(Presentations were created using Wealthy and Wise®.)

Net worth certainly has value, but the amount of sustainable after tax cash flow that can be produced from net worth is the real measure of wealth. Also keep in mind that the invasion of net worth to provide an unrealistic level of cash flow is bound to end up producing no cash flow at all.

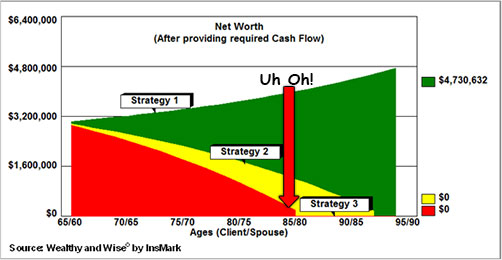

How are people to know? Check out the following analysis from InsMark’s Wealthy and Wise® System.

Male 65; Female 60

$3,000,000 in Liquid Assets Available for Retirement Cash Flow

Annual After Tax Cash Flow:

Strategy 1: $100,000

Strategy 2: $150,000

Strategy 3: $200,000

As you can see from the Strategy 3 flag pointing to zero, $200,000 in cash flow produces a long-range disaster as the liquid assets run out at ages 85/80. Strategy 2 hangs on longer, but it eventually dissipates at ages 93/88. Strategy 1 more than supports its level of cash flow and also provides for a substantial inheritance for heirs.

Wealthy and Wise® also calculates that Strategy 1 can support $29,000 in additional annual cash flow with Liquid Assets never dropping below their starting point of $3,000,000. The $29,000 can be used for: 1) additional retirement cash flow; 2) gifts to heirs; 3) funding deductible gifts to charity in the amount of $42,000 (31% tax bracket assumed); or 4) a combination of all of them.

Every individual contemplating retirement (or any other scenario that requires cash flow) must be certain to determine the sustainable level that a given amount of liquid assets will provide. In addition, a valid analysis must also illustrate the conversion of some or all illiquid assets (if present) to liquid assets whenever a shortfall of cash flow occurs.

If you initially address “let’s be sure you won’t run out of cash” with each prospect or client, you will have vitally interested listeners to the rest of your presentation.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

They are all highly skilled at running InsMark software and can help you with an InsMark Wealthy and Wise® analysis like this with the insurance company of your choice. Mention my name when you talk to them as they promise to take special care of my readers. You don’t need to be licensed for Wealthy and Wise® to secure help from Brian, Chris, or Erik – – although if you’re not licensed, we hope you decide to do so.

Note: If you are an Independent Marketing Organization that is interested in becoming an InsMark Referral Partner, please contact Julie Nayeri or David Grant at the number or email address indicated in the paragraph that follows.

For a license to use Wealthy and Wise®, go to InsMark or contact Julie Nayeri at InsMark at julien@insmark.com or (888) InsMark (467-6275). Institutional inquiries should be made to David A. Grant, Senior Vice President – Sales at (925) 543-0513 or dag@insmark.com.

![]()

More Recent Articles:

Blog #13: A New Look At An Old Idea

Blog #12: Three Smart (and relatively unknown by clients) Tax Strategies for Retirement Accounts

Blog #11 – Your Often Dead Without Deadlines

Blog #10: Annuity Rescue Made Easy

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive