Once every 18 months InsMark® hosts its Symposium. We need 18 months since much of what we present is new sales capacity, but we also review some of the best traditional capacity.

|

Most of your clients have retirement planning on their minds, and much of the Agenda is devoted to Retirement Planning with Life Insurance and Benefit Plans.

Below you will find seven brief summaries (from intermediate to advanced) of the many topics to be presented.

| #1 |

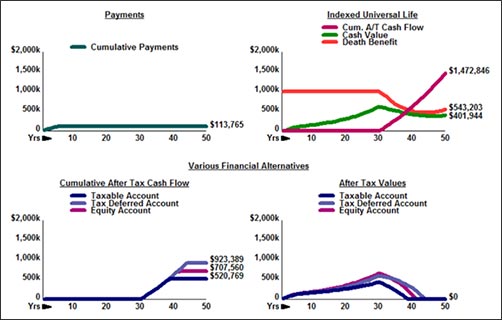

| A New Look at CheckMate® Selling |

| Comparisons to Alternate Investments |

| InsMark Illustration System |

| (Various Financial Alternatives) |

| #2 |

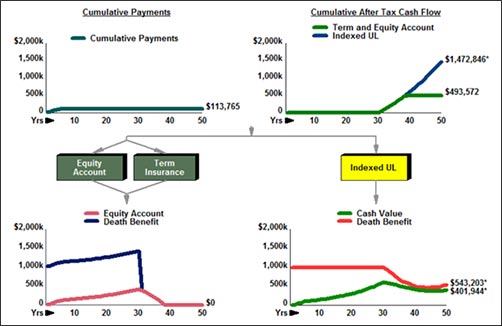

| Comparisons to “Buy Term and Invest the Difference” |

| InsMark Illustration System |

| (Permanent vs. Term) |

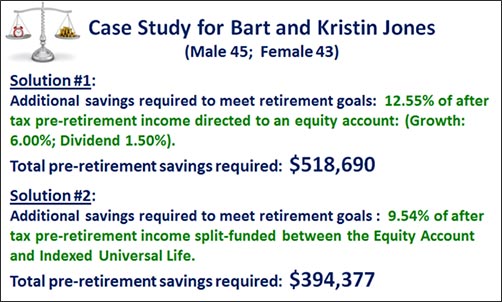

| #3 |

| Proof That Retirement Plans That Includes Life Insurance Are More Efficient Than Those That Don’t |

| (Funding Cost Reduced by 24%) |

| InsMark Illustration System |

| (Retirement Needs Analysis) |

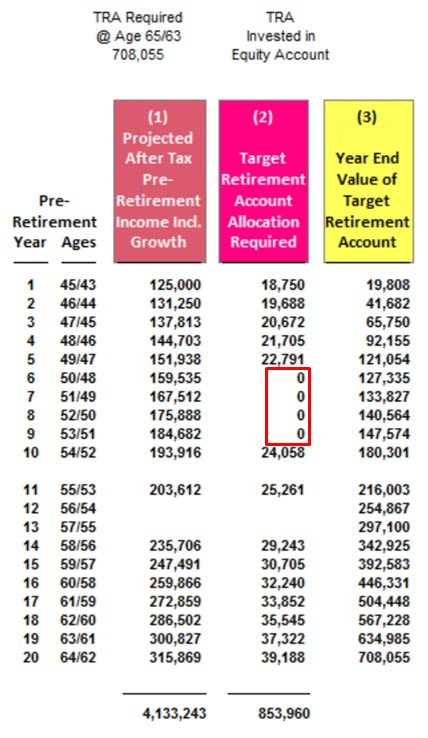

| #4 |

| Unique Solves for the Required Target Retirement Account (TRA) |

| (This is for Parents with a Daughter Going to College in Year 6) |

| 15.00% of expected pre-retirement after tax income in years 1 - 5; |

| 0.00% during the daughter’s four years of college; |

| 12.41% of expected pre-retirement after tax income thereafter. |

| InsMark Illustration System |

| (Retirement Needs Analysis) |

| #5 |

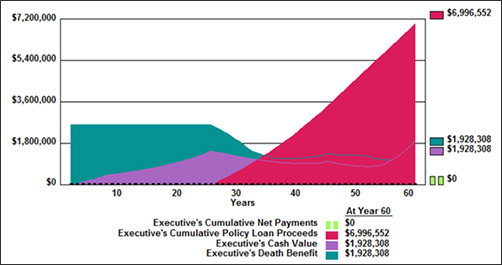

| An Executive Benefit Plan That Produces Tax Free Retirement Cash Flow Plus a Recovery of Employer Costs |

| Executive: Age 40 |

| This mirrors equity split dollar but with no imputed income. (The 2003 Split Dollar Regulations do not apply.) |

| InsMark Illustration System |

| (Retirement Needs Analysis) |

| #6 |

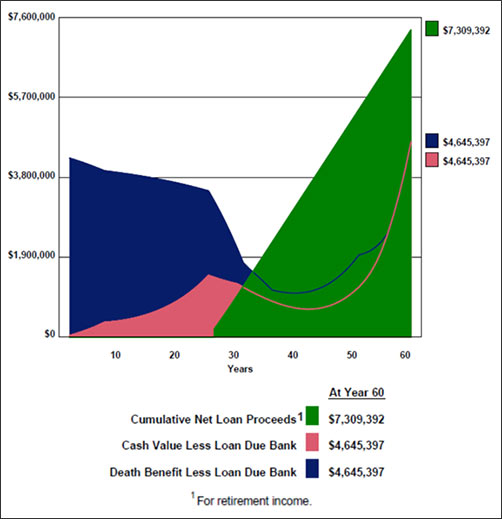

| A Premium Financing Strategy Coupled With An Executive Bonus Plan That Will Knock Your Socks Off |

| Executive: Age 40 |

| $0 out-of-pocket cost to executive. No collateral required by lender other than the policy. Loan interest accrued. Loan and accrued interest paid off at end of year 10. |

| InsMark Premium Financing System |

| (Income Tax Financing) |

| #7 |

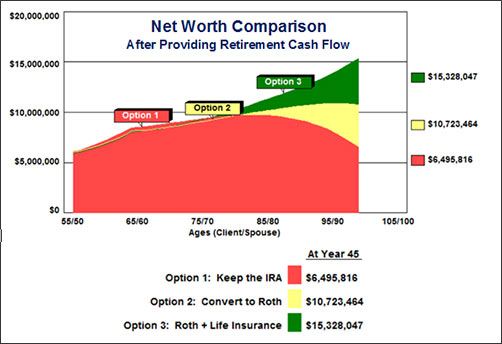

| Economics of a Roth IRA Conversion |

| Couple: Ages 55 and 50 |

| No out-of-pocket cost for income tax on the conversion. |

| Values further enhanced with life insurance. |

| No out-of-pocket cost for the life insurance. |

| Wealthy and Wise® |

| #8 |

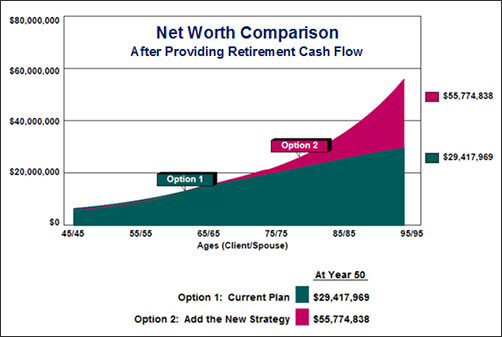

| An Irresistible Alternative for Large IRAs |

| This new strategy requires a very large life insurance policy. |

| (This concept will be introduced at the Symposium.) |

| Wealthy and Wise® |

InsMark Symposium

We hope to see you at the 2015 InsMark Symposium scheduled for March 27 - 28, 2015, in Las Vegas, Nevada. There are lots of great InsMark concepts and some terrific guest speakers as well. Attendees tell us it is consistently the best sales and marketing meeting they attend all year, including the MDRT, COT, TOT, and Forum 400. Contact Julie Nayeri at 888-InsMark (467-6275) or julien@insmark.com to register for the Symposium, or click here to view the Agenda and register online.

Licensing

To license any InsMark System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com with details of the case, and we will provide you with recommendations.

![]()

More Recent Blogs:

Blog #90: Video on Avoiding a $20 Million Mistake

Blog #89: Another Great Video -- IRA Rescue Made Easy

Blog #88: An Exceptional Video -- Equity Rescue Made Easy

Blog #87: No Income Tax on Social Security Retirement Benefits

Blog #86: The #1 Reason Advisors Are NOT Getting Paid What They’re Worth

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive