|

Editor’s Note: Blog #84 examines powerful comparisons between Indexed Universal Life and “term and invest the difference” using both an equity account and a Keogh plan as the alternative investment. The results may surprise you. Your self-employed prospects/clients are often eligible for Keogh contributions well in excess of IRA limitations. As is generally the case, when you compare cash value life insurance to any tax deferred retirement plan like a Keogh or IRA or 401(k), the life policy is typically the winner by a large margin. Information in Blog #84 should be useful to you in your practice. |

Last week in Blog #83, I discussed a life insurance analysis for Laura Lake Johnson, age 35, a very successful landscape painter living in Carmel, CA. Coupled with the information in Blog #83, the discussion in this Blog continues a comprehensive look at what we call “CheckMate® Selling” -- our comparative technique used to emphasize the astonishing worth of cash value life insurance.

Laura is single with a four-year old daughter, Caroline. As a self-employed artist, retirement planning is solely Laura’s responsibility. In Blog #83, she was considering $1,000,000 of level death benefit coverage using Indexed Universal Life (IUL) that provides her with substantial after tax retirement cash flow. For a reason described following the Table below, the IUL illustrations in this blog have an increasing death benefit during pre-retirement years; level thereafter. The IUL is max-funded with five premiums of $22,753.

| Laura’s Proposed IUL Policy |

| Increasing Death Benefit for 30 Years; Level Thereafter |

| Illustrated at 7.50% |

| Five Annual Premiums ($22,753 each) |

$113,765 |

|---|---|

| Initial Death Benefit | $1,000,000 |

| Cumulative After Tax Policy Loans for Retirement Cash Flow from Age 65 - 95 |

$2,403,903 |

| Cash Value at Age 95 Pre-Tax Equivalent Rate of Return at Age 95 |

$394,530 11.85% |

| Death Benefit at Age 95 Pre-Tax Equivalent Rate of Return at Age 95 |

$449,912 11.88% |

| This Table assumes the non-guaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. |

Click here to review the IUL illustration.

Laura mailed the illustration to her CPA. A few days later, he asked her an interesting question: “Why pay $22,753 for something you could get for $700?” (He is referring to a $700 annual premium for $1,000,000 of 30-year, level term insurance.) He added. “Do you think you might be better off investing the difference in a good mutual fund?”

The CPA has surfaced “buy term and invest the difference”, and in response, I decided to use IUL with an increasing death benefit. When comparing cash value life insurance to level term insurance (30-year term in this case) and a side fund, it is generally better to use a cash value policy with an increasing death benefit; otherwise, the term and its side fund combination will have a serious death benefit advantage until the term expires.

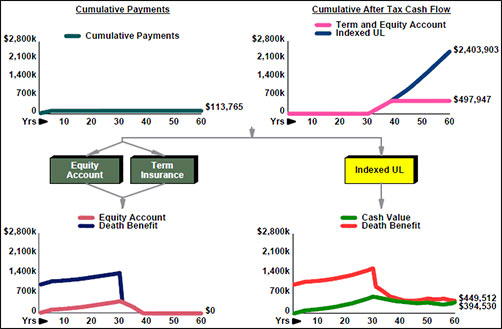

The following graphic summarizes the results of comparing the IUL to term insurance coupled with an equity account with growth of 7.50%. The identical after tax retirement cash flow from the IUL is illustrated from the equity account until it is collapses.

| Indexed Universal Life |

| vs. |

| Term Insurance and an Equity Account |

| This graphic assumes the non-guaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable; however, the ratio of the comparison should remain relatively stable given equal interest and growth assumptions. |

The equity account is consumed by Laura’s age 73 shortchanging her by over $1,900,000 in after tax retirement cash flow over the years illustrated compared to the IUL.

What has affected the growth of the equity account? The main factor is withdrawals that must be grossed up to account for the tax generated by taxable gains in order to match the results of the tax free loans from the IUL.

Click here to review the detailed comparison reports. As you can see from the Matching Interest Rate report on Page 5, it requires growth of 11.15% (a 48.6% increase over the 7.50% of the IUL) for the equity account to match the living results of the IUL over the years illustrated.

“This is an impressive analysis,” says the CPA upon reviewing the new numbers, “but as we have discussed in the past, Laura, you are eligible to participate in a Keogh plan at a very high level. Let’s have your adviser analyze the impact of contributing to a Keogh for five years coupled with the term insurance.”

Term/Keogh Plan Analysis

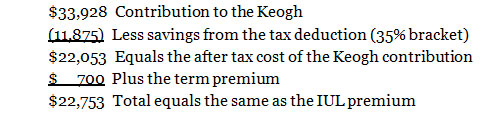

Since Laura will deduct the contribution to the Keogh but not the term premiums, the following calculation logic is assumed:

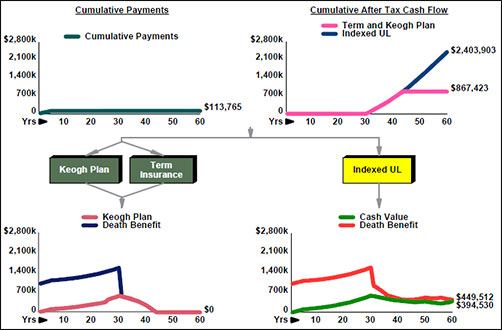

The following graphic summarizes the results of comparing the IUL to term insurance coupled with the Keogh earning a tax deferred yield of 7.50%.

| Indexed Universal Life |

| vs. |

| Term Insurance and a Keogh Plan |

| This graphic assumes the non-guaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable; however, the ratio of the comparison should remain relatively stable given equal interest and growth assumptions. |

The Keogh collapses at Laura’s age 77 shortchanging her by a little over $1,536,000 in after tax retirement cash flow compared to the IUL.

What has retarded the growth of the Keogh in Laura’s retirement years? All withdrawals from the Keogh are taxable which means they must be grossed-up to match the after tax loans from the IUL. It’s simply no contest!

Click here to review the detailed comparison reports. As you can see from the Matching Interest Rate report on Page 4, it requires growth of 9.07% (a 20.9% increase of over the 7.50% of the IUL) for the Keogh to match the living results of the IUL over the years illustrated.

Note: Small withdrawals are illustrated from the Keogh in years 6 through 30 to provide Laura with the $700 for the after tax cost of the term premiums (including a factor for the 10% penalty tax through her age 59). (See Page 5 in the Term and Keogh Plan Detail report.)

Advantages of IUL vs. Keogh/Term

The IUL has four additional advantages:

- If the market turns negative, there is no market risk to the policy owner;

- There is no 10% penalty tax associated for distributions prior to age 59½;

- There are no required minimum distributions during retirement;

- There is a substantial tax free life insurance death benefit available during retirement.

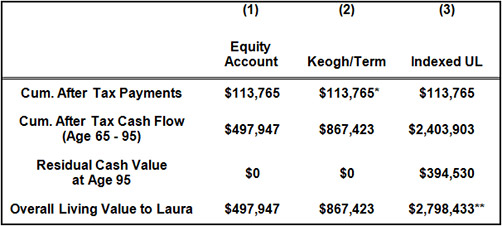

| Summary of the Alternatives |

| *After a 35% income tax deduction on the five Keogh contributions. |

| **462% greater than the equity account; 222% greater than the Keogh/Term. |

Conclusion

So -- is there ever a reason for spending $22,753 for something you can get for $700? You bet there is!

Other Policy Forms

This comparison works equally well using other forms of cash value life insurance such as whole life, universal life, and variable universal life provided corresponding adjustments are made to the yield/growth of the equity and Keogh accounts that reflect levels of risk assumption corresponding to the type of policy selected.

Other Tax Deferred Retirement Plans

This type of comparison also works well with other Tax Deferred Retirement Plans such as an IRA or 401(k) -- provided only dollars in excess of those contributed by the employer to a 401(k) are used for the life insurance.

Important Note: Laura’s retirement cash flow from the IUL consists of participating policy loans. Many of you are rightly concerned about the potential tax bomb associated with life insurance policies with loan activity that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or 925-543-0513.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com with details of the case, and we will provide you with recommendations.

Testimonials:

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“Thanks to InsMark, we recently set business goals in our firm that I basically thought were ridiculously unachievable - until now.”

Brian Langford, InsMark Platinum Power Producer®, Plano, TX

“Where else can anyone go to learn how to double your business in two years.”

Vincent Mezzetti, CLU, InsMark Platinum Power Producer®, Florida, NY

“InsMark is an integral part of my business and has been for many years. A great partner!”

Jeffrey Berg, InsMark Platinum Power Producer®, Edina, MN

![]()

More Recent Blogs:

Blog #83: Crystal Clear Alternatives

Blog #82: A Great Holiday Video

Blog #81: Economics of a Roth IRA Conversion

Blog #80: Converting Low Yielding Assets into a Charitable Gift Annuity

Blog #79: Insurance Sales to Clients with IRAs

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

Bob,

Can you do the calculations on a 50 year old preferred non-smoker male in Florida similar to what you illustrated in Blog #84: “Why Pay $22,753 for Something You Could Get for $700?”?

Thank you.

Roger

Hi Roger,

We don’t do specific proposals, but we do have high-end, independent Referral Resources who will. If you contact them, we would ask you to commit placing the business through them if a proposal is instrumental in making the sale.

Our Referral Resources are listed below. Be sure to mention you are looking for an illustration similar to the one featured in Bob Ritter’s Blog #84 "Why Pay $22,753 for Something You Could Get for $700?".

Thanks for commenting.

Bob Ritter

InsMark President

InsMark’s Referral Resources

If you would like assistance with any InsMark illustration, contact any of the Referral Resources listed below. All are InsMark Agency Platinum Power Producers®, and they are highly skilled at running InsMark software and can help you using your choice of insurance company. Mention my name when you talk to one of our Referral Resources as they have promised to take special care of my readers.