Joe Tanner, age 35, is making an annual contribution of $17,500 to his company’s 401(k) plan, and his employer matches the first $2,500. Can you make a case for diverting the after tax cost of the $15,000 beyond the employer’s match into a personal retirement plan?

|

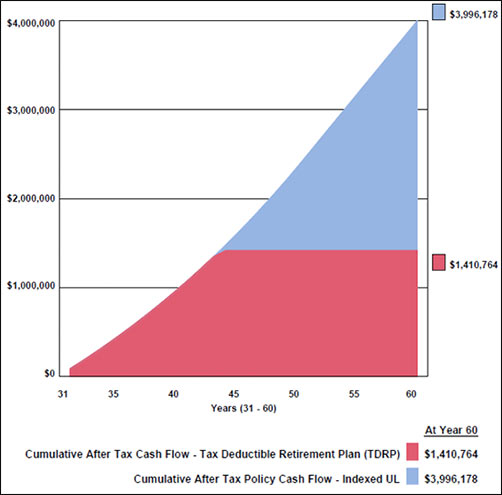

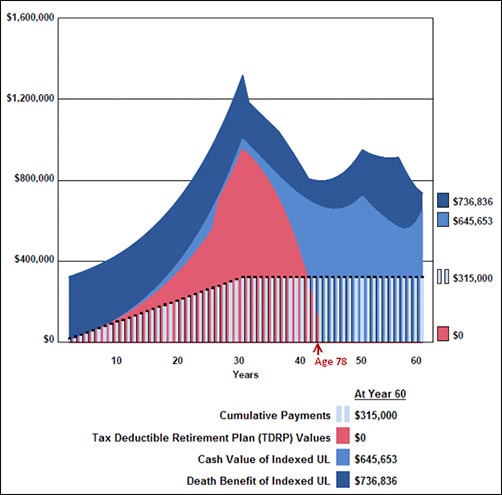

Check out the two graphics below:

Click here to view the full illustration.

The IUL has the same $10,500 premium as the after tax deposit to the 401(k) in excess of the employer’s match. Beyond that, the differences are significant:

- Unlike the 401(k), the IUL provides a significant death benefit for Joe’s family.

- Unlike the 401(k), a waiver of premium can be attached to the IUL in the event of disability.

- Unlike the 401(k), tax free cash flow (loans) from the IUL can be accessed prior to age 59 1/2 with no 10% premature distribution tax.

- Unlike the 401(k), the IUL is illustrated to maintain its values through age 95. At the end of the analysis, the IUL illustrates 283% more after tax cash flow plus remaining cash value in excess of $645,000 wrapped up in over $736,000 of death benefit.

The 401(k) doesn’t stand a chance of competing once you evaluate two issues:

- 30% of the money in Joe’s 401(k) belongs to the IRS;

- IUL with participating loans is a very powerful financial instrument.

Conclusion:

Every client with a 401(k) contribution in excess of the company match should consider the IUL alternative.

Further, it does not just apply to a 401(k). Anyone with an IRA, a Keogh, or a 403(b) plan is a candidate for the life insurance alternative. In addition, any employer with a classic profit sharing plan should consider personally-owned IUL as an alternative.

Important Note: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Licensing

To license Wealthy and Wise and/or the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com, and we will provide you with recommendations. This might not be a bad idea for your first couple of cases like the Callahans’.

Testimonials:

"InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me."

Doug Peete (Past President, Top of the Table), InsMark Power Producer®, Overland Park, KS

"As a top national brokerage firm representing many insurance companies, the InsMark Illustration System has everything we need in an advanced marketing presentation system."

Gary M. Baker, President/CEO, Bloom-Baker/Asensus of New England, Boston, MA

"I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark."

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Power Producer®, Financial Planner, Denver, CO

![]()

More Recent Blogs:

Blog #60: Coupling College Funding With Retirement Planning

Blog #59: The InsMark Business Valuator

– A Powerful Tool For Financial Advisers

Blog #58: A New Retirement Planning Strategy

Blog #57: Messages from Washington Are Often Unpleasant

Blog #56: An Easy Charitable Legacy

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive

Hi Bob,

I have unrelated question. Is it possible to demonstrate in Wealthy and Wise, the same type of report available in the illustration system – investments vs a policy?

I am particularly interested in the feature that shows the output of the larger tax deductible deposit amount going into the tax deductible retirement plan vs the after tax amount going into the policy.

What I really like is the comparison feature in Wealthy and Wise, which I am not aware is in the illustration system.

Thank you,

Don

Hi Don,

Wealthy and Wise is not designed for the product-by-product comparison you are looking for. However, a variation of it is available in the InsMark Illustration System (IIS). Click here to review the IIS illustration associated with Blog #61: Sacrificing Cash Flow with a 401(k) Plan. The comparison I think you want is the Multiple Mini-Graph on the lower half of the Preface. While not precisely the same format as Wealthy and Wise, it conveys the same information. There is a full page of that graphic available in the IIS module (Other Investments vs. Your Policy); however, I did not include it in Blog #61 since it was included as part of the Preface. Click here to view that full-page Multiple Mini-Graph.

Thanks for commenting, Don.

Bob Ritter

InsMark President

Bob could you please check illustration the illustration show beginning age of client as 0 not 35. Also is there a way to go back and rerun ALL IUL examples especially the Premium Finance ones showing a MAX of 7.5%? I know it makes it tougher when using lower Tax rates on distributions or when under PF charging higher loan rates but I sincerely believe it’s better to under Promise and OVER PERFORM. We can always use a 2nd illustration with higher % crediting on what the historical has done but in your EXAMPLES my 2 cents is to keep ALL illustrations at MAX of 7.5% and replace all the 8 and 8.5%. Your software is WAY to Effective and Professional, no need to Give Advisors things they may use as a sample with Higher Crediting than Necessary. Keep up the EXCELLENT and Creative Work! Thanks Bob. Best regards, Tim

Tim,

Re your request to correct the beginning age to 35 in the illustration associated with Blog #61, that was fixed weeks ago in both the Blog and the InsMark Illustration System. You must not have done Live Update on your InsMark Illustration System. To get, the update, go to your InsMark Illustration System, click on Help on the Main Workbook Window toolbar, select Live Update (3rd from the bottom), check InsMark Illustration System, and Click Update.

Regarding your interest rate comments, I agree with you, and I have been using 7.50% more recently. I am reluctant to assign staff to re-do hundreds of prior illustrations in our System and our website due to the heavy commitment we have to coding new versions of our software. That said, I will make sure we change them as you request over time as we develop modifications to areas where they reside.

Thanks for commenting.

Bob Ritter

InsMark President

Mr Ritter, I’m not sure if you get this type of “reply” but I’ll start by trying it! First, thanks for the great work you do, I’m affiliated with National Life and read your Blogs religiously. I am a fan of the NQDC Plans and using the IUL platform as the funding vehicle, often times in concert with GUL to crank up the DB. Your Blog #61 is a Masterpiece IMHO!! I have three observations — 1. in the age column on the illustration page, it starts with age 0 (should it be age 35? 2. If the employer “matches” $2500, wouldn’t I need to put my $2500 in as well reducing the total gross before tax available for NQ to $12.500 (not $15,000) or $$8750 after tax? 3. Also the cash flow payments show $315,000 for each strategy on one of the charts. Either way the comparison still works based on the equivalent after tax adjustments. I’m probably missing something here.

Thanks in advance,

Brud

Hi Brud,

Thanks so much for bringing the illustration Age bug to our attention. It has been fixed in the Blog.

The way I did the illustration in Blog #61 was correct:

Stay Fully Funded

in the 401(k)

Employee’s

Cost of

Funding

Partially Fund the 401(k) and Purchase Indexed Universal Life

Partial Funding

of the 401(k)

Employee’s After Tax Cost of Partial Funding

of the 401(k)

Employee’s

Premium for Indexed

Universal Life

Employee’s

Cost of

Funding

Re your point #3, I am unsure as to what you mean. Both Columns 2 (After Tax Cost of the TDRP) and Column (Policy Premium) should total the same number on Pages 2 and 3 of the illustration.

Bob Ritter

InsMark President

= = = = = = = = = = = = = = = = = = = = = = = = = =

Bob, that’s why you are the “Guru”. You did get it right, Employer matches can cause the total contribution to exceed the $17,500. That’s why a 100% match can be good for a small closely held company with highly compensated stakeholders. However, with the negative leverage of a Qualified Plan, why would you even utilize the “match” if in fact it is your Company money that is making the match? Thanks, Brud

This is one of your best presentations!!

Thanks for the nice comment, Jim.

Bob Ritter,

InsMark President