In Blog #63, I examined in detail three of the InsCalc Calculators from the InsMark Illustration System, one of which involved a Single Premium Immediate Annuity (“SPIA”). As you will see below, our Wealthy and Wise® System also does an excellent job reflecting the impact of a SPIA as an alternative investment and its effect on overall net worth and wealth to heirs.

Case Study

Aaron and Connie Bigelow, ages 75 and 70, have been holding much of their investment portfolio in cash waiting for interest yields to increase. “Time’s up,” says Connie, “let’s look for another alternative.” They may want to consider a single premium immediate annuity.

The Bigelows’ current net worth consists of the following:

| Taxable Account | 1,000,000 | 1.00% |

| Tax Exempt Account | 500,000 | 3.00% |

| Equity Account | 500,000 | 6.00% |

| Aaron’s IRA | 350,000 | 6.00% |

| Personal Residence | 500,000 | 5.00% |

| Personal Property | 150,000 | – 3.00% |

| Total Assets | 3,000,000 | |

| Liabilities | 0 | |

| Net Worth | 3,000,000 |

Aaron and Connie’s after tax cash flow requirements are $100,000 a year — with a 3.00% annual increase for inflation, and all calculations that follow include that level of cash flow.

In order to increase cash flow and ensure more stability of income, Aaron and Connie are considering the purchase of a $600,000 single premium immediate annuity (“SPIA”) using funds from their taxable account.

Payments from the SPIA are guaranteed by the issuing life insurance company for as long as either of them remains alive (with at least 10 years of payments guaranteed).

I use the following website for quotes for the SPIA: www.immediateannuities.com, and it determined that the monthly income for the Bigelows would be $3,333 from a competitive carrier (annualized as $39,996 in the illustration). In their 28% tax bracket, their after tax annualized income from the SPIA is as follows:

Years 1 – 19: $37,611

Year 20: $29,339

Year 21 and thereafter: $28,797

Note: Calculations for after tax income from the SPIA are available on the data arrays accessible from the drop-down menus on the Expected Cash Flow tab in Wealthy and Wise®.

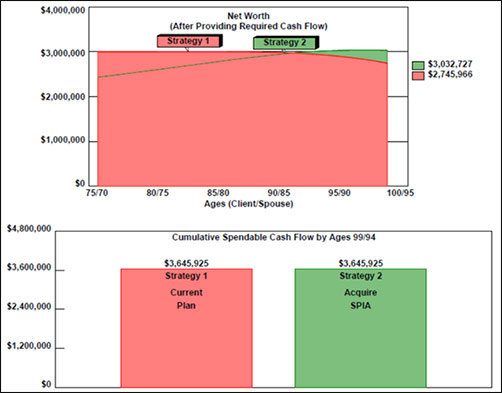

Below is a graphic of the impact of the SPIA on the Bigelows’ net worth:

Although the Bigelows liquid assets are initially reduced by acquiring the SPIA, they believe the reduction is tolerable due to the presence of the guaranteed stream of cash flow. Also on the plus side, their long-range Net Worth is improved by almost $300,000 due to the efficiency of the SPIA.

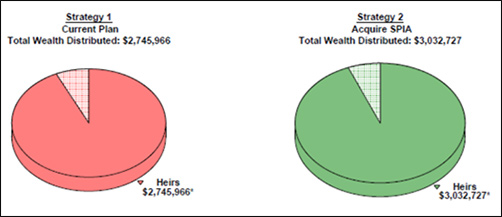

Below is a look at the results after 25 years for heirs:

*Due to the results of “stretch-out” tax planning, the checkered section on the Heirs’ slices represents retirement assets in the following amounts on which income tax is still due by the heirs: Strategy 1: $172,554; Strategy 2: $172,554.

Click here to review the Comparison reports. For those licensed for Wealthy and Wise, see below for access to the Case Data file (Workbook) for Blog #64 where you can review all the data entry and Scenario reports for this Case Study.

Conclusion

For those seeking to lock down a portion of their retirement cash flow, a SPIA can provide an effective way to do so. The SPIA may be particularly valuable during troubled economic times.

Licensing

To license Wealthy and Wise, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or 925-543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

Joint Interviews

If you want or need help from a qualified producer for joint interviews with any InsMark illustration and are willing to share the case, email us at bob@robert-b-ritter-jr.com, and we will provide you with recommendations.

Testimonials

“InsMark is the best value for me in the industry.”

Mike Breedlove, InsMark Power Producer®, Tyler, TX

“I have been using InsMark since it was a C:> prompt back in the early 1980s. The new Jazz release is the most exciting upgrade to the InsMark Illustration System I’ve seen in 28 years! With unlimited options for customization, you can now be as creative as you want when producing illustrations.”

Chris Jacob, CFP, InsMark Power Producer®, SFI-Cadeau, St. Louis, MO

![]()

More Recent Blogs:

Blog #63: Sometimes You Just Need a Good Calculator

Blog #62: Review of the Rescue Plans

Blog #61: Sacrificing Cash Flow with a 401(k) Plan

Blog #60: Coupling College Funding With Retirement Planning

Blog #59: The InsMark Business Valuator

– A Powerful Tool For Financial Advisers

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |