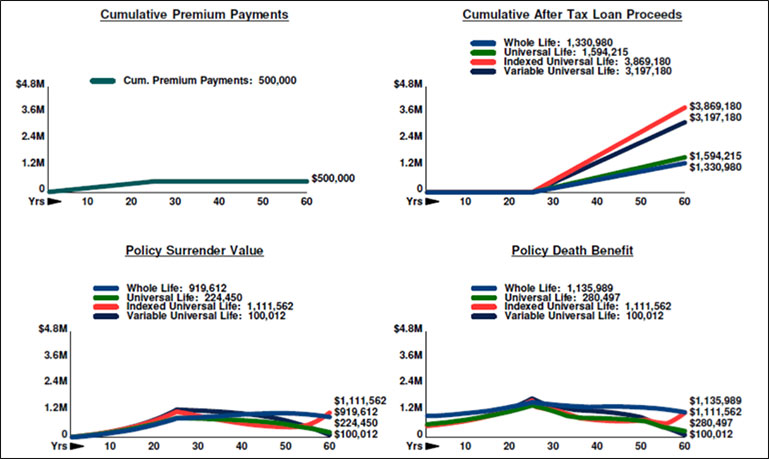

In Blog #117, we compared Whole Life, Universal Life, Indexed Universal Life, and Variable Universal Life. While many unsophisticated clients might decide that bigger numbers are better, this is not the way to determine suitability. Recall the graphic below from Blog #117.

So let’s review some results from Blog #117 — and think about this: How is a client supposed to self-identify the most appropriate policy other than guessing at its suitability? Bigger numbers are not necessarily better than smaller ones — they are just different.

Many of you have your own suitability procedures, and I am not suggesting you abandon them; rather, we are providing the BRT variation for you to consider as a coordinated part of InsMark Compare™.

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) or go to insmark.com. Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials:

“InsMark has increased my production by 10 fold. It clearly communicates to the client the best financial scenario to take.”

Gary Sipos, M.B.A., A.I.F.® InsMark Platinum Power Producer®, Sipos Insurance Services, Freehold, NJ

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

Important Note: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

![]()

More Recent Blogs:

Blog #117: Which is the Best Policy for My Clients? (Part 1)

Blog #116: Advisor Marketing Break Through: How To Have Qualified Prospects Contact You

Blog #115: Part 2 of Leveraged Deferred Compensation (Is Arthur Better Off With Term Insurance?)

Blog #114: Leveraged Deferred Compensation (Part 1)

Blog #113: Life Insurance Alternatives to a 401(k)

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

Hi Bob –

Your referral resource, Brian Manderscheid from LifePro, has been a gem to work with!

We use Insmark Compare with every one of our cases. As I’ve said over the years, your genius is your commitment to “Compared to What”.

Thanks! Glenn

InsMark Platinum Power Producer

McMurray, PA

Thanks, Glen.

Always good to hear from you, and thanks for the nice compliment.

We’re very proud of the InsMark Compare module, and I’m glad it is so useful to you.

See you at the InsMark Symposium in March.

Bob Ritter, InsMark President

Best regards,

Bob