(Presentations in this Blog were created using the InsMark Illustration System.)

A dog you want costs $500. Your boss wants to help you buy it, so she gives you a $500 bonus.

Is it a free dog? No — because you have to pay the tax on the bonus. If you’re in a 40% tax bracket, the dog costs you $200.

So let’s see if your boss will help you out. You ask her to increase the bonus to $833. If so, you’ll pay $333 in income tax and have $500 left over to buy the dog.

Would this get you a free dog? Yes — but it doesn’t matter because she won’t do it. All she’ll come up with is the $500.

We have to find a way to pay the $200 tax on the $500 bonus — and pay for the dog.

What if we could find a bank to take the dog as collateral for a $200 loan? And the bank added the interest to the loan? And the loan included free dog life insurance so when the dog died, the loan was paid off?

What if we could find a bank to take the dog as collateral for a $200 loan? And the bank added the interest to the loan? And the loan included free dog life insurance so when the dog died, the loan was paid off?

Now that would be a free dog!

Let’s see if we can make this work with a life insurance policy.

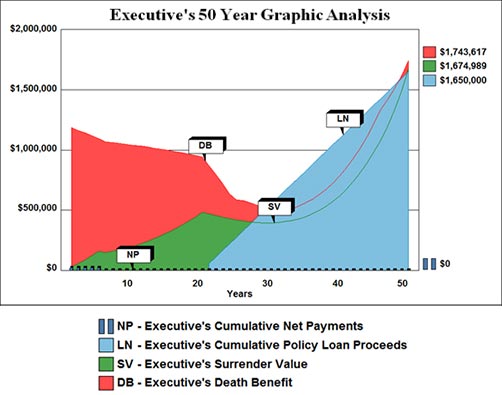

Assumptions:

Executive: Age 45;

Initial face amount of policy: $1,184,217;

Premium: $50,000 a year for 5 years;

Bonus from employer: $50,000 a year for 5 years;

Income tax due by executive (40% tax bracket): $20,000 a year for 5 years;

Policy loans by the executive to cover the income tax: $20,000 in years 2 through 6*;

Policy loans by the executive for retirement cash flow from age 65 to 95: $55,000 a year.

You won’t get a bank to help you with the free dog, but you can certainly get a business and a life insurance company to join in a transaction that resembles it.

It’s called an Executive Bonus Plan, and it’s designed to reward a valuable executive with a benefit that, like the free dog, cannot be duplicated personally.

Below are the illustrated results for this plan from the InsMark Illustration System software.

Click here to see reports for this Executive Bonus Plan from the InsMark Illustration System software.

InsMark’s Referral Resources

(Put our Illustration Experts to Work for Your Practice)

We created Referral Resources to deliver a “do-it-for-me” illustration service in a way that makes sense for your practice. You can utilize your choice of insurance company, there is no commission split, and you don’t have to change any current relationships. They are very familiar with running InsMark software.

Please mention my name when you talk to a Referral Resource as they have promised to take special care of my readers. My only request is this: if a Referral Resource helps you get the sale, place at least that case through them; otherwise, you will be taking unfair advantage of their generous offer to InsMark licensees.

Save time and get results with any InsMark illustration. Contact:

- Ben Nevejans, President of LifePro Financial Services in San Diego, CA.

InsMark’s Documents On A Disk™ System (DOD) has specimen legal documents for installation of several variations of the Executive Bonus Plan. Click here for Highlights of the Plan of the one typically used for non-owner employees. Click here for Highlights of the Plan of the one typically used for owner-employees. Click here to review features of DOD.

InsMark’s Documents On A Disk™ System (DOD) has specimen legal documents for installation of several variations of the Executive Bonus Plan. Click here for Highlights of the Plan of the one typically used for non-owner employees. Click here for Highlights of the Plan of the one typically used for owner-employees. Click here to review features of DOD.

Click here to see reports for this Executive Bonus Plan from the InsMark Illustration System software.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

More Recent Articles:

Blog #1: “Tell Me What’s Wrong With It?”

| 3 Reasons Why It’s Profitable For You To Share These |

| Blog Posts With Your Business Associates and |

| Professional Study Groups (i.e. “LinkedIn”) |

Robert B. Ritter, Jr. Blog Archive