(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

“Best policy for my clients” cannot be established by a standard that applies to all clients. Rather, it must be determined by an objective analysis that is unique to each client as to type of policy (see Case Study #1 below) as well as each client’s personal comfort with different levels of interest or dividend assumptions (see Case Study #2 below).

| Case Study #1 |

| (Robert and Abby Altman) |

The Altmans are considering cash value life insurance policy with a $973,000 face amount on Robert, age 41, to supplement their retirement cash flow. In order to establish suitability, their financial adviser has prepared an analysis of the four main product types: Whole Life, Universal Life, Indexed Universal Life, and Variable Universal Life. Each policy is funded with premiums of $20,000 a year through Robert’s age 65 with policy loans thereafter for retirement cash flow.

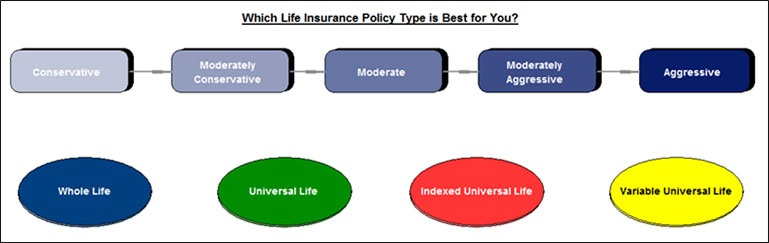

Based on Robert and Abby’s risk tolerance, the following image gives them an indication of the risk profile associated with each of these four main life insurance policy types. The risk profile graphic below is part of an optional report (named, as you might suspect, “Risk Profile”) that is available in a new module named InsMark Compare™ in the InsMark Illustration System.

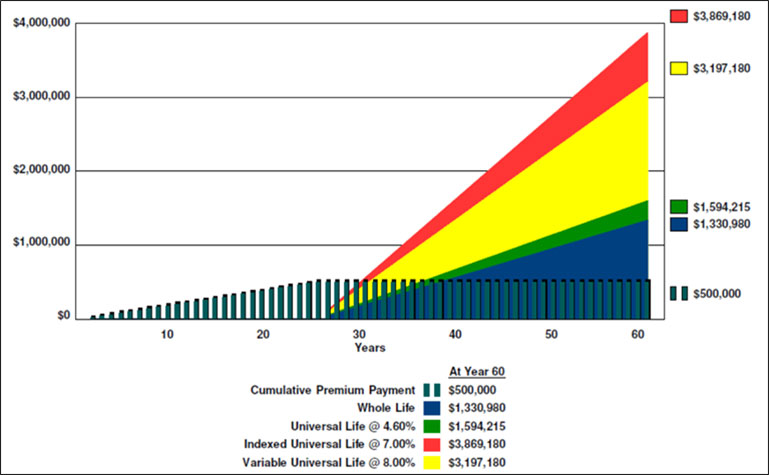

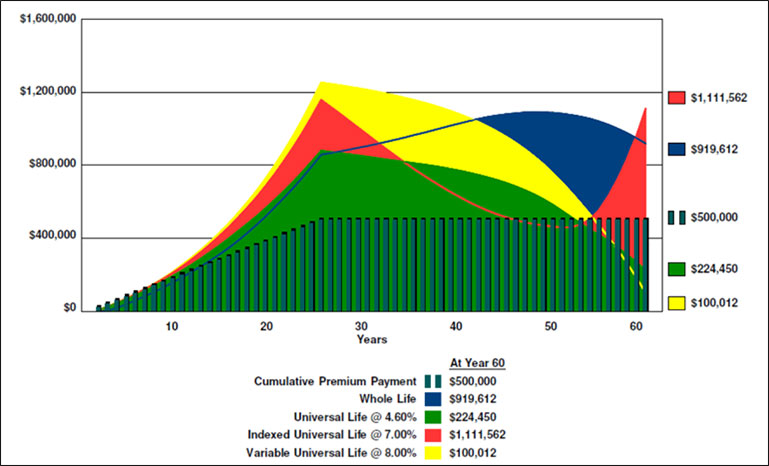

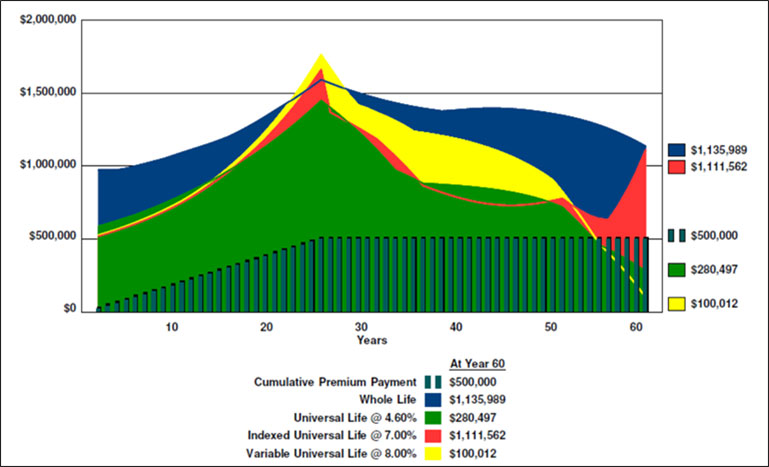

Below are three graphics from InsMark Compare™ that illustrate the differences between the four policy types when evaluating after tax loan proceeds for retirement cash flow, surrender values, and death benefits.

| Case Study #1 |

| Comparison of Cumulative After Tax Loan Proceeds |

| Case Study #1 |

| Comparison of Surrender Values |

| Case Study #1 |

| Comparison of Death Benefits |

Click here to review all the reports reflecting the four policy-types insuring Robert Altman. I defined the four different insurance companies as Carriers A, B, C, and D.

Included in the reports are the graphics shown above as well as year-by-year values and internal rates of return for each policy. Since suitability plays a significant role in your advice to clients, this analysis should be a welcome addition to your toolbox as it displays a very clear range of choices.

There is no assumed “winner” in this comparison as this depends on each client’s personal risk tolerance and benefit emphasis (retirement cash flow, cash value, and death benefit).

On the top section of Pages 3 to 8, you will see the following suitability definitions as they apply to each policy type selected for Case Study #1:

- Conservative (Whole Life);

- Moderately Conservative (Universal Life);

- Moderate (Indexed Universal Life);

- Aggressive (Variable Universal Life).

These suitability designations are my arbitrary choices and are not hardcoded in the illustrations. You can customize your own definitions for Pages 3 to 8.

Note: The product designations are hardcoded in the Risk Profile report. If you have a problem with this for a given case, don’t use the Risk Profile report.

Note: Located on the Personal Insurance tab in the InsMark Illustration System, this four-way comparison module also contains an optional FINRA-approved Risk Tolerance Questionnaire to help guide your clients’ decisions. This is provided in our system courtesy of Back Room Technician (BRT) by Advisys, Inc. You do not need to be licensed for BRT to use it; however, you should be certain that your compliance department approves its use. (If you aren’t licensed for FINRA-approved Back Room Technician, you are missing a terrific piece of software. Click here for more information.)

| Case Study #2 |

| (Jack and Ginny Hudson) |

Assume you have a client who decides that one of the product selections is the right fit. Another use of this new illustration module would be to prepare several variations of that policy type using different interest assumptions (or, in the case of whole life, different dividend assumptions). This provides a valuable Due Care analysis that will be helpful to your client not only as to product type, it also addresses their comfort level for yield assumptions.

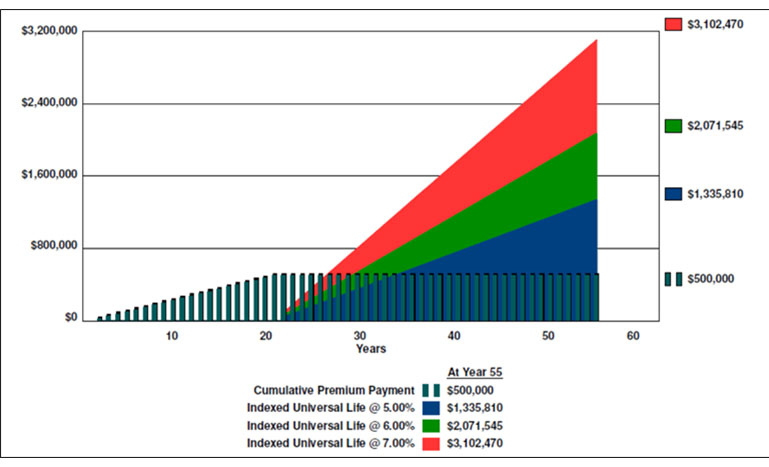

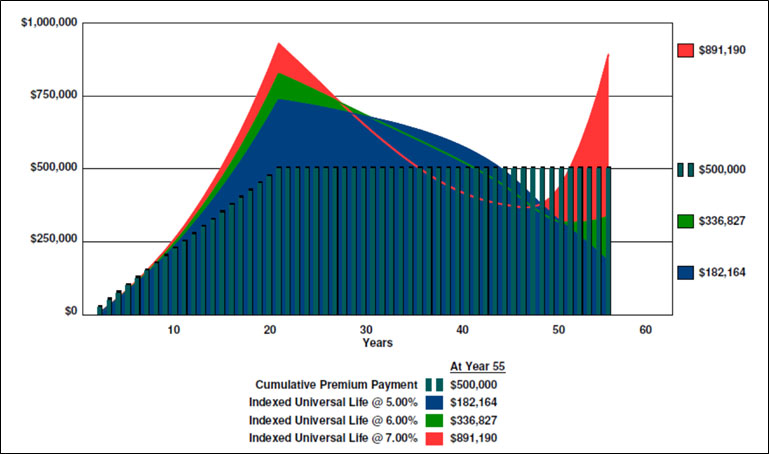

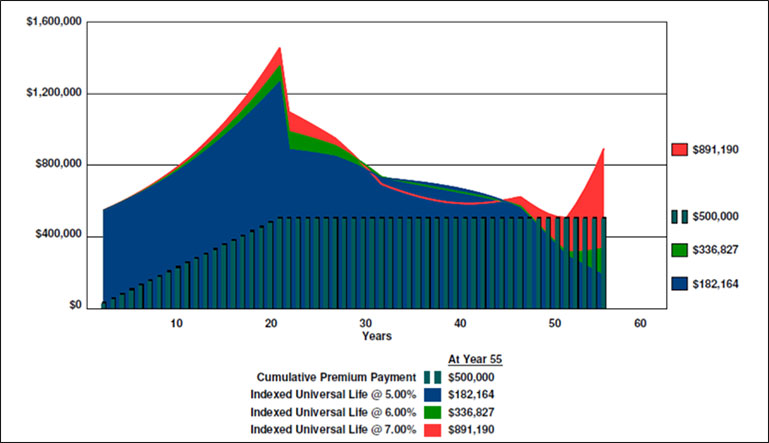

Jack and Ginny Hudson have settled on indexed universal life as their preferred policy. Jack is age 46, and he and Ginny are considering a $527,000 policy with $25,000 annual premiums through his age 65 with policy loans thereafter for retirement cash flow. There are three variations of this same policy at interest rates of 5.00%, 6.00%, and 7.00%.

Below are three graphics showing the differences in the variations when considering after tax loan proceeds for retirement, surrender values, and death benefits:

| Case Study #2 |

| Comparison of Cumulative After Tax Loan Proceeds |

| Case Study #2 |

| Comparison of Surrender Values |

| Case Study #2 |

| Comparison of Death Benefits |

Click here to review the details. I defined the insurance company as Carrier E.

As with Case Study #1, there is no “winner” among the three illustrations presented as that designation depends on each client’s personal risk tolerance and benefit preferences.

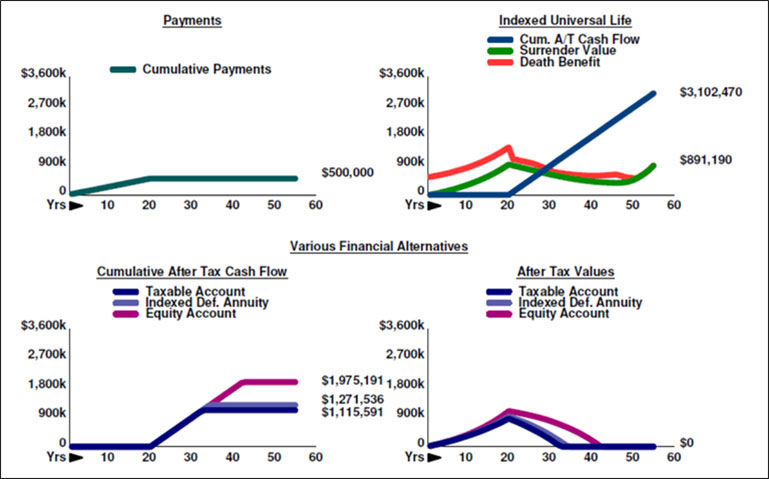

Various Financial Alternatives

Assume that Jack and Ginny select the 7.00% illustration as reasonable for them. Remember: this is their decision, not yours. You are there to guide not coerce. Having it be their selection also helps them reject competitors who surface with a quote bearing a higher interest rate that might otherwise impress them.

Suppose Jack were to remark, “I really like having the additional life insurance, but we are after the best retirement dollars, too. Could an equity account produce better results?”

It’s important to anticipate an observation like this and be prepared for it. You may even want to bring it up in the interview because one way to have your case short-circuited is to have it surface when you’re not present. There is one very powerful way you can address this in the InsMark Illustration System using the Various Financial Alternatives module located on the Personal Insurance tab.

The Various Financial Alternatives module allows you to compare the costs and benefits of any policy against three other hypothetical investments (four if no cash flow is present since some room is freed up). So I compared the 7.00% indexed universal life against the following alternatives:

- Hypothetical taxable account at 7.00%;

- Hypothetical indexed deferred annuity at 7.00%;

- Hypothetical equity account at 7.00% growth plus a dividend yield of 2.00%.¹

¹ The indexes available for indexed universal life generally don’t credit a dividend. The current S&P 500 dividend yield is about 2.00%. So to be fair, I added a 2.00% dividend to the equity account growth rate for a gross yield of 9.00%, 200 basis points greater than the IUL.

Below is a graphic of the results:

| Various Financial Alternatives |

Click here to review all the details of the comparison.

What is most interesting to me appears on Page 4 of the reports, i.e., the yield each alternative investment must earn in order to match the results of the 7.00% indexed universal life:

- 11.11% for the taxable account, 411 basis points greater than the life policy;

- 9.38% for the indexed deferred annuity, 238 basis points greater than the life policy;

- 8.24% growth for the equity account plus the 2.00% assumed dividend for a total yield of 10.24%, 324 basis points greater than the life policy.

It’s no contest — cash value life insurance policy is clearly superior. If you have the cash flow to buy what you want, permanent insurance is unmistakably the best choice.

Two other comparison modules in the InsMark Illustration System could also prove useful as alternatives to Various Financial Alternatives:

Other Investment vs. Your Policy: This module allows you to compare the selected policy’s costs and benefits against just one of several alternatives. While not as comprehensive as Various Financial Alternatives, it is a less busy illustration.

Permanent vs. Term: This module allows you to compare the selected policy costs and benefits against the same costs and benefits applied to term insurance and one of several alternatives. (This is often a good supplement to Various Financial Alternatives or Other Investment vs. Your Policy.)

Combining Different Illustrations

You can print combinations of life insurance illustrations in any InsMark System by using the icon below that appears on the lower right of the Main Workbook Window. Be sure you have all the illustrations for the combination you want in the same workbook. Select only the ones you want to include.

Click here to review a combination presentation coupling InsMark Compare™ from Case Study #2 with Various Financial Alternatives including a Cover Page, a menu-driven Table of Contents, and Section Pages. This presentation contains 30 pages including seven graphics.

Including Annual Reproposal Results

In Case Study #2, I used only three of the four available positions for the data for the 5.00%, 6.00%, and 7.00% illustrations leaving open the fourth data position so that year-by-year actual data based from annual reproposals can be entered.

Click here for a hypothetical example of how reproposal data might look in the far right illustration columns for Case Study #2 assuming a report date of ten years hence. With this feature, there will be far fewer surprised clients as we experienced in the vanishing premium disasters of the 1990s.

Conclusion

I don’t know how you can be better prepared for a suitability interview than with the techniques discussed in this Blog. The multiple product type evaluations in Case Studies #1 and #2 are not only appropriate analyses for all prospects, but coupled with a report like Various Financial Alternatives, they produce a devastatingly effective presentation.

|

Special thanks to Brian Manderscheid, Vice President of LifePro Financial in San Diego, for his assistance in preparing the InsMark Compare™ illustrations for this Blog. He is a very creative user of all InsMark software products. If you like InsMark Compare™, your first few multi-policy comparisons may be tedious as you are becoming familiar with this new module. Consider asking Brian for help. He is one of our Referral Resources and can be reached at (888) 543-3776 or IMCaseDesign@Lifepro.com. If you ask Brian and his staff for assistance, my only request is that, if it proves helpful in securing the case, you place that business through LifePro Financial — as is my request whenever you utilize one of our Referral Resources. |

|

Special thanks to Steve Savant, Syndicated Financial Columnist & Talk Show Host and contributing author to InsMark and Back Room Technician, for his help in the development of our new InsMark Compare™ illustration module. |

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Testimonials:

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer®, Financial Planner, Denver, CO

“InsMark provides incredible tools to give clients a visual of how they can optimize their wealth. It’s great for deciding which road to go down.”

Jim Heafner, MBA, CFP, Heafner Financial Solutions, Inc., Charlotte, NC

“InsMark’s Checkmate® Selling strategy is still one of the most compelling tools to bring a client to a definitive decision, based on their best case alternatives!!! Solid mathematical comparisons that prove the validity of our insurance solution!!!”

Frank Dunaway, III, CLU, Legacy Advisory Services, Carthage, MO

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Make certain you have the appropriate state and federal licenses if you include variable universal life in the product type comparison in an InsMark Compare™ illustration.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #4: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

![]()

More Recent Blogs:

Blog #116: Advisor Marketing Break Through: How To Have Qualified Prospects Contact You

Blog #115: Part 2 of Leveraged Deferred Compensation (Is Arthur Better Off With Term Insurance?)

Blog #114: Leveraged Deferred Compensation (Part 1)

Blog #113: Life Insurance Alternatives to a 401(k)

Blog #112: Retirement Planning Strategies Using Indexed Universal Life

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

Hi Bob –

Your referral resource, Brian Manderscheid from LifePro, has been a gem to work with!

We use Insmark Compare with every one of our cases. As I’ve said over the years, your genius is your commitment to “Compared to What”.

Thanks! Glenn

InsMark Platinum Power Producer

McMurray, PA

Thanks, Glen.

Always good to hear from you, and thanks for the nice compliment.

We’re very proud of the InsMark Compare module, and I’m glad it is so useful to you.

See you at the InsMark Symposium in March.

Bob Ritter, InsMark President

Best regards,

Bob

Do you folks have any software that will compare EIAs or EIAs to Var. Annuities?

Michael,

We currently do not compare annuities of any type with other annuities. We do compare life policies to annuities (indexed or otherwise) as well as retirement plans like IRAs, 401(k)s, Keoghs, etc.

What sort of comparison do you have in mind? We tend to do year-by-year numerical ledgers and graphics as you saw in the illustrations in Blog #117 (starting on Page 3 of the main illustration). Have you seen something done by others re annuities vs. annuities that you could send me so I can evaluate it?

Best regards (and thanks for commenting),

Bob