(Click here for Blog Archive)

(Click here for Blog Index)

This Blog addresses a typically difficult situation. James and Allison McNamara are both age 55 with a current net worth of $4.75 million. They are at the peak of their earning (and saving years) and intend to retire at age 65. They are reviewing an Indexed Universal Life (IUL) presentation involving a Private Retirement Plan (PRP). Unfortunately, the policy will not be sufficiently seasoned in just 10 years to start policy withdrawals or loans. Rather, such cash flow works best after 15-20 years.

This presents a dilemma that involves the difficult task of demonstrating to clients the value of a retirement strategy that produces no retirement cash flow until, say, 10 years after retirement begins.

To address this issue, I don’t think you can rely on the usual presentation format and try to talk your way through the issue; however, our Wealthy and Wise® System can handle it easily since the System merely finds the needed retirement cash flow from other assets. The results of this analysis should open up a whole new market segment for PRP presentations, i.e., those near (or even at) retirement with large sums available for retirement savings but who would normally pass on a plan that doesn’t begin to produce income until well past retirement.

| Below is a summary of James and Allison’s current net worth: | |

|---|---|

| $ 2,000,000 | Equity Assets @ 6.50% growth; 1.00% dividend |

| 500,000 | Taxable Assets @ 5.00% |

| 500,000 | Tax Exempt Assets @ 4.00% |

| 500,000 | Retirement Plan¹ Assets @ 7.50% |

| 850,000 | Residence² @ 6.00% growth |

| (300,000) | Mortgage @ 4.50% |

| 300,000 | Rare Coin Collection @ 7.50% |

| 400,000 | Personal Property @ -5.00% |

| $ 4,750,000 | Total Net Worth |

| ¹ Continuing annual pre-retirement contributions are assumed to be $17,500 a year increasing by 3.00%. |

| ² There are plans to downsize their home when they retire, and the McNamaras have provided estimates for the sale and purchase prices which are included in the analysis. |

Click here for comments on yields and Monte Carlo simulations.

Case Study

James and Allison are in a 40% combined federal and state income tax bracket. They would like to have at least $200,000 a year in after tax cash flow at retirement, and they want to include 3.00% indexing as an inflation offset. They do not want their net worth to diminish after they retire.

Strategy 1 will reflect the McNamara’s current situation. Strategy 2 will be identical to Strategy 1 with the exception that it will include $1.8 million of Indexed Universal Life (IUL). It has scheduled premiums of $100,000 a year for five years with policy loans beginning in year 21, ten years after they retire. Allison is the insured in this example.

Click here to review the InsMark illustration for their IUL. The illustration includes participating policy loans (cash values securing these loans continue to participate in whatever interest is credited to the policy). This feature can produce significantly better results than fixed loans. For a demonstration of this, see my Blog #52: Participating Loans vs. Fixed Loans.

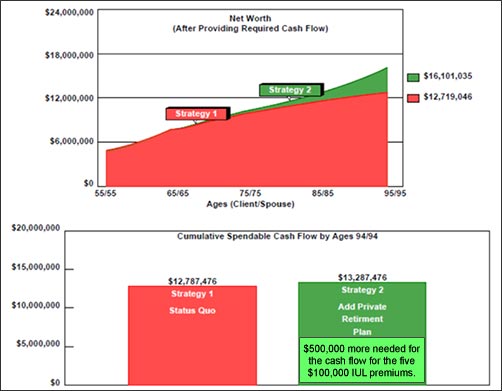

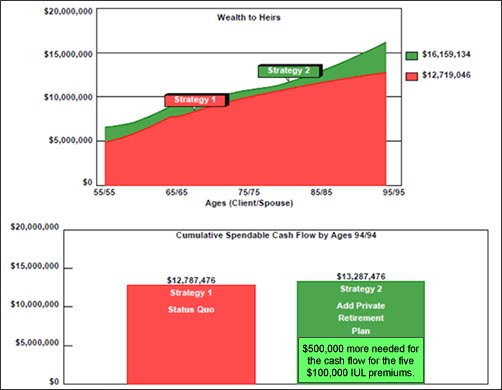

The key to the power of this analysis lies in your understanding that Strategy 2 does not require James and Allison to “spend” $100,000 of their current income for the next five years to fund policy. Instead, Wealthy and Wise found the cash flow for the premium from current assets, i.e., asset reallocation. The results may surprise you because not only does their asset base provide the premiums for the life insurance, it will cost James and Allison almost $3.4 million in illustrated long-range net worth and wealth to heirs if they don’t acquire this policy! You can see this effect in the graphics below.

Their long-range net worth is increased by 26.6%, and as you can see below, wealth to heirs is similarly enhanced.

Imagine this conversation:

James: “That looks great, but instead of growing net worth to over $16 million, what if withdrew more cash flow”

Allison: “We’d really like to have a cash flow cushion so we can help the children and grandchildren with some of their needs, like advanced education, down payments on a house, things like that.”

James: “And some special travel for us after retirement, too. We have ten children and grandchildren — how about $10 million way out at the end. How much more cash flow could we expect if we dropped the $16 million back to $10 million — leaving maybe $1 million for each of them?”

The precise answer is $84,439 of additional after tax cash flow illustrated each and every year from age 65, when they retire, through age 95. (I was able to tell the McNamaras this number accurately in about 30 seconds. Access to a report on how you can do this using the new Cash Flow Availability Calculator in our Wealthy and Wise software is available below.)

James: “Wow! What I like about this approach is that we would have plenty of cushion in the $10 million in case of financial ups and downs as will likely occur.

Allison: “Almost $85,000 a year in addition to the indexed $200,000? Can you show us how this works?”

Click here for the summary report of the illustrated after tax cash flow established for Strategy 3.

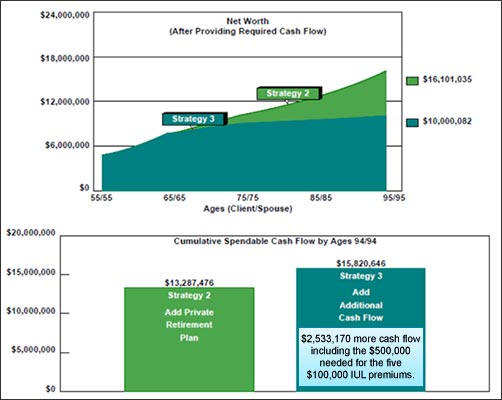

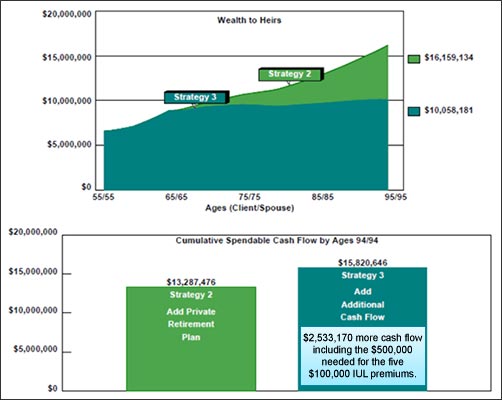

Below are the revised graphics of net worth, wealth to heirs and cumulative cash flow for the McNamaras including this new assumption. In their case, Strategy 3, while providing additional after tax cash flow totaling $2,533,170, ends up with net worth and wealth to heirs at the designated $10 million.

Cash Flow Availability Calculator

Click here for a report describing the new Cash Flow Availability Calculator that will be of help to all Wealthy and Wise licensees who want to use the logic demonstrated in Strategy 3. A short section is included in the report regarding entering life insurance data in Wealthy and Wise.

Wealthy and Wise Reports

Click here to review all the Wealthy and Wise reports associated with Strategies 1, 2, and 3. This is divided into two sections: The Comparison section (9 pages) and the Appendix with all the backup reports (74 additional pages). That is a huge number of reports, I know; however, I have been asking Wealthy and Wise licensees for years which reports they include in order to trim down the number for specific presentations. I have never gotten the same selections twice, so I leave it to you to decide. In this case, I included every applicable one. (The Comparison section is key, but you will need many of the back-up reports.) I recommend that you have all the reports for a specific client in your possession particularly if you are visiting with a client’s attorney or CPA. Wealthy and Wise backs up every number shown, and you will likely need access to some of the reports for the multiple times you get asked this question by a client, attorney, or CPA: “How was this number calculated?” Incidentally, those professional advisers are typically very impressed with the scope of a Wealthy and Wise report.

Conclusion

As you can see, the strategy of including investment-grade life insurance in the retirement plans of virtually every age group can produce very impressive results — even for those close to, or in, retirement. (There was a similar analysis in Blog #58 for a couple in their 40s.)

Important Note: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing

To license Wealthy and Wise, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275), or you can click here to order it at the InsMark website. Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or 925-543-0513.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com, and we will provide you with recommendations.

Testimonials

"If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale. In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

"As I’ve said to anyone that will listen, Wealthy and Wise is the best piece of software in the industry.”

Simon Singer, International Forum Member, InsMark Power Producer® Encino, CA

"I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner, and the Wealthy and Wise software has helped me supplement my LEAP skills and increase my commissions. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it."

Vincent M. D’Addona, CLU, ChFC, MSFS, AEP, InsMark Power Producer®, New York, NY

![]()

More Recent Blogs:

Blog #70: What Exactly is CheckMate® Logic?

Blog #69: Seven Variations of a Great Executive Benefit

(including my favorite)

Blog #68: A Pretend 401(k) Plan vs.

Indexed Universal Life

Blog #67: Filling the Pothole in Wealth Planning

Blog #66: Buy Now vs. Buy Later Video

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive