|

Editor’s Note: Bob will be discussing the elimination of income tax from Social Security retirement benefits at the 2015 Symposium on March 27 and 28 in Las Vegas. Included will be how such data can be calculated in the InsMark Illustration System and reflected in “do-it vs. don’t do-it” wealth planning scenarios using InsMark’s Wealthy and Wise® System. Click here for Symposium details. Or contact Julie Nayeri at 1-888-InsMark (467-6275) or julien@insmark.com. |

Yes, there is a way to avoid income tax on Social Security retirement benefits, and I can help you illustrate it. Some of your clients may have heard about it, but most will never have seen the immense difference it makes. In the Case Study that follows, there is a difference of more than $1 million in spendable, retirement cash flow.

Background

The Social Security Trust Fund is under a serious financial strain. In recent years, the government has tried to modify the effect of overpromising benefits by introducing taxation of retirement benefits from Social Security based on certain income of the taxpayer. A factor known as modified adjusted gross income (MAGI) is derived by tweaking a taxpayer’s adjusted gross income (AGI), and the level of MAGI is then used to determine the taxable portion of Social Security retirement benefits.

If your MAGI is under $25,000 for singles ($32,000 for couples filing jointly), your benefits aren’t taxable.

If your MAGI is between $25,000 and $34,000 for singles ($32,000 to $44,000 for couples), you will have to pay income tax on up to 50 percent of your benefit.

If your MAGI is over $34,000 for singles ($44,000 for couples), you will have to pay income tax on up to 85 percent of your benefit.

To avoid taxation, it’s critical to reduce MAGI at retirement. This is easier for low income people. It’s harder for those higher up the income scale because of the variety of income producing assets these folks have that generate income that affects MAGI at retirement including, but not limited to, these typical ones:

- Tax deductible retirement plans (e.g., IRA, 401(k), Keogh);

- Municipal bonds (yes, income is added to MAGI);

- Equity accounts (dividends and capital gains);

- CDs.

This means that conversion to Roth retirement plans becomes very important before required minimum distributions occur. Another strategy is converting other MAGI-affected assets to max-funded life insurance where the cash flow produced by policy loans is not taxed and does not count in calculating MAGI.

Click here for a good discussion of MAGI and how it is calculated.

Case Study

Imagine a couple, both age 49. Due to serious longevity in both sides of their families, they plan to wait until age 70 to claim their Social Security retirement benefits. They have made plans to reduce their MAGI to under $32,000.

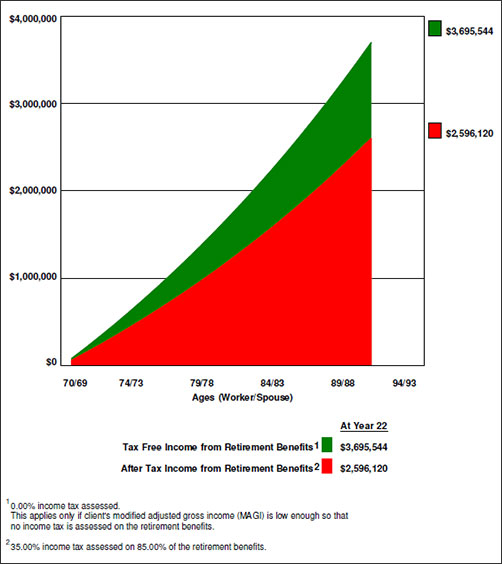

Below is the difference in cash flow between taxable and tax free benefits, the latter producing almost $1.2 million¹ more spendable retirement cash flow. (We ran the numbers through age 91, their joint life expectancy, and included a 3.00% inflation assumption.)

¹In an earlier version of this Blog, there was a tax bracket error that has since been corrected.

Click here to review the full report.

Conclusion

A tax free retirement benefit from Social Security is a powerful concept that few clients know much about. Anyone you share it with will probably want to see their comparative numbers coupled with your related advice about MAGI. In addition, they will likely want to know what other financial expertise you have that they don’t.

Note: Special thanks to Steve Dravin for encouraging me to provide this new calculation capacity.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com with details of the case, and we will provide you with recommendations.

Testimonials:

| “InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.” |

| Doug Peete, Past President, Top of the Table, InsMark Silver Power Producer®, Overland Park, KS |

| “InsMark is an absolutely mind blowing experience.” |

| Larry Gustafson, InsMark Platinum Power Producer®, Denver, CO |

| “InsMark is an integral part of my business and has been for many years. A great partner!” |

| Jeffrey Berg, InsMark Platinum Power Producer®, Edina, MN |

![]()

More Recent Blogs:

Blog #86: The #1 Reason Advisors Are NOT Getting Paid What They’re Worth

Blog #85: IRS Says Goodbye to a Tiny Bit of Its Red Tape

Blog #84: “Why Pay $22,753 for Something You Could Get for $700?”

Blog #83: Crystal Clear Alternatives

Blog #82: A Great Holiday Video

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive