(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

-769x636.jpg)

Since May is Disability Insurance Awareness Month, this Blog is dedicated to some thoughts on disability income insurance linked with life insurance.

When I was active as a producer, I pretty much shied away from disability income insurance due to the terrible underwriting issues that always seemed to plague my applications. My friends in the business tell me that this has eased considerably in recent years, and many of them consider disability income coverage to be a significant part of their practice.

The coverage issues that affect all your clients are fourfold:

- Disability;

- Early death;

- Retirement;

- Long-term care.

All four can be addressed with a cash-rich life insurance policy with accelerated death benefits combined with a disability income policy. This combination can be used effectively for individuals and executive benefits.

Case Study of an Executive Benefit

Tom Hamilton is Chief Marketing Officer, a key rainmaker, and a non-owner executive of Acme Ford, LLC. The owners plan to sell the company in five years. The goal is to provide a benefit package for Tom that causes him to remain with the firm for at least the next seven years (including two years after the expected sale of the company in order to remain a resource for the new owners).

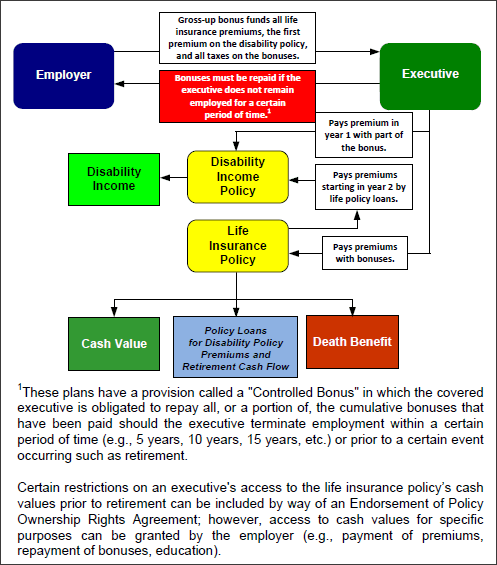

They plan to provide Tom with a Controlled Executive Bonus plan in which the max-funded life insurance policy coupled with a disability income policy helps solve all four issues: disability, early death, retirement, and long-term care, as follows:

- An employer-paid gross-up bonus is used to fund the premiums on the policy owned by Tom.

- To help with needed family income should disability occur during pre-retirement years, Tom makes loans on the policy which he uses to pay for a personal, long-range, disability income policy with a benefit of $12,750 a month and annual premiums of $7,200. (In this example, the policy loans don’t start until year 2, so an additional gross-up bonus is paid by the firm during the first year so Tom can net the needed $7,200.)

- The policy death benefit serves the family well in the event of Tom’s early death.

- The extensive after tax cash flow from policy loans adds an important source of retirement income.

- In the event that institutional or home care is needed during retirement, an advance of a portion of the policy death benefit provides needed dollars.

Here is a flow chart of the case:

| Controlled Executive Bonus Plan |

Click here for a copy of this Flow Chart for your personal use.

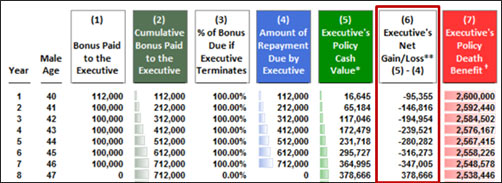

The question that Acme Ford has to answer is this: Will this plan glue Tom to the firm for 7 years? For the answer, check out the snapshot below of the first 8 years outlining Tom’s repayment obligations. There is a swing in Tom’s favor of $725,000 between his loss in year 7 and his gain in year 8. This, coupled with the potential losses in prior years and the immense gains in subsequent years, should produce some serious superglue.

Note: In the plan documentation, Tom’s obligation to repay the bonuses during the first seven years would typically be waived should he die or be terminated without cause.

Another interesting aspect of the Controlled Executive Bonus plan is that, in view of the repayment liability, Tom may refuse to participate. With the array of benefits provided by the plan, what would his refusal tell Acme Ford? My guess is that Tom would likely be considering another employment offer. What an unexpected management tool this could turn out to be!

Click here to review Tom’s Controlled Executive Bonus illustration using the Executive Security Plan module from the InsMark Illustration System.

The benefits to Tom are considerable:

- No personal out-of-pocket cost;

- A disability income policy with annualized tax free income of $150,000+;

- A seven-figure pre-retirement life insurance death benefit;

- A substantial post-retirement death benefit;

- Annual, tax free, retirement cash flow of $125,000;

- Residual cash value in the final year illustrated at $1.1 million.

Benefits to Acme Ford are the retention of a valuable key executive plus all plan funding is tax deductible.

Note: In the absence of a business to fund the plan, the logic of this presentation will work for an individual as well. In Part 2 next week, you’ll see how Tom can acquire this plan even if Acme Ford is unwilling to provide it.

Click here for a link to the disability income proposal used for the case study example above. Most of you know how strongly I feel about comparison selling. Pay particular attention to Page 3 to see the effective comparative strategy in the quote.

Note: The disability income proposal and the carrier’s basic illustration should accompany the Controlled Executive Bonus illustration.

Conclusion

Good as the overall benefits are, without the disability income policy, Tom’s plan is a chair with only three legs: death benefit, retirement cash flow, and long-term care.

Resources

I know many of you currently have a disability resource, but for those who want a vital new relationship, we strongly recommend Disability Insurance Services in San Diego, CA, an InsMark’s Referral Resource, for disability income and long-term care.

Quotes are available for:

- Individual Disability Income Insurance;

- Business Overhead Expense Insurance;

- Disability Buy/Sell Insurance;

- Critical Illness Insurance;

- Long Term Care Insurance;

- Bank Loan (ensuring repayment of loans);

- Lump Sum Key Person Insurance.

Click here for a link to the InsMark DI Quoting Service to request a proposal for any of the plans listed above.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing InsMark Systems

To license the InsMark Illustration System and/or Documents On A Disk, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com, and we will provide you with recommendations.

Testimonials:

“InsMark is the Picasso of the financial services world – their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Silver Power Producer®, Overland Park, KS

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer®, Financial Planner, Denver, CO

Important Note #1: The hypothetical life insurance illustration associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

![]()

More Recent Blogs:

Blog #100: Mysterious Fees for Mutual Funds

Blog #99: One More Time – The Value of “You” to Your Clients

Blog #98: The Value of “You” to Your Clients (Part 2 of 2)

Blog #97: The Value of “You” to Your Clients (Part 1 of 2)

Blog #96: Retirement Cash Flow Funded by Premium Financing

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive